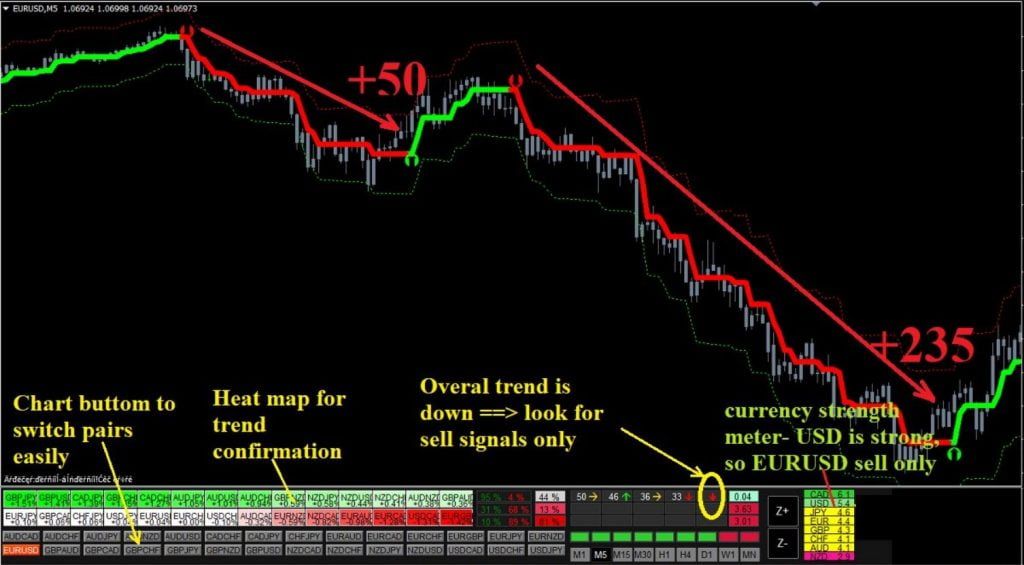

A NON-Repaint indicator system, the Forex Hydra Indicator & Strategy provides straightforward buy/sell signals. It is often marketed for $37 per lifetime. It has an ON-SCREEN dashboard that provides you with numerous essential information, including a currency strength meter.

The Forex Hydra Strategy employs indications from numerous technical indicators, such as trend trading and countertrend trading, among others, to join the market. As a result, there is a greater opportunity for long-term growth and less exposure to isolated pairs or individual operations.

It detects swift and profitable price changes and provides clear buy and sell signals. In order to provide just the trades with the highest likelihood, the algorithm thoroughly examines each trading signal.

The Forex Hydra method can provide you with trade signals that you can either accept as-is or modify with further chart research, which is advised. Although this strategy can be used by traders of all experience levels, it may be helpful to practice trading on an MT4 demo account first until you are reliable and self-assured enough to trade in real time.

Stick to your money management plan and avoid trading during a period of breaking news. Before a half-hour and an hour of the high-impact forex news, stop trading.

A signal notice can be sent to you by the Forex Hydra Indicator System by email, mobile notification, or platform pop-ups. This is advantageous since it allows you to monitor numerous charts at once and eliminates the need to spend the entire day staring at the charts in anticipation of signals.

Any Forex currency pair as well as other assets including equities, commodities, cryptocurrencies, precious metals, oil, gas, etc. can be traded using the Forex Hydra Strategy. Additionally, you may apply it to any time frame that works best for you, including charts for one minute to one month. Use M1 and M5 for scalping, M15 and H1 for day trading, and H4 and D1 for swing trading.

How to Use

Open your preferred trading pairs before you begin trading. Decide on a time frame. From M1 to D1, this trading strategy operates on all time frames. Use M1 and M5 for scalping, M15 and H1 for day trading, and H4 and D1 for swing trading.

Step 1: Identify the trend

Use the currency strength indicator, for instance, to determine the trend

- If the currency strength of ABC is greater than 5.0 AND the currency strength of XYZ is less than 2.0, then we are in an uptrend when looking at the pair ABC/XYZ.

- We are in a downturn if the currency strength of ABC is less than 2.0 AND the currency strength of XYZ is greater than 5.0.

Step 2: Wait for a buy/sell signal

- Take only BUY indications if the trend is upward. If we are in a downward trend, only act on sell indications.

- stop loss at the high/low of the most recent swing.

Step 3: Exit the trade

With the desired profit pip in hand, stop trading. If not, give the opposing signal to exit. Additionally, a trailing stop can be used to get out of the deals. Put a stop loss at the next support line or lower low level.