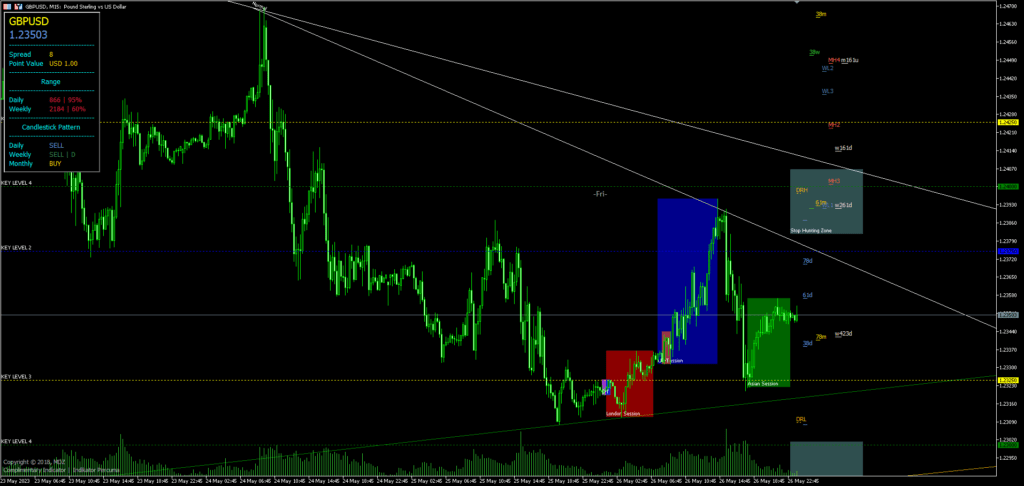

An MT4/MT5 All-in-One Indicator that plots a lot of data is the MDZ Price Action Indicator. For example, a trading session, a key level, a trend line, a range, a Fibonacci retracement, the end of a trend, and more. Possessing dependable and adaptable technologies that provide thorough market knowledge is a vital advantage.

One such instrument created to provide traders with a variety of market insights for making wise trading selections is the MDZ Price Action Indicator. This all-purpose indicator works with a range of trading assets and periods. Its strong capability to display several level types gives it a significant advantage in assessing market conditions and identifying the best entry points. The main characteristics and advantages of the MDZ Price Action Indicator are explored in this article, along with instructions on how to use it.

The AIO Forex Indicator offers a great level of customization, allowing users to change how required levels are shown and whether they should be enabled or disabled based on personal preferences. The indicator can be modified to fit traders’ trading styles and methods because to its adaptability.

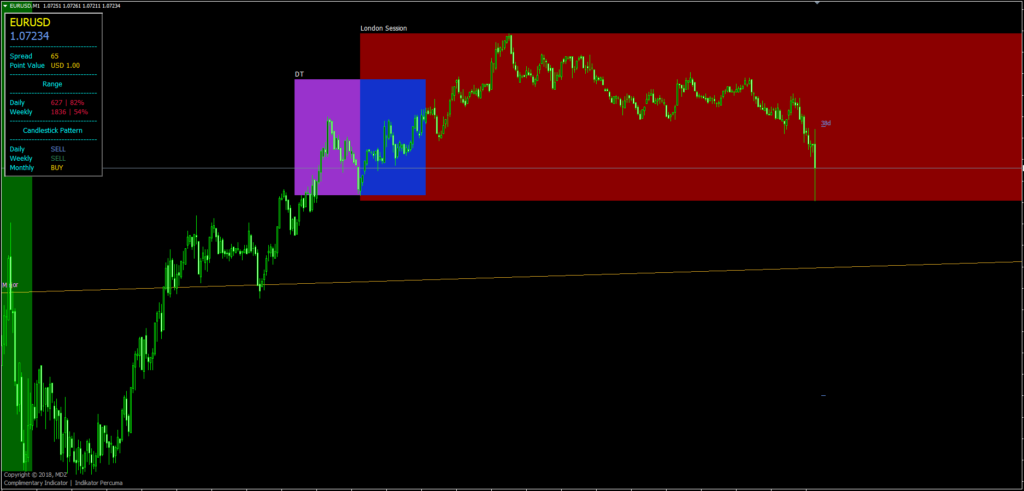

Any Forex currency pair as well as other assets, including commodities, cryptocurrencies, binary options, stock markets, indices, etc., can be used with this MDZ Price Action MT5. Additionally, you may apply it to any time window that works best for you, from 1-minute charts to monthly charts.

Although the All-in-One Indicator is not a stand-alone trading indicator system, it can be very helpful for your trading as additional chart analysis, to locate trade exit positions (TP/SL), and more. All levels of traders can utilize this technique, however until you are reliable and self-assured enough to trade on a live account, it can be helpful to practice trading on an MT4/MT5 demo account. Most Forex firms let you create a trading account, either genuine or practice.

