Market Attitude With a number of other really helpful characteristics, the Forex indicator accurately anticipates market sentiment. It operates under the presumption that 95% of retail traders lose money. While banks or “Smart Money” are typically NET winners. Then, wouldn’t it make sense to trade against the “herd” in order to avoid losing retail traders?

Finding the real market emotion of the retail traders (herd), however, is a challenge. To display the general market sentiment, the Market Sentiment Indicator MT4 gathers data from hundreds of thousands of retail traders. In essence, it demonstrates what the “herd” is doing so you may act in the other way!

For any form of trading scenario, including day trading, scalping, swing trading, top-and-bottom trading, etc., it provides a higher winning trading signal on any MetaTrader 4 instrument. The technology itself is quite simple to use and learn. even if trading is entirely new to you.

This Strategy only uses manual labor. The indicators generate the signals, but the trader ultimately decides whether to enter the market and whether to establish protection stops or profitable exit stops. As a result, the trader must be conversant with the concepts of risk and reward and set entries and exits using initial support and resistance levels.

Market Sentiment MT4 can provide you with trade signals that you can use as-is or further filter using additional chart analysis, which is advised. Although this strategy can be used by traders of all experience levels, it may be helpful to practice trading on an MT4 demo account first until you are reliable and self-assured enough to trade in real time.

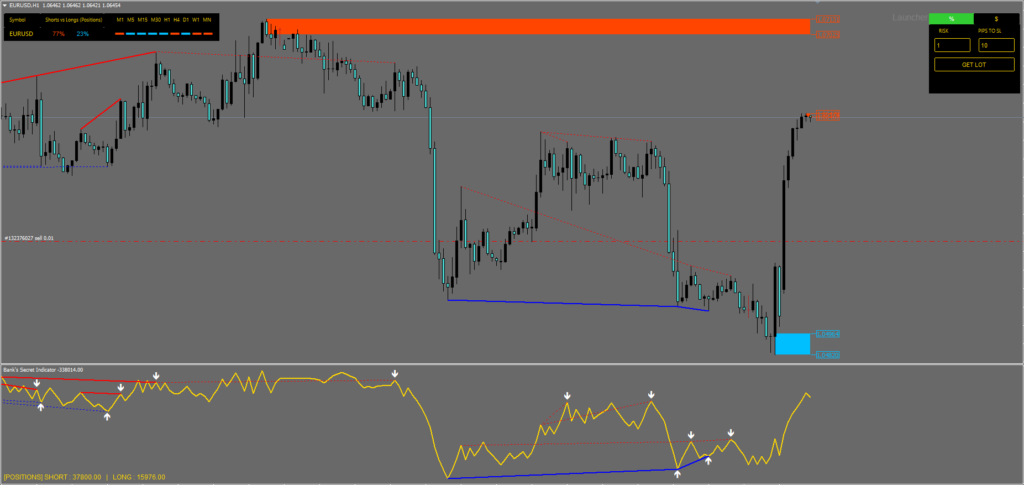

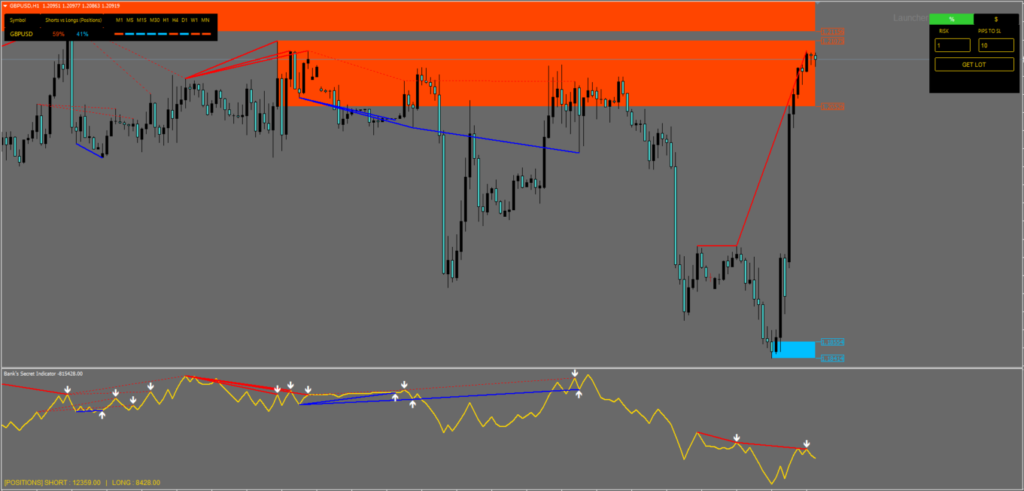

Main Chart of this Market Sentiment Indicator

As the market continues to move against retail traders, you can see in the image below that they are primarily net long (87%) positions. Simply trading against the “herd” will put you in the smart money’s camp and may provide you a significant competitive edge.

Next, without having to open a ton of charts, the Market Sentiment MT4 tool enables you to quickly evaluate the overall market trend over several time frames. Probably familiar with the phrase “the trend is your friend” And “you should only trade with the trend” We concur!

This feature lets you see if the market is going upward or downward for each time range. The M1, M5, M15, M30, H1, H4, D1, and W1 all show a downward trend in the image below. Additionally, the MN is rising.

You may have also noticed these sizable red and blue “zones” on the chart displayed in the preceding pictures. The Market Sentiment Indicator’s feature that highlights areas of strong supply and demand where prices have historically experienced rapid rebounds.

The on-chart risk calculator is another useful aspect of this indicator. Simply specify how much of your account you want to risk and how far you want your stop loss to be from your entry price, and the BSI will figure out your lot size for you.

The Market Sentiment Indicator for MT4 can be configured to send you signal alerts via platform pop-ups, email, and mobile notifications. This is advantageous since it allows you to keep an eye on numerous charts at once rather than having to spend the entire day waiting for signals to come on the charts.

Any Forex currency pair as well as other assets including stocks, commodities, cryptocurrencies, precious metals, oil, gas, etc. can be traded using the Market Sentiment Indicator MT4. Additionally, you may apply it to any time frame that works best for you, including charts for one minute to one month.

Trading rules

Stick to your money management plan and avoid trading during a period of breaking news. Half an hour after the big currency news, stop your trades.

As usual, use wise money management to get the best outcomes. You need to master discipline, emotions, and psychology to be a successful trader. Knowing when to trade and when not to is essential. Avoid trading at times and under unfavorable market conditions, such as low volume or volatility, outside of the main sessions, with exotic currency pairs, wider spreads, etc.