An MT4 Hedge Strategy called Precision Long Trend Trading is available for FREE download. Identifying and tracking a market trend are key components of the well-liked trading approach known as “trend following.” This strategy is predicated on the idea that traders can profit from market trends by following them and placing trades that move in the same direction as the trend. Markets have a tendency to move in trends. A trend-following approach that produces trading signals using trend indicators is the Precision Long Trend Trading system. This essay will discuss this tactic and how it might be applied to market trading.

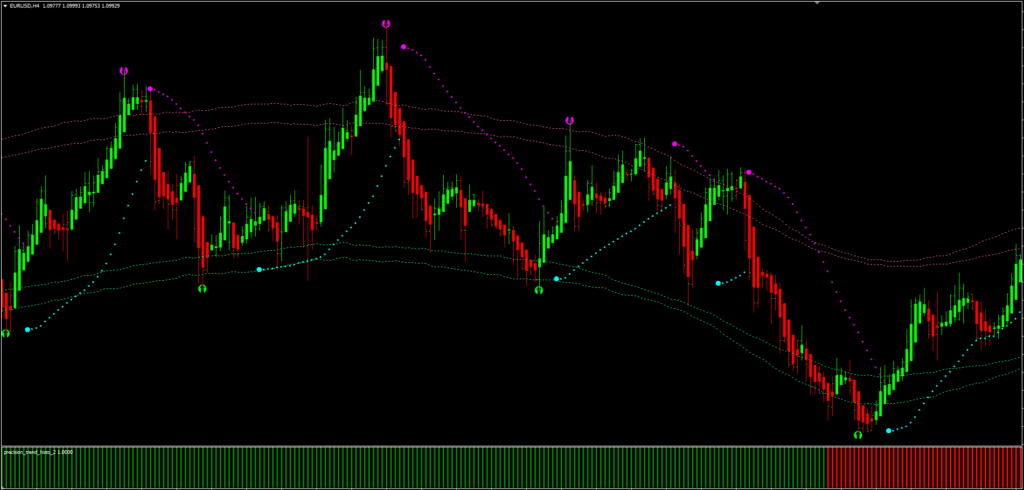

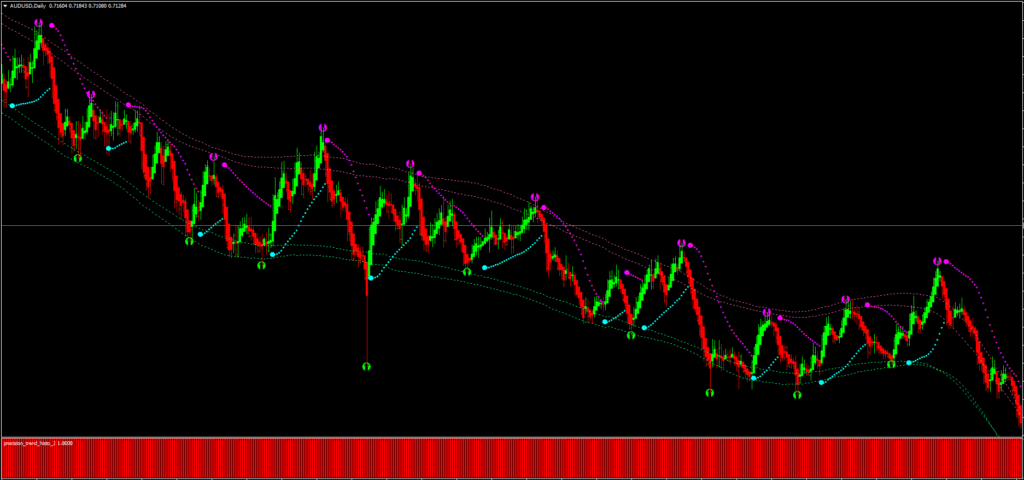

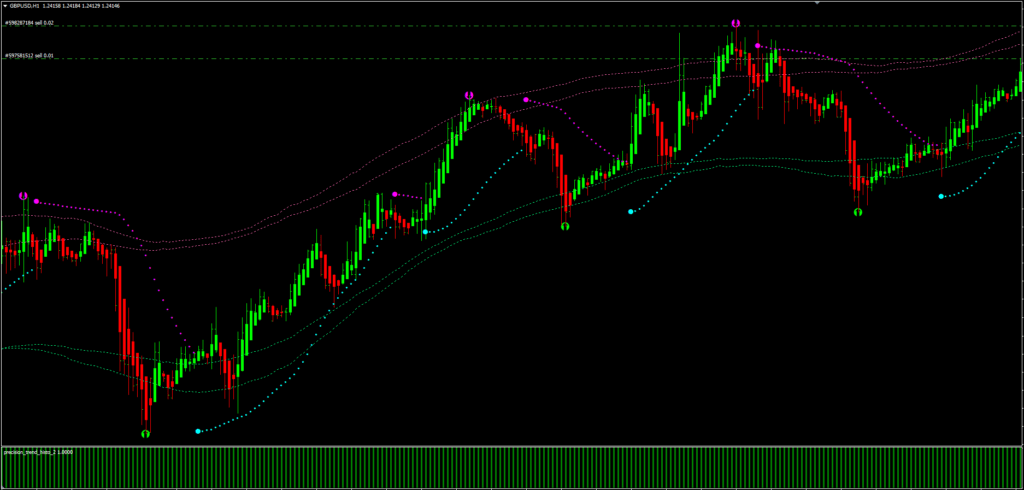

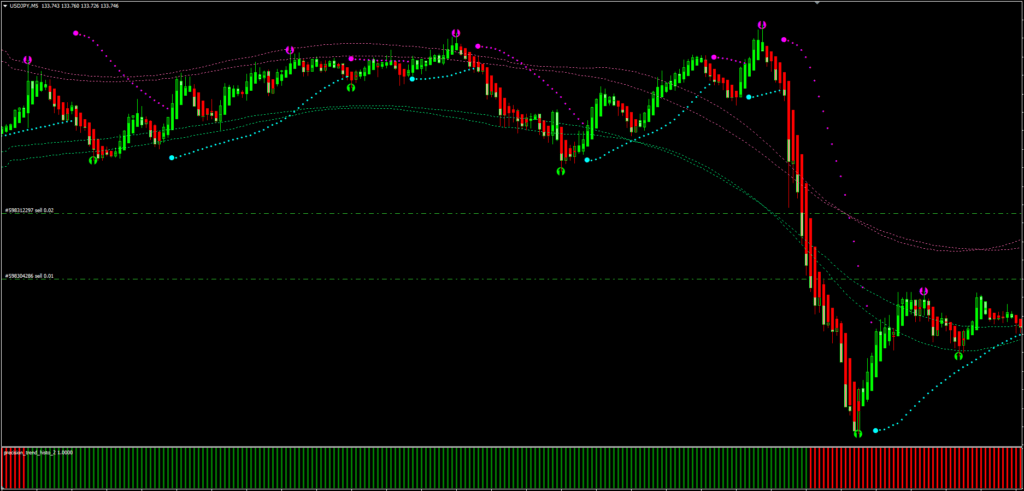

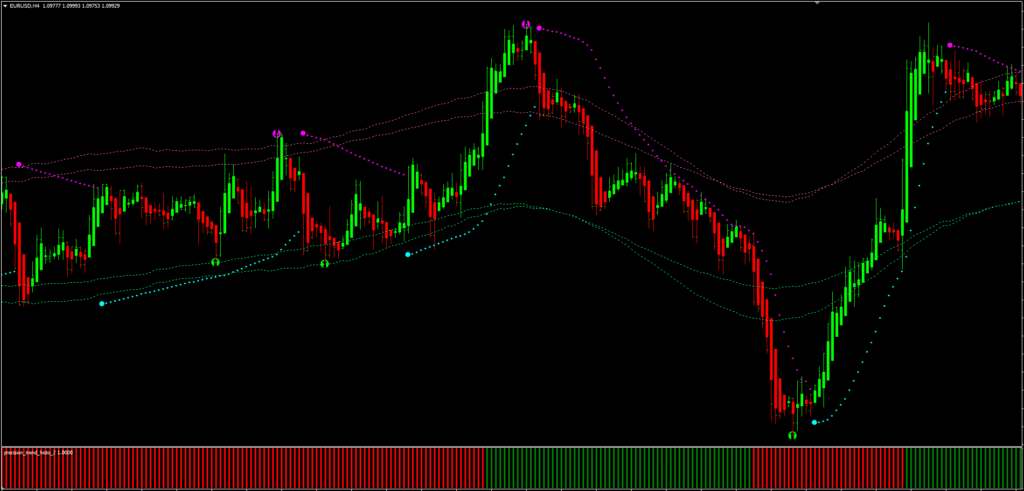

A trend-following method called the MT4 Hedge method is based on the Precision Trend (slow) and Parabolic SAR trend indicators. The Precision Trend configuration takes a very long time to establish a strong trend. Only timing signals in the direction of the Precision Trend-defined trend are determined by the Parabolic SAR. TMA Bands are added to the chart as dynamic levels of support and resistance, which can be seen as quick target levels.

This strategy’s basic tenet is to use trend indicators to determine the trend’s direction and then Parabolic SAR to time entry along the trend. The Precision Trend indicator is intended to support the strategy and confirm the trend’s direction. While TMA Bands offer dynamic support and resistance levels to help traders identify quick target levels, the Parabolic SAR indicator is utilized to provide entry signals that are used to trade in the trend’s direction.

This MT4 Hedge Strategy only uses manual labor. The indicators generate the signals, but it is up to the trader to decide when to enter the market, create protective stops, and when to quit it profitably. As a result, the trader must be conversant with the concepts of risk and reward and set entries and exits using initial support and resistance levels.

