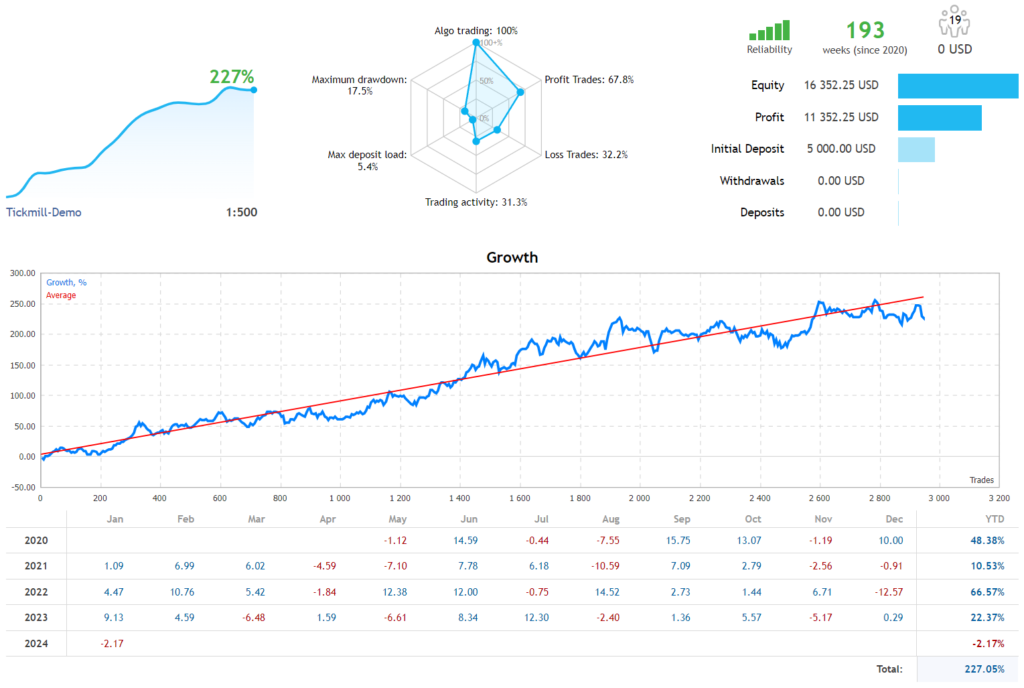

The High Low EA is a trading robot that uses a successful strategy based on spotting and seizing important recent highs and lows to enter trades. This post will go into further detail about its sophisticated trade management techniques, extensive risk management features, and other topics.

Fundamentally, the High Low EA is based on a straightforward idea: trading the breakouts of noteworthy recent highs and lows. But the real power of this EA is in how it’s done. Knowing when to enter and exit the market is just as important as recognizing the highs and lows, making execution a crucial differentiator. Thus, its entry calculations and exit algorithms are sophisticated.

Trade Management Techniques

The High Low EA really shines at trade management, using a variety of strategies to make sure that every trade is handled carefully and precisely:

- Trailing Stop Loss (SL): To protect trades while allowing for profit, the EA uses a Trailing SL mechanism that is adjusted based on several parameters.

- Move to Break-even: This feature protects the initial capital by allowing the trade to be moved to a break-even point with the option to add extra pip amounts.

- Dynamic Trailing SL: This gives more room for the full take profit (TP) to be realized by trailing based on recent highs and lows. It also has the option to be implemented only up until the break-even point.

- Time-Based Trailing stop loss (SL): This trading robot uses a trailing stop loss (SL) based on the length of the trade to limit exposure and minimize risk when the market momentum wanes.

Recommendations

- $100 is the minimum account balance.

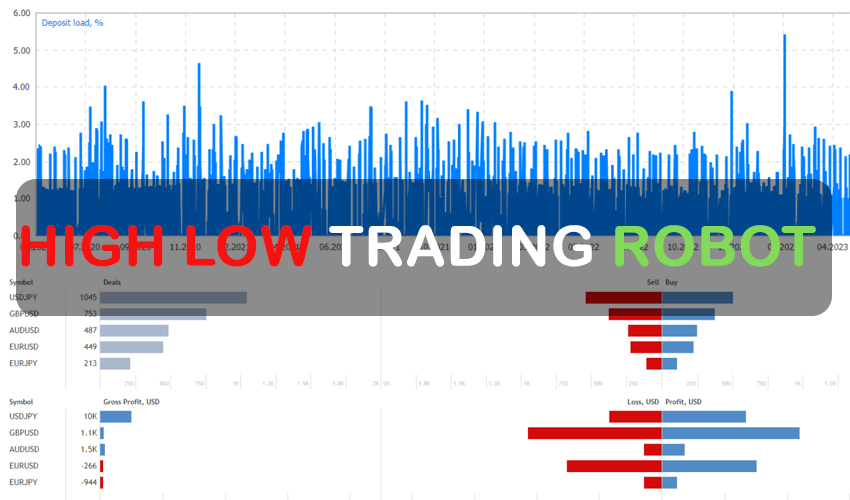

- With EURUSD, GBPUSD, USDJPY, and AUDUSD, it functions best. Work with any pair of currencies.

- H1 TimeFrames are the best for it. (Do any TimeFrame work.)

- This free forex EA should be run 24/5 on a VPS (Reliable and Trusted FOREX VPS – FXVM).

- low spread ECN account is also advised (Find the Perfect Broker For You Here).