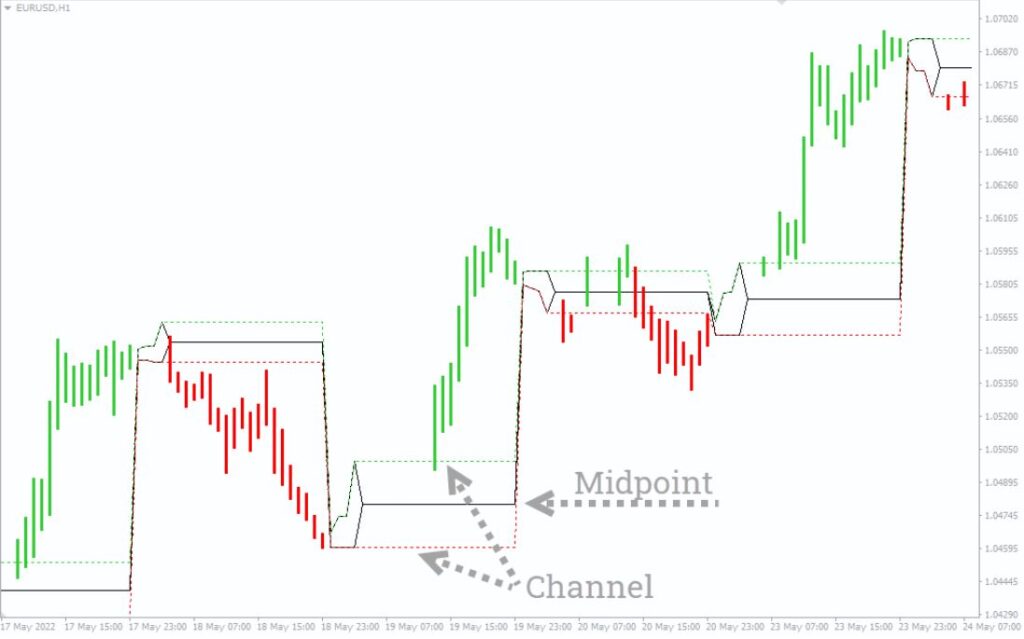

As you are already aware, the market first consolidates before expanding and adopting new trends during the Asian market’s opening. Trading this range is aided by the Intraday Channel Breakout indicator. It is predicated on the four-hour opening range.

The pivot range is located in the middle of the channel, which is formed by the highest and lowest points. Only shorter time frames, ranging from one minute to four hours, are suitable for short-term trading techniques. It is intended to be used for periods shorter than a day.

If the market is above the midpoint, it is biased upward; if it is below the halfway, it is biased downward.

Buy Signal

When the price breaks above the channel, enter a long trade. The closing of the triggering candle must occur above the channel. Similar to this, when the price action breaks below and the triggering sell candle closes below the channel, a bearish channel is formed.

Intraday Channel Breakout Trading Example

The price movement of the euro relative to the US dollar is displayed on the chart. When the currency pair becomes closer together, the indicator creates a channel. A optimistic sentiment is evident when the price climbs above the midway. Price advances and breaks through the channel.

In a similar vein, price reversals are indicated when the price moves below the midpoint and breaks below the channel. Your goal is to fill a temporary role.

Conclusion

One of the best indicators for trading the Asian range is the intraday channel breakout. It provides precise points of entry for commerce.