The Precision Long Trend System can provide you with trading signals that you can use as-is or further filter with further chart analysis, which is advised. All levels of traders can utilize this strategy, but until you are reliable and self-assured enough to trade on a live account, it can be helpful to practice trading on an MT4 demo account.

Simple to understand is this MT4 Hedge Strategy. With this strategy, even a total novice can begin trading and earning money. You can configure it to send you signal alerts via email, platform pop-ups, and mobile notifications. This is advantageous since it allows you to keep an eye on numerous charts at once rather than having to spend the entire day waiting for signals to come on the charts.

Any Forex currency pair as well as other assets like stocks, commodities, cryptocurrencies, precious metals, oil, gas, etc. can be used with this Precision Long Trend Indicator. Additionally, you may apply it to any time window that works best for you, from 1-minute to 1-month charts.

implementing this hedging technique

Because this tactic was created for hedging, users can use a reverse order for the stop loss. This implies that traders can use a reverse order to enter a trade in the opposite direction of the trend, thereby hedging their position, instead of employing a stop loss to restrict losses. If the market turns against a trader, this strategy can assist them minimize their losses.

Benefits

The Precision Long Trend Hedge Strategy’s simplicity is one of its primary advantages. This technique is simple to learn and use for traders because it is built around a few basic indicators. The technique also incorporates hedging, which can aid traders in limiting losses and safeguarding their positions during volatile market movements.

