An MT4 All-in-One indicator that offers real-time insights into market structure, order blocks, discount zones, equal highs and lows, and more is called the Smart Money Concept Indicator. With the use of this SMC Indicator, traders may automatically mark up their charts with widely accepted price action techniques. Having dependable and adaptable technologies that provide thorough market knowledge is a significant advantage.

A comprehensive tool called the Smart Money Concepts (SMC) Indicator was created to help price action traders navigate the intricate and rapidly changing financial markets with greater accuracy and efficiency.

Examining the notion of “Smart Money Concepts,” price action traders have rapidly embraced this phrase despite its relatively recent inception. The main concept is to deliberately interact with liquidity in order to find more advantageous market points of interest.

Any Forex currency pair as well as other assets including commodities, cryptocurrencies, binary options, stock markets, indices, etc., can be used with this SMC indicator. Additionally, you may use it on whatever time interval—from the 1-minute charts to the month charts—that works best for you.

There is more to this AIO Indicator than just a trading indicator system. Nonetheless, it can be a great asset to your trading as a tool for further chart research, determining the trade exit position (TP/SL), and more. Although this technique is accessible to traders of all skill levels, it can be helpful to practice on an MT4 demo account until you have the consistency and self-assurance necessary to move on to actual trading. With most Forex firms, you can open a genuine or demo trading account.

Features

The Fundamentals of Market Structure

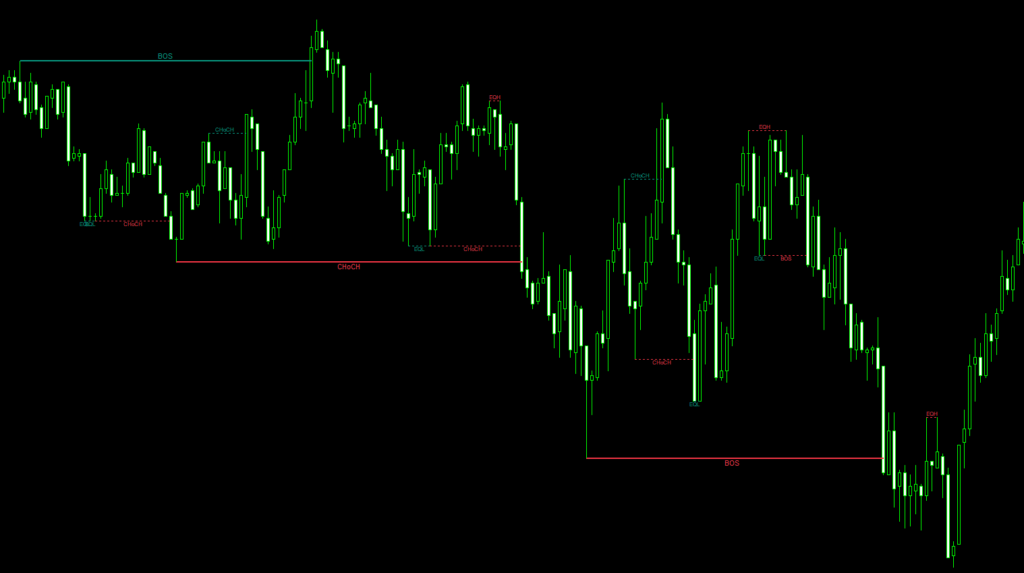

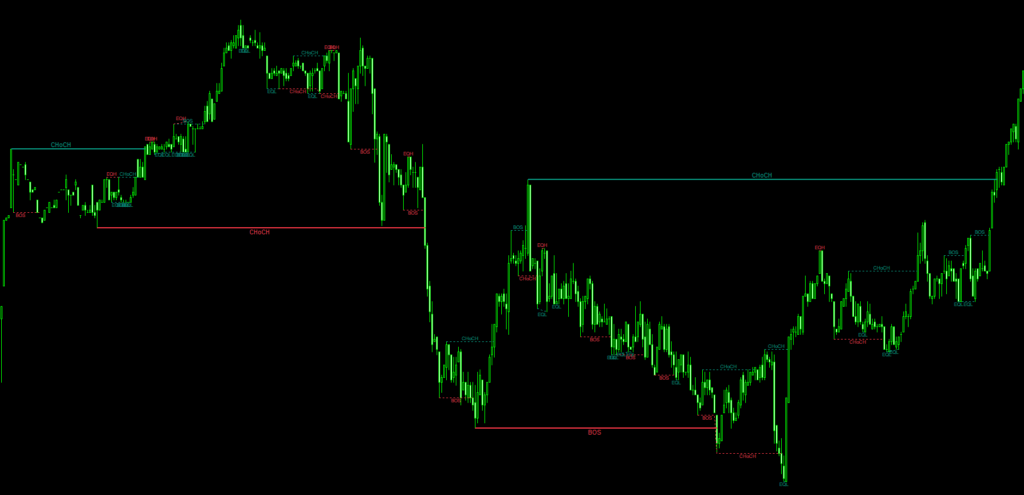

The framework for recognizing trend continuations and reversals is provided by the market structure. The two main elements that form this structure are the Break of Structure (BOS) and the Change of Character (CHoCH).

