This Forex EA is an HFT Robot for Overcoming Prop Firm Obstacles. This EA is made to successfully negotiate and outperform the demanding tests and requirements of proprietary trading companies. The features and benefits of this EA are explored in detail in this article, with a focus on how to pass prop firm assessments and challenges.

- Constructed to Handle Difficulties with Prop Firm Evaluations: The HFT Robot is designed to satisfy the exacting standards of prop firm assessments that permit HFT trading. Its primary goal is to successfully complete these tests or challenges.

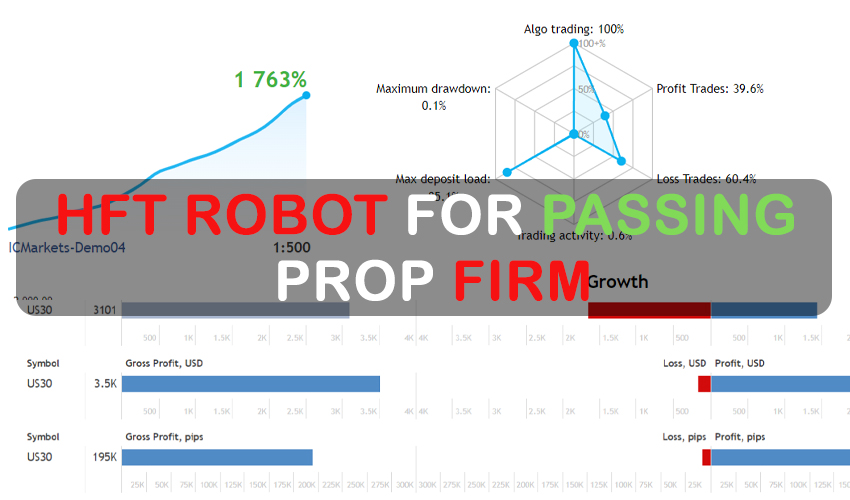

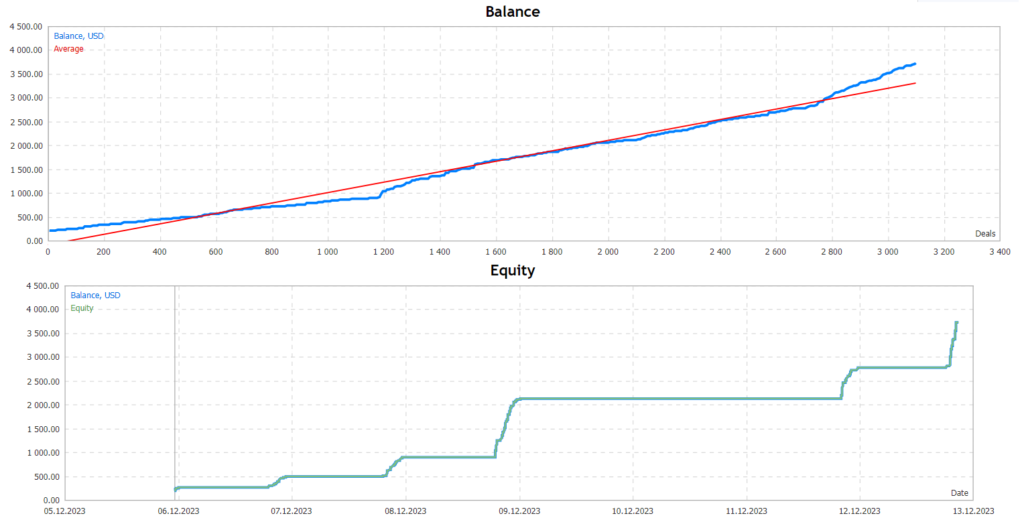

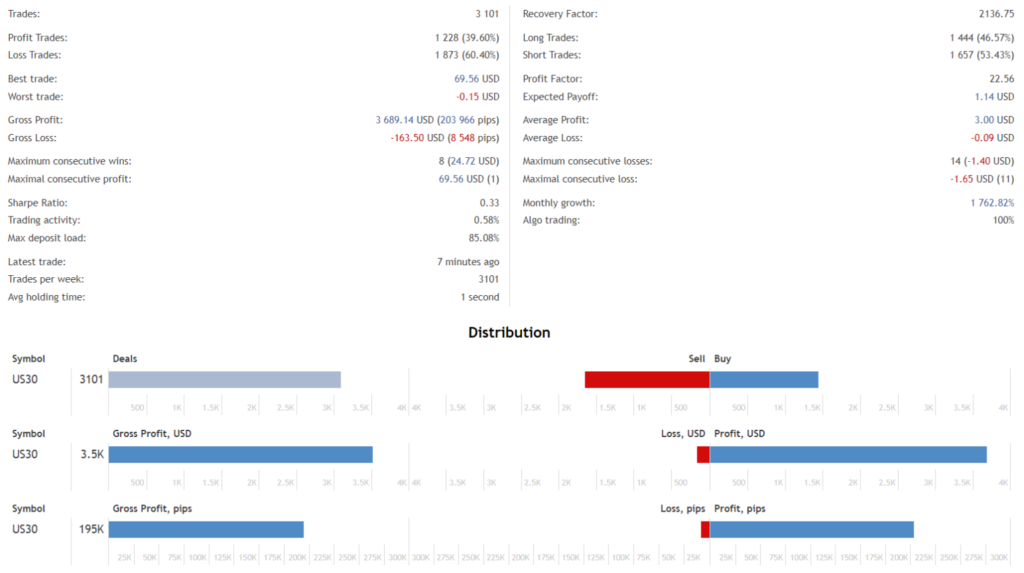

- Efficiency in Reaching Goals: This EA can quickly reach challenge goals in a remarkably short amount of time. Its capacity to maintain a very low drawdown—a critical component in the high-stakes world of prop trading—sets it apart.

- Advanced HFT Strategy: This EA’s core is a unique HFT strategy that recognizes big changes in the market. It can now profitably and efficiently from these movements as a result.

- Sturdy Risk Management: One essential component meant to protect equity from unforeseen market fluctuations is the inclusion of a stop-loss mechanism. The trader’s capital must be protected, and this risk management tool is crucial.

- Equity Protector: Its integrated equity protector is yet another exceptional feature. This feature guarantees that profits are protected from market volatility by automatically stopping the EA once the goal is reached.

- Pro-ratio money management, or PRMM, is one of the EA’s innovative money management systems. This special feature allows for faster challenge completion without incurring significant drawdowns by automatically adjusting the lot size based on gains. Additionally, traders can choose to manually enter the lot size, which provides them with operational flexibility.