Features of MDZ Price Action Indicator

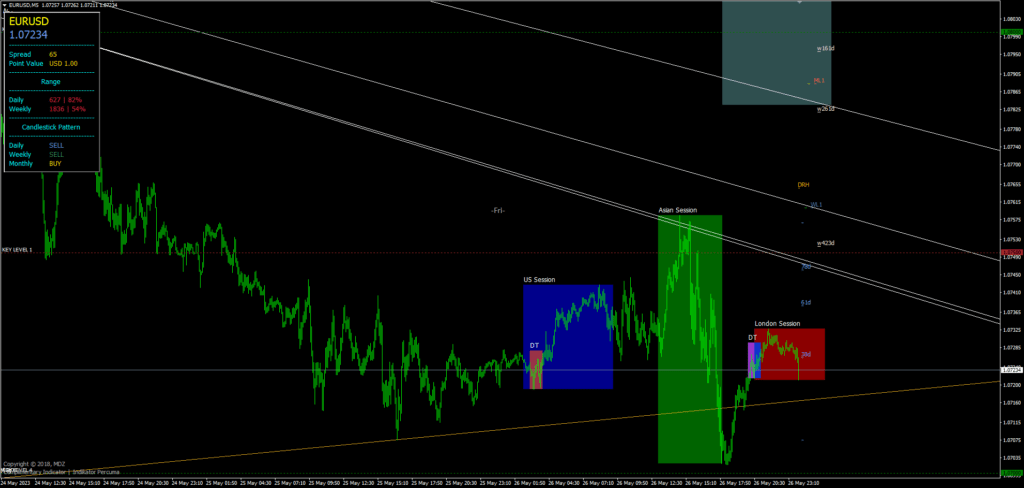

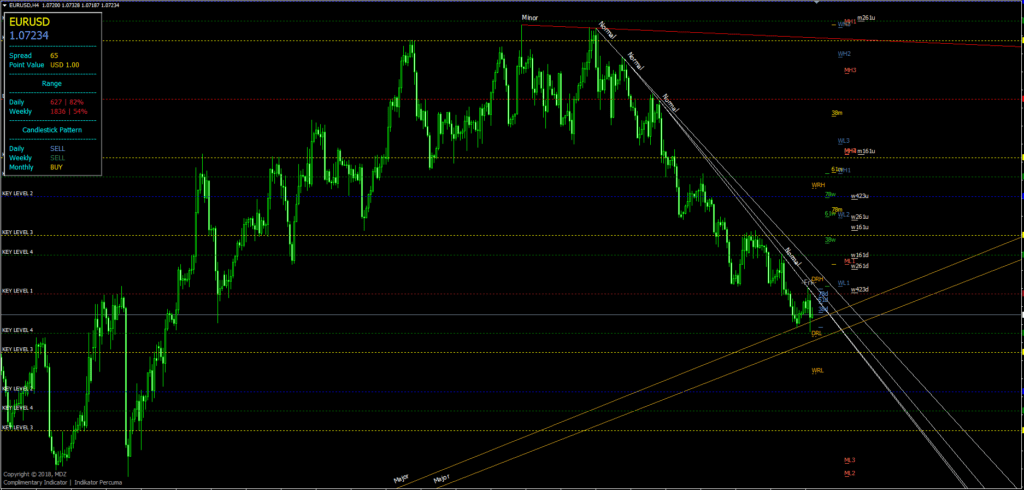

The MDZ Price Action Indicator provides a thorough analysis of numerous price levels, trends, and ranges that can be used as benchmarks by traders. These elements are essential for creating a sound trading strategy and assessing market circumstances. The AIO Forex Indicator shows the following important components:

- Key support and resistance levels: These levels mark significant price points likely to trigger a strong market reaction. Identifying these levels can help traders spot potential trade entry and exit points.

- Trend lines: Trend lines are valuable for recognizing the market’s direction and momentum. They offer a visual representation of the prevailing trend, aiding in interpreting market movements.

- Trading ranges (daily and weekly): These ranges outline the price boundaries within which the market is anticipated to fluctuate during a specific period. They provide insights into potential breakout or reversal points.

- Lows and highs (daily, weekly, and monthly): These levels highlight the highest and lowest price points reached during a given timeframe, offering crucial information on market sentiment and possible turning points.

- Fibonacci extension grid: This grid enables traders to predict potential price targets and reversal points based on the Fibonacci sequence, a widely accepted mathematical principle in trading analysis.

- Trading sessions: The MDZ Price Action Indicator also showcases various trading sessions, allowing traders to monitor market activity across different time zones.

The PDF files that are linked provide detailed explanations of various capabilities, as well as tips on how to use them efficiently. Utilizing the MDZ Price Action MT5 Indicator to its fullest potential will enable you to make more strategic and educated trading decisions.