Character Shift (CHoCH)

A possible change or reversal in the market is indicated by a Change of Character (CHoCH). When the price breaches a previous swing high during a downtrend (bearish CHoCH) or a prior swing low during an uptrend (bullish CHoCH), this shift is evident. CHoCH is divided into two categories by the SMC indicator:

- Leading CHoCH: The lack of previous reversal indicators, such as a lower low during a downtrend or a higher high during an uptrend, is what distinguishes this variety.

- Supported CHoCH (CHoCH+): The supported CHoCH, in contrast to the leading CHoCH, exhibits early warning indicators of a market reversal, such as a lower low during a decline or a failed higher high during an upswing.

Break Of Structure (BOS)

As the opposite of CHoCH, a Break of Structure (BOS) is observed when the price breaks a previous swing high in an upward trend (bullish BOS) or a previous swing low in a downward trend (bearish BOS). These structures typically have a CHoCH pattern, which denotes continuations of a trend rather than reversals. As a result, consecutive BOS are frequently seen in a trending market.

The Intricacies of Swing & Internal Structure

Swing structure and internal structure are the two distinct market structure dimensions that the Smart Money Concepts indicator presents. While swing structures draw from longer-term swing highs and lows, internal structures are drawn from shorter-term ones. Users can choose which lookback to use to find swing points for these two buildings using the indication.

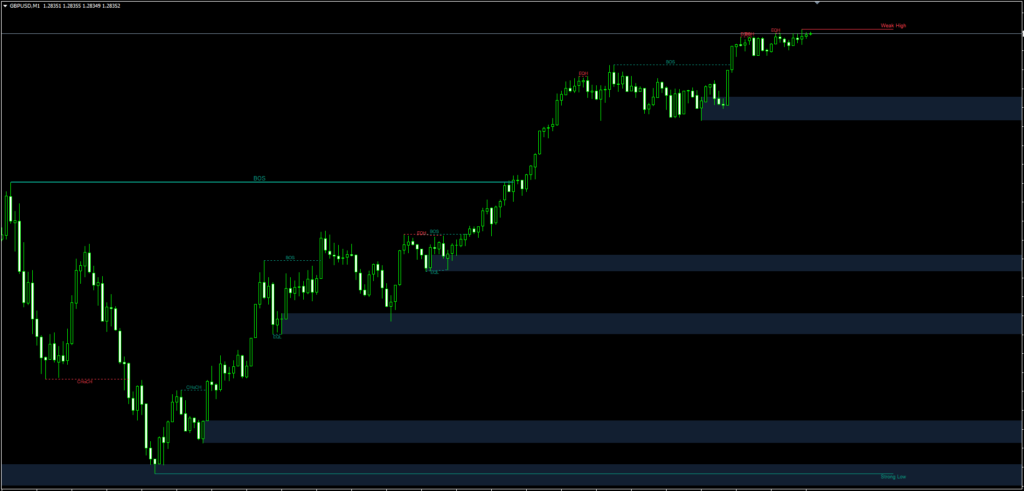

Equal Highs & Lows

Additionally, the toolkit identifies equal highs and lows in history that are derived from extremely brief swing points. These levels are useful in anticipating impending market formations such as BOS or CHoCH, as well as short-term reversals.

Strong/Weak Highs/Lows

The maximum and minimum levels derived from medium-term swings are indicated by the SMC indicator. We refer to these as Strong/Weak Highs/Lows. One can determine the strength or weakness of a maximum or lowest level by calculating a relative percentage from the trading volume that occurs on both swings.

Another Indicator to Utilize Alongside SMC Indicator

An additional effective tool for the MT4 and MT5 platforms is the MDZ Price Action Indicator, which goes well with the SMC Indicator. Insights such as Key Levels, Trend lines, Ranges, Fibonacci retracements and end-of-trend markers, and Trading sessions are provided by this adaptable indicator.

One of the MDZ Price Action All-In-One Indicator’s special features is automatic trend line recognition, which helps traders visualize market trends more easily. The Fibonacci features provide insights into possible reversal levels and trending move completions, while the Range tool aids in identifying market ranges and possible breakout points.

This indicator, which superimposes trading sessions onto the chart, aids traders in comprehending daily sentiment shifts and global market interconnections. Similar to the Smart Money Concepts Indicator, the MDZ Price Action Indicator is a dependable and thorough tool that provides traders with essential market data to efficiently traverse financial markets.

Conclusion

Finally, traders are provided with an advanced, integrated, and intuitive tool by the AIO Indicator. Traders can obtain valuable insights from high/low patterns, swing points, and market structures by effectively annotating their charts. Better risk management, improved decision-making skills, and overall trading performance result from this.

RP4000, the admin of our group chat, forwarded this to us. So give the RoyalPrinceTrading some love and check out his indicators and EA on MQL5.