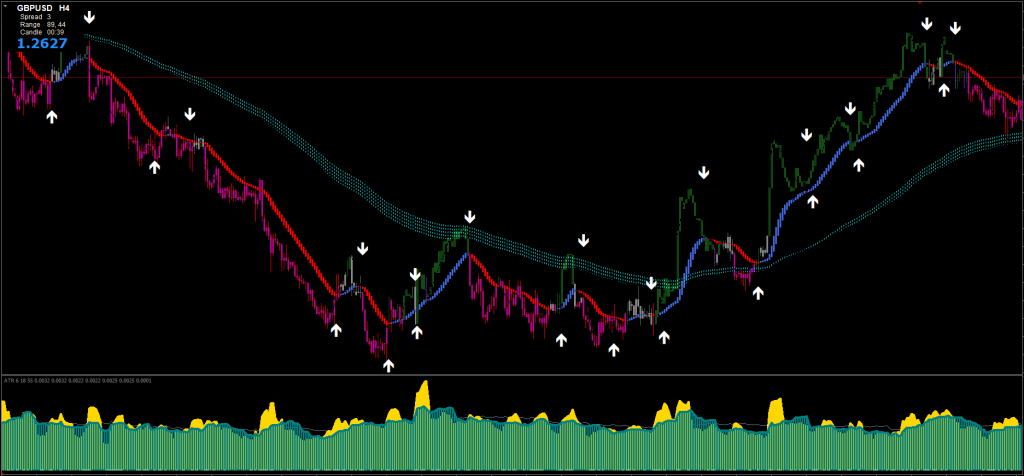

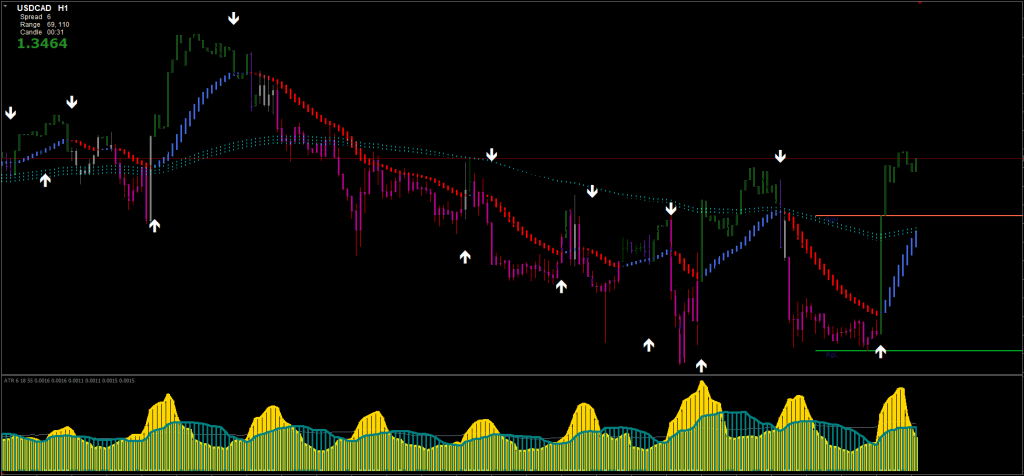

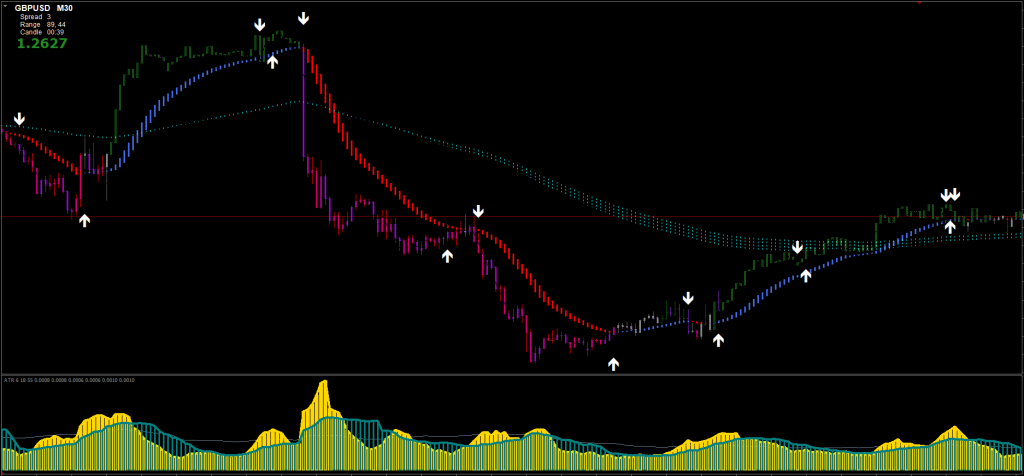

An adapted Average True Range (ATR) indicator created to gauge market volatility is used in this ATR Filter Strategy. In order to improve and filter trade signals, it combines it with trend-following indicators.

The customized indicator previously discussed is called the ATR Mastic. It is a specialized indicator that combines the ATR fast and ATR slow histograms to improve upon the standard ATR. Traders can more accurately assess market volatility with our dual-histogram technique. ATR rapid histograms indicate favorable market volatility circumstances and are a good time to consider entering a market when they exceed slow histograms. Beyond the ATR Filter Strategy, the ATR Mastic’s adaptability can be utilized as a filter in conjunction with other trend-following techniques or as an effective integration into other strategies.

This is a fully manual ATR Filter Strategy. The trader will decide whether to enter the market, put protective stops, or take profitable profits when the indicators generate the signals. As a result, the trader needs to understand the concepts of risk and return and know when to enter and quit based on initial support and resistance zones.

You can use the ATR Indicator to get trade signals that are suitable for you or, as is advised, refine the signals further by adding your own chart research. Although this technique is accessible to traders of all skill levels, it can be helpful to practice on an MT4 demo account until you have the consistency and self-assurance necessary to move on to actual trading.

The ATR Filter System has the ability to notify you by signal. This is useful since it allows you to monitor numerous charts at once and eliminates the need for you to spend the entire day staring at the charts while you wait for signals to appear.

Any currency pair as well as other assets including equities, commodities, cryptocurrencies, precious metals, oil, gas, etc. can be traded using this ATR filter strategy. Additionally, you can use it on any time frame—from the 1-minute to the 1-month charts—that works best for you.

