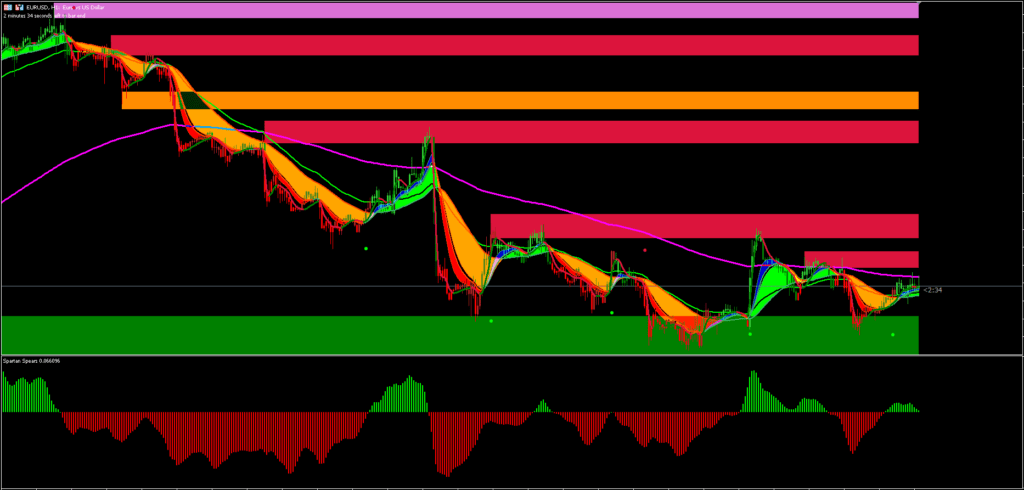

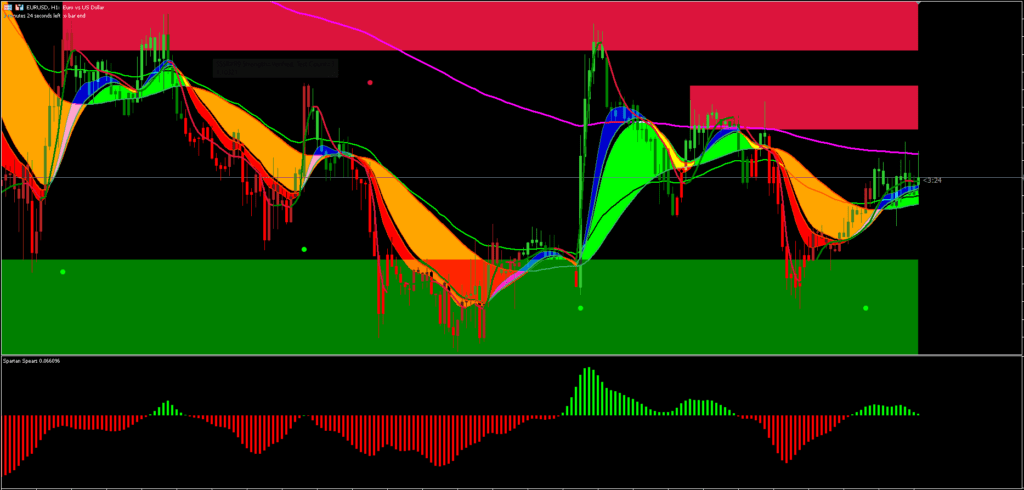

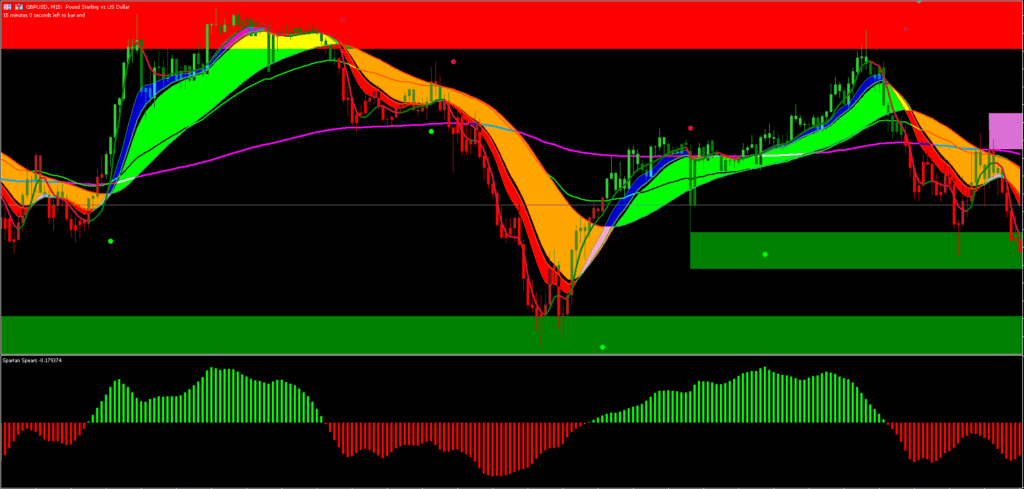

The Big Bull System is a free trend-following strategy for MetaTrader 5. This MT5 Trend Following system is unique in that it combines supply and demand information with trend-following strategies. We shall examine its mechanics and applicability for various trader types in-depth in this article.