This tactic’s potency in trending markets is another advantage. The method works well in trending markets when the trend direction is obvious because it is based on trend indicators. By following the trend and placing transactions in the same direction, the method can provide winning trades in these markets.

Trading Rules

When employing this Precision Long Trend Strategy, keep in mind to tighten your stop losses around High Impact News Releases or refrain from trading at least 15 minutes before and after these events.

As usual, use wise money management to get the best outcomes. You need to master discipline, emotions, and psychology to be a successful trader. Knowing when to trade and when not to is essential. Trading should be avoided at times and under unfavorable market conditions, such as low volume or volatility, outside of the main sessions, with exotic currency pairs, wider spreads, etc.

Buy Entry

- Precision Trend Green bar.

- Parabolic Sar Aqua dot below the candle.

Sell Entry

- Precision Trend Red bar.

- Parabolic Sar Purple dot above the candle.

Trade Exist

Any position can be closed out utilizing a fixed profit objective when employing the MT4 Hedge Strategy. As an alternative, the profit objective should be established utilizing a previous level of support, resistance, or high-low as a guide. In the event that the system conditions change, you can also manually close the transaction.

- Set your stop loss above the Parabolic Sar’s dots and below them.

- Quick profit goal at TMA levels.

- When the precision trend or the direction of the parabolic sar changes, you should leave your position.

- Because this tactic was created for hedging, users can use a reverse order for the stop loss.

Using prior support and resistance levels as a guide, set a stop loss below or above the entry price, or on the previous high/low swing. It is not advised to use fixed stop loss values without any reference points.