The MT5 Forex System Spike Detector Indicator is available for free download. It is a highly successful trend-following strategy made for day trading and forex scalping. To find high-probability trading opportunities in the market, the system combines the Spike Detector and the SuperTrend, two potent technical indicators.

Key price levels and trend orientations are identified by the price action and trend-following approach known as the spike detector indicator. It is perfect for scalpers and day traders who want to execute rapid, short-term trades based on the state of the market.

The Spike Detector is a special indicator that recognizes market spikes—rapid price fluctuations. These surges are frequently brought on by news events or other market triggers, which can offer profitable trading opportunities to experienced traders. The Spike Detector with SuperTrend MT5 system enables traders to interpret these spikes in one of two ways: either as a chance to open trades that are in line with the main trend or as an opportunity to look for spikes using the renko spike bar MT5.

A well-liked trend-following indicator that aids traders in determining the trend of the market is the SuperTrend indicator. Traders can improve their chances of success by spotting trading opportunities that are in line with the general market trend by utilizing the SuperTrend with the Spike Detector.

The adaptability of this MT5 Forex System is one of its benefits. Depending on their preferences and risk tolerance, traders can utilize the method to trade a variety of currency pairs and time intervals. Traders can fine-tune the system to their needs by having it tailored to fit their unique trading techniques.

The Spike Detector Indicator is a completely manual device. The indicators generate the signals, but it is up to the trader to decide when to enter the market, create protective stops, and when to quit it profitably. As a result, the trader must be conversant with the concepts of risk and reward and set entries and exits using initial support and resistance levels.

You can use the trade signals provided by the MT5 Forex System as-is or, as is advised, further filter them using additional chart analysis. All levels of traders can utilize this strategy, but until you are reliable and self-assured enough to trade on a live account, it can be helpful to practice trading on an MT4 demo account.

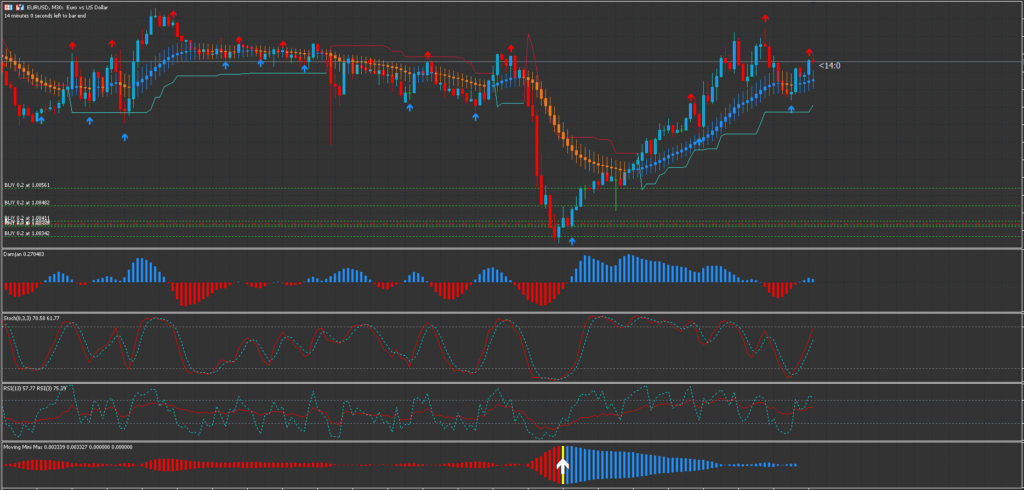

Main Chart

Any Forex currency pair as well as other assets like equities, commodities, cryptocurrencies, precious metals, oil, gas, etc. can be used with this spike detector indicator. Additionally, you may apply it to any time window that works best for you, from 1-minute to 1-month charts.

Trading rules

When employing this MT5 Forex System, keep in mind to tighten your stop losses around High Impact News Releases or refrain from trading at least 15 minutes before and after these events.

As usual, use wise money management to get the best outcomes. You need to master discipline, emotions, and psychology to be a successful trader. Knowing when to trade and when not to is essential. Trading should be avoided at times and under unfavorable market conditions, such as low volume or volatility, outside of the main sessions, with exotic currency pairs, wider spreads, etc.

Buy Entry

- Spike Detector gives a Blue arrow.

- Damjan Blue bars.

- Stochastic begins to cross upwards.

- RSI Crossing level 30 upwards.

- The Min-Max indicator shows Blue bars.

- Heiken Ashi smoothed (4 ma Candles indicator) agrees with the main trend(Blue).

- Optional – Supertrend Blue Line.

Sell Entry

- Spike Detector gives a Red arrow.

- Damjan Red bars.

- Stochastic begins to cross downwards.

- RSI Crossing level 70 downwards.

- The Min-Max indicator shows Red bars.

- Heiken Ashi smoothed (4 ma Candles indicator) agrees with the main trend(Orange).

- Optional – Supertrend Sell Line.

Trade Exist

Using a fixed profit target, all positions with the Spike Detector Indicator can be closed out. As an alternative, the profit objective should be established utilizing a previous level of support, resistance, or high-low as a guide. In the event that the system conditions change, you can also manually close the transaction.

Initially set the stop loss below or above the supertrend line.

It is advised to employ a stop loss. Set the stop loss below the entry price using prior support and resistance as a guide or on the prior high and low swing. It is not advised to use fixed stop loss values without any reference points.