The Super Big Bull Strategy concurrently considers crucial levels of support and resistance and places emphasis on trading in the trend’s direction. Traders can make better trading decisions by gaining a more comprehensive understanding of the market by incorporating these factors.

This approach is adaptable and simple enough for traders of all skill levels, regardless of experience level.

Indicators Used in this Trend Following Strategy

The BIGBULL CANDLES, BIGBULL PTL, BIGBULL Ribbons, BIGBULL JMA, BIGBULL BARS, BIGBULL DOT, BIGBULL Histogram, and the supply and demand indicator are some of the indications that the system makes use of. Together, these indications enable traders to identify the proper direction of the market in close proximity to support and resistance zones.

These are the primary markers that this Trend Following Strategy uses to decide which entries to make. However, there is an extra indicator included with the system, so you can try further filtering the signals.

- The 50 and 200 Exponential Moving Average, Close (EMA) is a popular technique for assessing the trend’s strength and direction.

- BIGBULL CANDLES: This makes it easier to see possible market trends by altering the chart candle colors to correspond with the moving average convergence divergence.

- The BIGBULL PTL, or Perfect Trend Line Indicator, is a representation of the two periods’ peak and lowest points. A subsequent trend is produced based on these parameters, which aids traders in identifying possible breakout or breakdown events.

- BIGBULL Ribbons: This cutting-edge tool makes it easier to identify possible crossovers without changing the calculation period by building a ribbon using the “speed” property of the EMA variation indicator.

- BIGBULL JMA: The Jurik Moving Average’s (JMA) ability to react to changes in market volatility makes it stand out from other moving averages. The Average True Range (ATR) is a new level of flexibility added by the Super Big Bull Strategy. This dual adaptability gives traders a more flexible tool to respond to changes in the market, particularly in times of extreme volatility.

This Big Bull System can provide you with trade signals that you can use exactly as they are or, as is advised, refine the signals further by adding your own chart analysis. Although this technique is accessible to traders of all skill levels, it can be helpful to practice on an MT4 demo account until you have the consistency and self-assurance necessary to move on to actual trading.

Trend Following Strategy works solely through manual means. The trader will decide whether to enter the market, put protective stops, or take profitable profits when the indicators generate the signals. As a result, the trader needs to understand the concepts of risk and return and know when to enter and quit based on initial support and resistance zones.

Any Forex currency pair as well as other assets including equities, commodities, cryptocurrencies, precious metals, oil, gas, etc. can be traded using the MT5 Trend Following Trading System. It is most effective on M5, M15, and M30, but you can use it on any time frame that works best for you.

Trading Rules

When using this Big Bull System, don’t forget to tighten your stop losses around High Impact News Releases or stay out of the market at least fifteen minutes before and after these events.

As usual, effective money management is essential to getting the best results. You need to understand psychology, emotions, and discipline in order to trade profitably. Understanding when to trade and when not to is essential. Steer clear of trading amid negative market conditions, such as low volume or volatility, after significant sessions, exotic currency pairs, wider spread, etc.

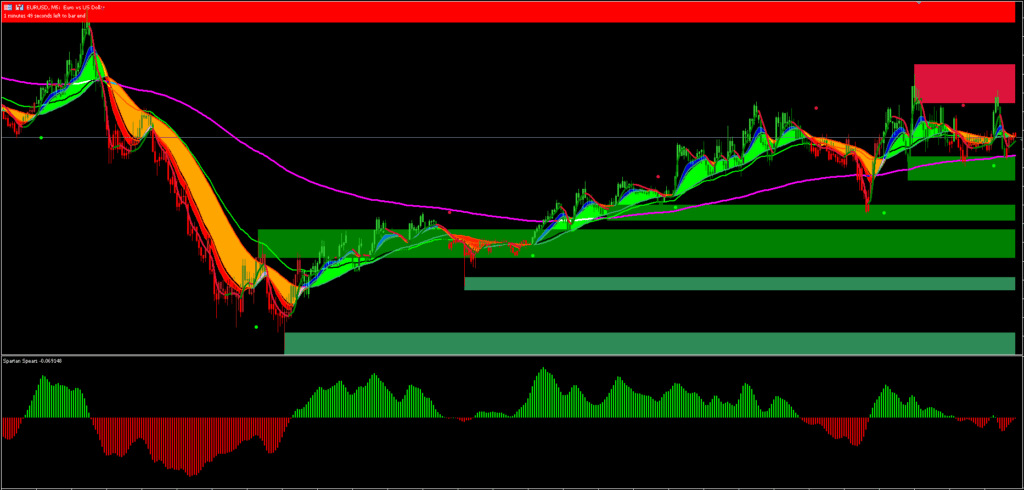

Buy Entry

- Support Bounce: Ensure the price is bouncing off a support level. This suggests potential upward momentum as demand exceeds supply at these levels.

- PLT Signal: Wait for the PLT to display a GREEN buy dot, indicating bullishness.

