A Non-Repaint Indicator for MT4 is the Commando Trading system. Signals to buy or sell are produced. According to the creator, it is the fastest, most accurate, and most successful forex trading method in the world. It is made to offer traders a simple-to-use, incredibly successful trading technique that can be utilized to generate steady earnings in the forex market. A trading handbook and a good collection of tools are included with the system.

The majority of this scaling strategy is manual. Arrow BUY/SELL signals are generated by the NON Repaint indicator, but you must filter them using the suggested approach or one of your own. The trader will decide whether to enter the market, place protection stops, and profitable exit stops. As a result, the trader must be conversant with the concepts of risk and reward and set entries and exits using initial support and resistance levels.

Any Forex currency pair as well as other assets including commodities, digital currencies, binary options, stock markets, indices, etc. can be traded using the Commando Trading system. Additionally, you can use it on whatever time frame that works best for you, from 1-minute to 4-hour charts. M5 and H1 periods are ideal for use.

This NON-Repaint Indicator for MT4 can provide trading signals that you can use as-is or further filter with further chart research, which is advised. Although this strategy can be used by traders of all experience levels, it may be helpful to practice trading on an MT4 demo account first until you are reliable and self-assured enough to trade in real time.

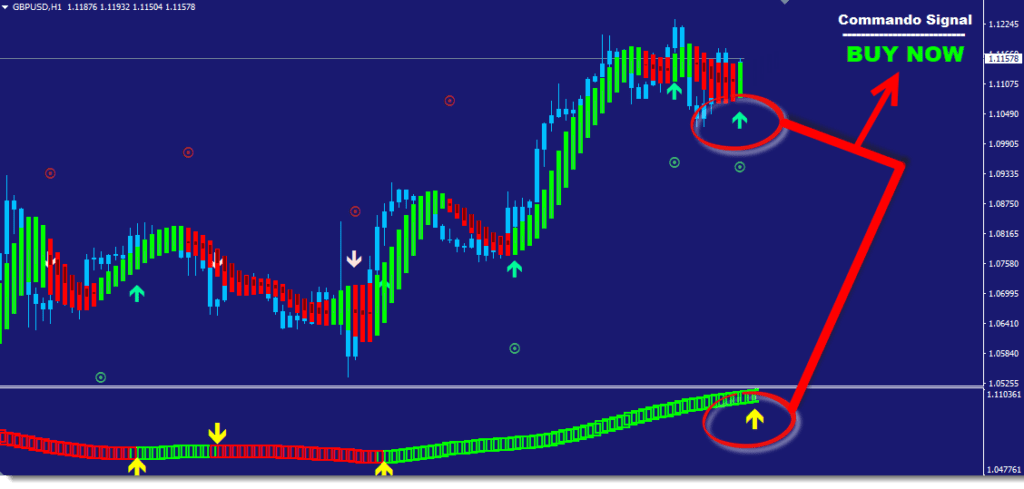

Main Chart of this NON-Repaint Indicator

As you can see, the Commando Forex System’s primary interface is quite uncomplicated and uncomplicated. With this strategy, even a total novice can begin trading and earning money. You will receive multiple buy/sell signals with this NON-Repaint Indicator system, ensuring that you never miss a chance to make money. Arrow, on-chart, smartphone, and audio popup window notifications will be sent to you. This is advantageous since it allows you to keep an eye on numerous charts at once rather than having to spend the entire day waiting for signals to come on the charts.

Trading rules

Stick to your money management plan and avoid trading during a period of breaking news. Half an hour after the big currency news, stop your trades.

As usual, use wise money management to get the best outcomes. You need to master discipline, emotions, and psychology to be a successful trader. Knowing when to trade and when not to is essential. Trading should be avoided at times and under unfavorable market conditions, such as low volume or volatility, outside of the main sessions, with exotic currency pairs, wider spreads, etc.

When the market is moving somewhat quickly, this Forex System is most effective. Typically, this occurs between the New York and London sessions. It is also available for usage in the sessions in Sydney and Tokyo.

Two alternative templates are offered by this system. Use the standard trading method if you prefer.

- For time frames H1 and up, select Long_Term.

- For time frames M30 and below, use short_term.

Buy Entry

Since the message will be shown right there on your chart’s top right, a Buy transaction will be simple to identify. “BUY NOW” will appear there. The signal is verified by the yellow arrow on the SCF Window below. At this point, you would instantly place a Buy trade.

Sell Entry

Similar to the Buy Trade, a sell signal will display the words “SELL NOW” in a message. When a red arrow appears, you must enter a sell trade. The signal should also be confirmed by the appearance of a yellow arrow. At this point, you should instantly place a sell trade.

Trade Exist

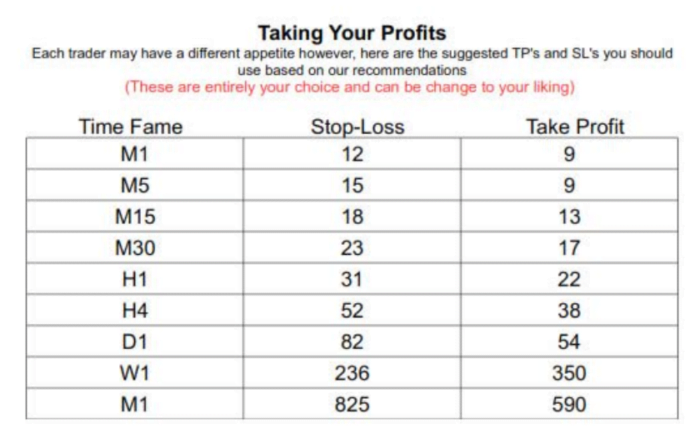

This approach allows for the liquidation of any positions using a predetermined profit target. As an alternative, the profit target ought to be established utilizing prior support or resistance as a guide. To position your take profit a few pip below that level, you can draw a line horizontally from the prior support/resistance level. In the event that the system’s conditions change (the opposite arrow emerges), you can also close the transaction manually.

It is advised to employ a stop loss. Set the stop loss below the entry price using prior support and resistance as a guide or on the prior high and low swing. It is not advised to use fixed stop loss values without any reference points.