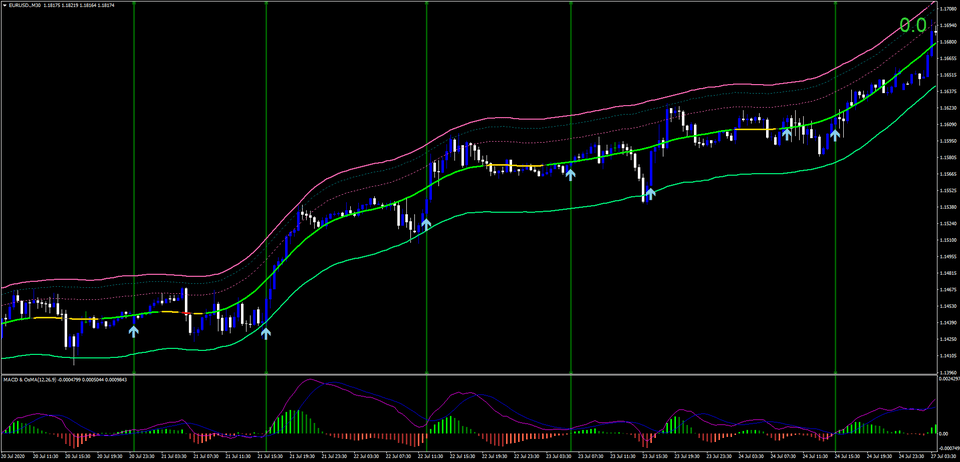

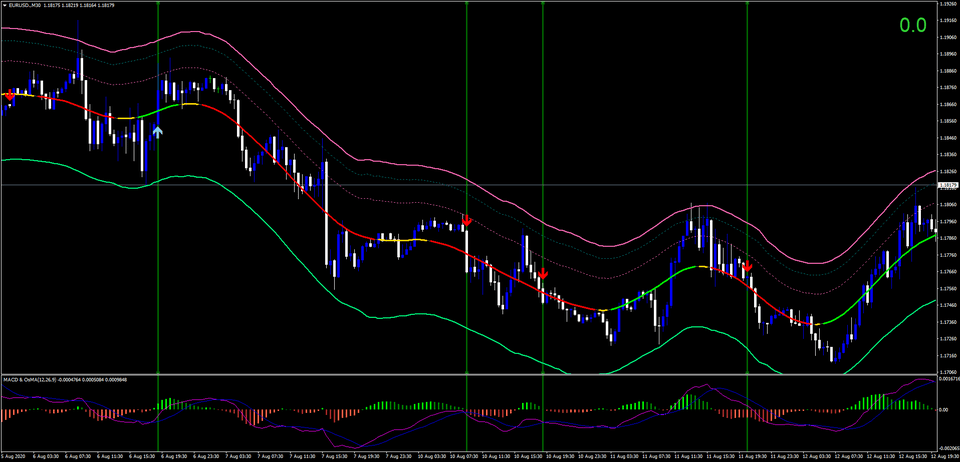

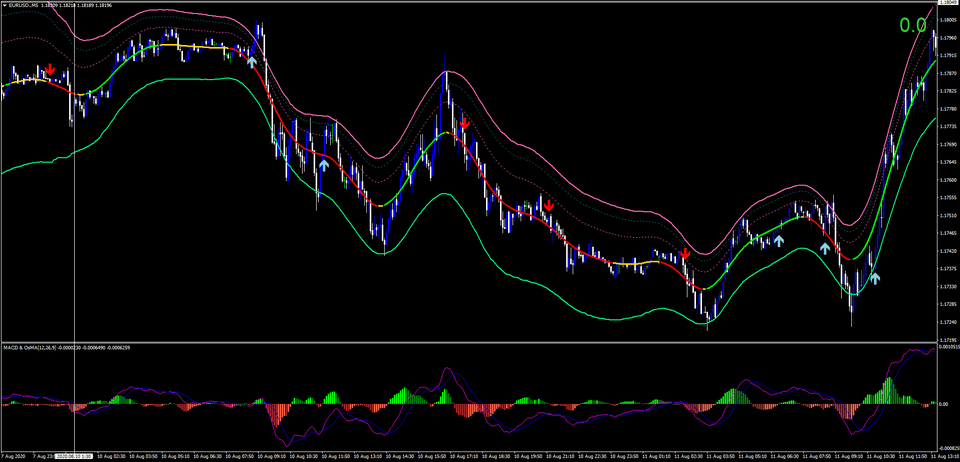

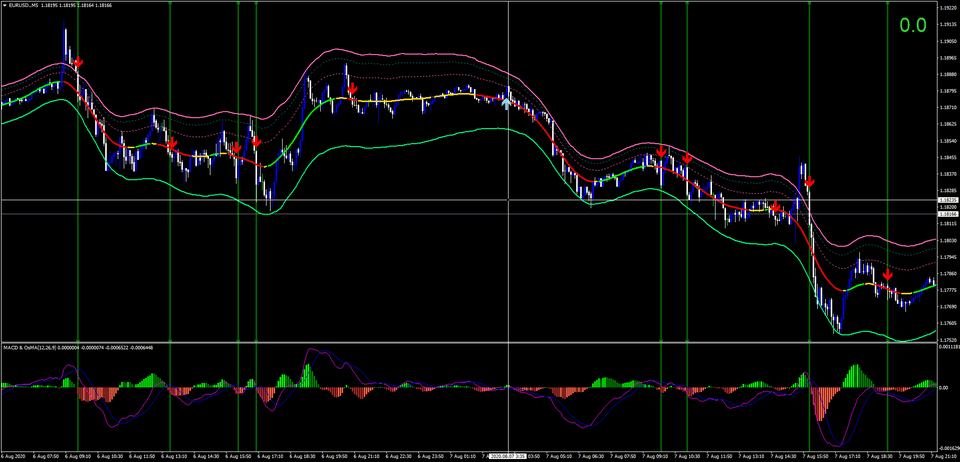

A trend-following approach based on two filters and a trend arrow is called Hidden Signals FX-approach. The MACD OSMA is the first and most significant filter. The second filter is based on the recalculable ATR TMA price action filter. The entry arrow is a medium-slow trend indicator that produces reliable signals; when it arrives later, the filters we suggest are able to prevent many false entry signals, making this a successful forex strategy that can be used at any time.Frames.

- Five minutes.

- Minor and Major currency pairs for MT4.

Rules for Trading Hidden Signals Forex Trading Technique

Long Signal entry

Below the upward-crossing green line on the main chart and the mt4 chart, there is a buy arrow filtered by the MACD OSMA indicator.

Short Signal entry

The red color line on the main chart and the downward-crossing MACD OSMA indicator below the chart are filters for the sell arrow.

Exit open position

- Put your initial stop loss (SL) above or below the swing high or low.

- The ATR TMA serves the purpose of giving precise price targets.

- The dot-gray line represents the minimal profit goal for purchases.

- The lower band of the ATR TMA is the minimum profit target for a sell.

- As an alternative, the profit is a 1: 1.3 ratio stop loss (SL).

In conclusion, this is a clear, straightforward forex strategy that is simple to use and effectively handles to avoid losses inside markets.

This forex strategy has the benefit of producing a very minimal drawdown.

The forex ATR TMA has the drawback that it updates the indicator color, but the signals are medium-slow and coincide with a well-established trend in the market.

Hidden Signals Forex trading Strategy in action in photos.