The MT4/MT5 COT Indicator was created in accordance with the CFTC’s Commitment of Traders report. The forex market is extremely competitive and has drawn many traders from around the world. Understanding market emotion and taking advantage of it are two essential elements of effective trading. This is where the CFTC’s Commitments of Traders (COT) report and the FXSSI COT Indicator come into play, offering traders insightful information. The COT MT4 Indicator, its characteristics, and how it can enhance your trading experience on the MT4/MT5 terminal will all be covered in this article.

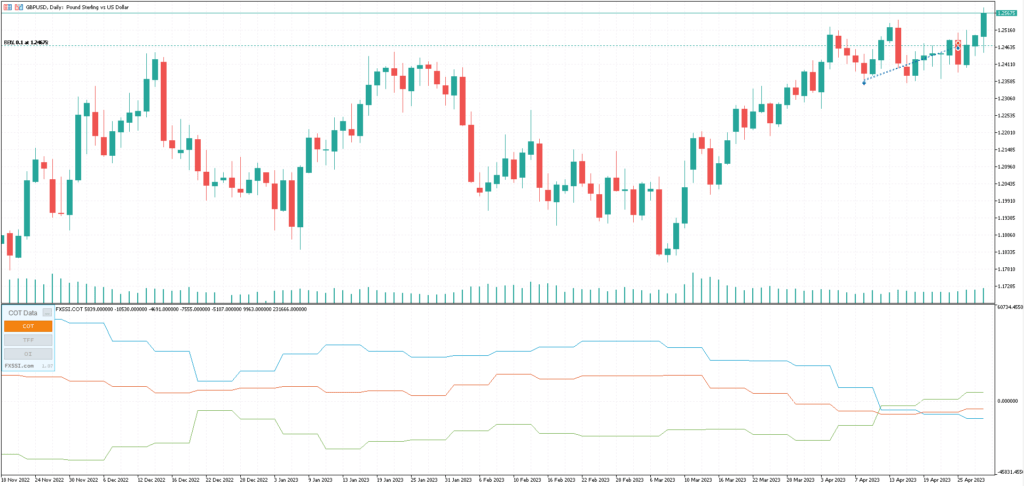

With the help of the FXSSI COT Indicator, you may display the CFTC’s COT report as a chart in your MT4 or MT5 terminal. Every Friday afternoon, the COT report is made public. It is based on open positions as of Tuesday of that same week. The related futures contracts traded on the Chicago Mercantile Exchange (CME) are used to create the FX COT report.

The COT report is a useful tool for traders since it offers information on open interest positions in the market. The positions of several market participants are displayed, including small, large, and commercial hedgers. Trading professionals can improve their decision-making by better understanding market mood by evaluating the data presented in the report.

Only the EURUSD, GBPUSD, USDJPY, USDCHF, USDCAD, AUDUSD, NZDUSD, and USDMXN can be utilized with this COT MT5 indicator. Additionally, you may apply it to any time window that works best for you, from 1-minute charts to monthly charts. For best use, it is advised to work with the H4, D1, and W1 timeframes because data is updated once per week.

There are no limitations placed on this indicator by the fxssi.com website. On this website, there are many beneficial free and paid indicators. So have a look at their other indicators and give the FXSSI Indicators some love.

What is Commitment of Traders

The U.S. Commodity Futures Trading Commission (CFTC) releases a weekly report titled Commitment of Traders (COT) that details the positions of traders in the futures markets. The COT report lists contracts for traders in a variety of categories, including small traders, non-commercial traders, and commercial hedgers.

Commercial hedgers, such as farmers or manufacturers, are often businesses that use futures contracts to hedge their exposure to price variations in the underlying commodity. Large speculators, such as hedge funds, who seek to profit from changes in market prices typically make up non-commercial traders. Small traders are usually persons who conduct modest levels of trading.

The COT report is frequently used by traders and analysts to assess market sentiment and spot potential market turning moments. The market may be overbought and ripe for a correction, for instance, if there is a big increase in the number of contracts held by non-commercial traders. On the other hand, a big rise in the number of contracts owned by commercial hedgers would suggest that they are growing more optimistic about the market and perhaps anticipating an increase in prices.

How is the COT used

Commitment of Traders (COT) reports are used by forex traders to learn more about the positions of important market participants like big banks, hedge funds, and other institutional traders. The COT report details the net long or short positions of these traders as well as any changes from the prior week.

This data can be used by forex traders to assess market sentiment as well as spot prospective trends in the market. An indication that the market is bullish and that prices may be expected to climb is, for instance, a considerable increase in the number of long positions held by non-commercial traders.

It is important to remember that the COT report is just one instrument available to forex traders for market research. Along with other technical and fundamental analytical techniques, it should be used. Furthermore, as the COT report is only published once a week, it might not offer a real-time market perspective.

How to Use the COT Indicator to Enhance Your Trading

- Identify Market Sentiment: By analyzing the COT report data, traders can gain insights into the overall market sentiment. For instance, if large speculators are heavily long on a particular currency, it may indicate a bullish sentiment in the market.

- Confirm or Contradict Technical Analysis: The COT Indicators can be used alongside other technical analysis tools to confirm or contradict the conclusions drawn from chart patterns or indicators. For example, if your technical analysis suggests a bullish trend, but the COT data shows large speculators are heavily short, it may be a signal to reconsider your trading decision.

- Diversify Your Strategy: Integrating the COT MT4 Indicator in your trading strategy can add an additional layer of market analysis, enabling you to make more informed decisions and potentially improve your overall trading performance.

Displayed Data by COT MT4 Indicator

COT (The Commitment of Traders Report):

- Commercials (blue).

- Large Speculators (green).

- Small Speculators (red).

TTF (The Traders in Financial Futures):

- Dealer/Intermediary (gray/black).

- Asset Manager (orange).

- Leveraged Funds (dark blue).

OI (Open Interest):

- Open Interest (blue).