- Market Condition Sensitivity: The EA works best in active market conditions because it understands how crucial timing is in high-frequency trading. It passes the Prop Firm Challenge in less than an hour thanks to this strategic approach.

- Non-Martingale or Grid System: The HF T Robot is different from other trading systems in that it is not a grid system or a martingale. It opens trades one at a time, following a methodical process that involves closing each trade before opening the next.

- Trade Management: Unlike grid or martingale systems, the EA opens trades one at a time and makes sure each is closed before opening a new one. Its methodical approach to risk management is highlighted by the stop-loss settings for every trade.

It is imperative to acknowledge that the HFT Robot is designed exclusively for utilization in HFT-permitted prop firm assessments and challenges. No testing has been done on funded prop firm accounts, live/real broker accounts, or other trading challenges. This specialization highlights its usefulness in a particular market but also highlights its limitations outside of it.

In order to perform at the promised level, favorable trading conditions are essential. You would need a low-latency Virtual Private Server (VPS), fast execution times, and a broker with minimal spreads and slippage.

Recommendations

- It is specifically designed to pass assessments and challenges from prop firms.

- Designed to function on either GER30 (DE30) or US30 (DJ30, WS30).

- With M1 or M5 TimeFrames, it functions best.

- This free forex EA should be run 24/5 on a VPS (Reliable and Trusted FOREX VPS – FXVM).

- low spread ECN account is also advised (Find the Perfect Broker For You Here).