- Ribbon Confirmation: Ribbon 1 should be above Ribbon 2. This shows that the short-term momentum is bullish compared to the longer-term momentum.

- ATR JMA Indicator: Ensure the ATR JMA displays a GREEN line, which signifies bullish market conditions.

- BIGBULL Bar Confirmation: The BIGBULL Bar value should be greater than 0, confirming the bullish sentiment.

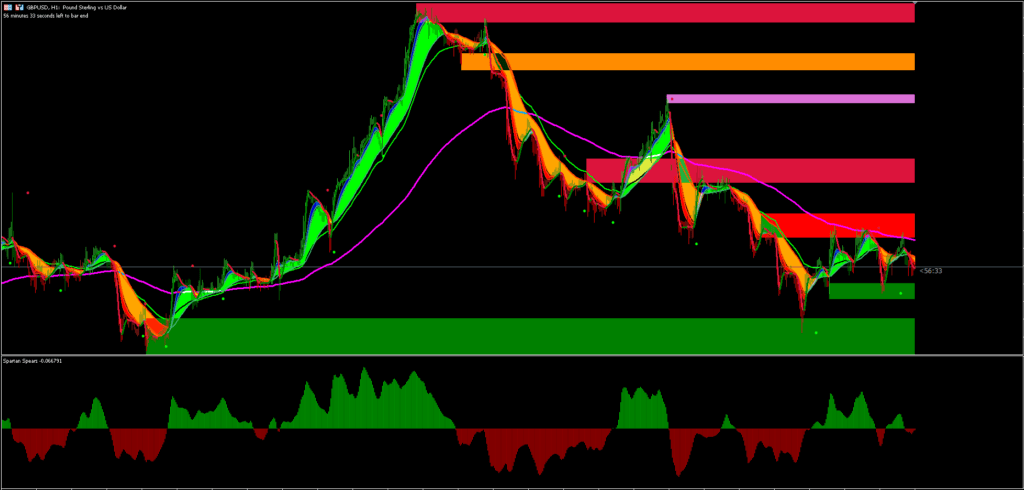

Sell Entry

- Resistance Bounce: Observe if the price bounces off a resistance level. This indicates potential downward momentum, as supply is exceeding demand at these levels.

- PLT Signal: The PLT should exhibit a RED sell dot, indicating bearishness.

- Ribbon Confirmation: Ribbon 1 should be below Ribbon 2. This means the short-term momentum is bearish compared to the longer-term momentum.

- ATR JMA Indicator: The ATR JMA should have a RED line, signifying bearish market conditions.

- BIGBULL Bar Confirmation: The BIGBULL Bar value should be less than 0, reaffirming the bearish sentiment.

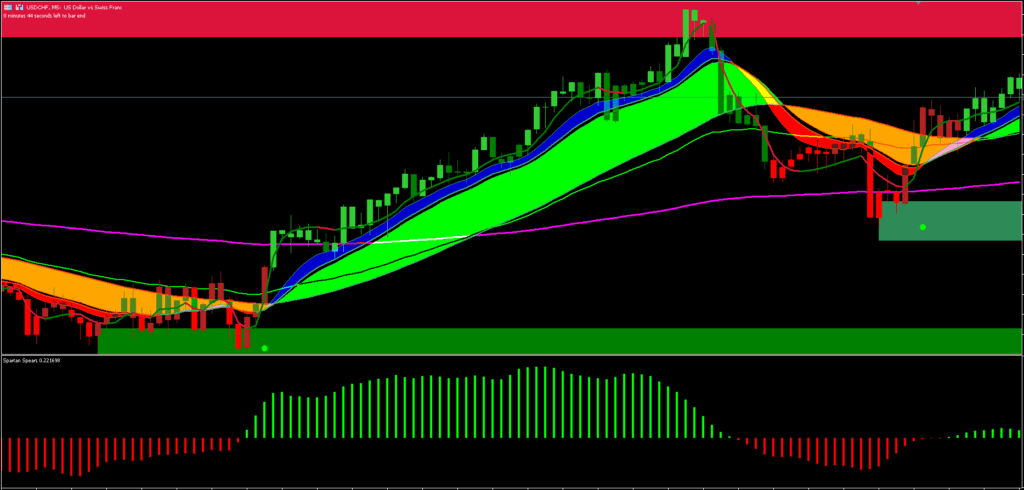

Trade Exist

Exiting a trade is just as important as entering one. It’s crucial to know when to take profits or cut losses to maintain a profitable trading strategy.

- Stop Loss Placement: Initially, place the stop loss just above (for sell trades) or below (for buy trades) the support or resistance zone. This ensures you’re out of the trade if the market goes against your position.

- Profit Targets:

- Opposite Zone: Book profits before the price reaches the opposite zone (i.e., before reaching resistance in a buy trade or support in a sell trade).

- Risk-to-Reward Ratio: Aim for a profit target that gives you a risk-to-reward ratio of 1:1.7. This ensures that you’re earning more than you’re risking.

- Ribbon Change: If Ribbon 1 changes its direction, consider it a signal to book profits.