Trading rules for ATR Filter Strategy

When employing this ATR Filter Strategy, don’t forget to tighten your stop losses around High Impact News Releases or stay out of the market at least fifteen minutes before and after these events.

As usual, effective money management is essential to getting the best results. You need to understand psychology, emotions, and discipline in order to trade profitably. Understanding when to trade and when not to is essential. Refrain from trading in adverse periods and conditions of the market, such as low volume/volatility, outside of main sessions, exotic currency pairs, wider spread, etc.

Buy

- Ensure the price is above the Trender H indicator, confirming a bullish trend.

- Optionally, the price should be above the Begashole trend indicator for added confirmation.

- Look for the Barbarian buy arrow, indicating a potential upward movement.

- The ATR Mastic Sc should display a green paint bar, signaling bullish market conditions.

- The gold histogram of the ATR Mastic A should be greater than the blue histogram, reinforcing the buy signal.

Sell

- Ensure the price is below the Trender H indicator, confirming a bearish trend.

- Optionally, the price should be below the Begashole trend indicator for additional verification.

- Look for Barbarian sell arrow, indicating a potential downward movement.

- The ATR Mastic Sc should display a red paint bar, signaling bearish market conditions.

- The gold histogram of the ATR Mastic A should surpass the blue histogram, validating the sell signal.

Exit Strategy

Exiting at the right moment is crucial, and this Free Forex Strategy provides clear guidelines for this:

- Place the initial stop loss above or below the previous swing high or low, providing a safety net against market reversals.

- Aim for a profit target with a stop loss ratio of 1:1.18, balancing risk and reward efficiently.

- Consider securing profits by setting a modest profit target, thereby enhancing the strategy’s profitability through strategic stop loss placement.