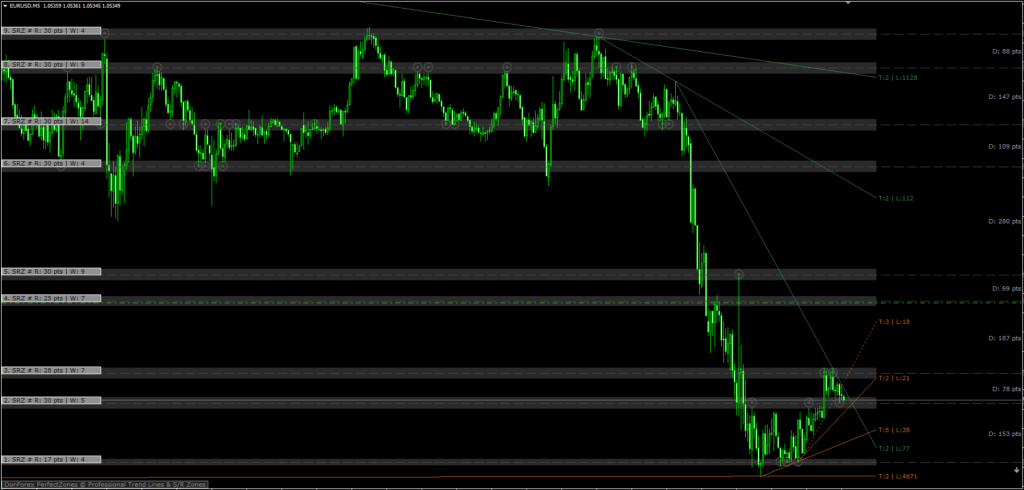

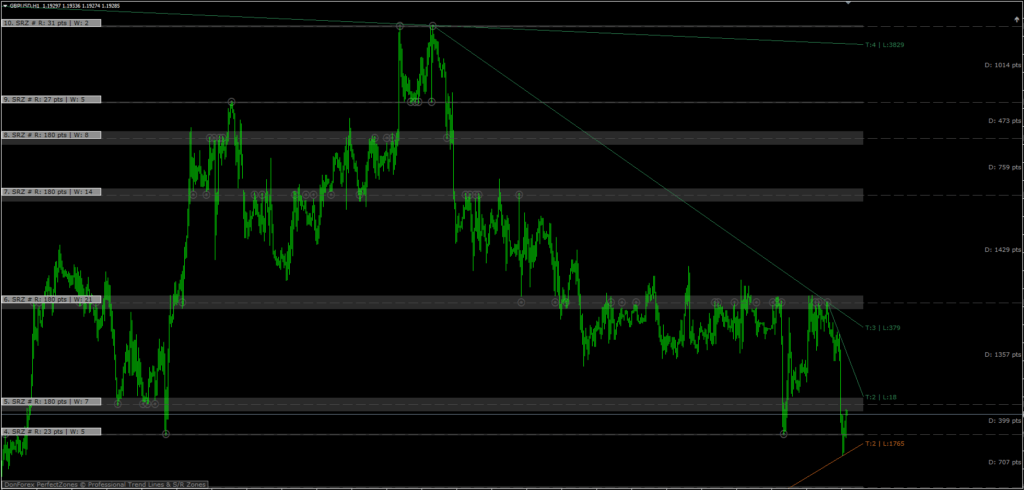

This very sophisticated support and resistance indicator for MT4 automatically creates trend lines, support and resistance zones, and other technical indicators. One of the most common forex market analyses utilized by thousands of traders worldwide is support and resistance.

- use a wholly own calculating technique

- automatically creates zones of support and resistance.

- generates trend lines automatically.

- shows the trend lines that have broken but are still in effect (dotted lines)

- determines and shows the following:

- The size (in points) of the Support and Resistance zones

- the ‘weight’ of the Support and Resistance zones (the zone with a greater value is considered to be more important)

- The distance (measured in points) between two adjacent zones

- The trend lines’ length (measured in bars)

- The number of times the trend lines have been touched (greater value, stronger line)

- shows (with an arrow) whether there are no longer any Support and Resistance zones in the specified direction.

- Adjustable time periods for trend lines, support and resistance levels, and the amount of bars

- two levels of selectable sensitivity

- Variable trend line fashion

- Calculates Support and Resistance zones’ colors automatically

- from the backdrop color of the graph (a really useful feature)

- Trend lines’ color settings

- Employ offline charts

Most of the time, this Support and Resistance Indicator is manual. It does create independent indications, but I don’t advise relying only on them. The trader will decide whether to enter the market, place protection stops, and profitable exit stops. As a result, the trader must be conversant with the concepts of risk and reward and set entries and exits using initial support and resistance levels. For that reason, our support and resistance indicator is ideal.

Although it isn’t a stand-alone trading indication, the support and resistance indicator can be very helpful for your trading as additional chart analysis, to determine trade exit position(TP/SL), and more. Although this strategy can be used by traders of all experience levels, it may be helpful to practice trading on an MT4 demo account first until you are reliable and self-assured enough to trade in real time. Most MT4 Forex brokers allow you to create a trading account, either genuine or practice.

Any Forex currency pair as well as other assets like commodities, cryptocurrencies, binary options, stock markets, indices, etc. can be used with this support and resistance indicator. Additionally, you can use it on whatever time frame that works best for you, from 1-minute to 4-hour charts.

Tips on How to use this Support and Resistance Indicator

Stick to your money management plan and avoid trading during a period of breaking news. Half an hour after the big currency news, stop your trades.

As usual, use wise money management to get the best outcomes. You need to master discipline, emotions, and psychology to be a successful trader. Knowing when to trade and when not to is essential. Trading should be avoided at times and under unfavorable market conditions, such as low volume or volatility, outside of the main sessions, with exotic currency pairs, wider spreads, etc.

- Look for “clear” charts (such as those with beautiful top/bottom peaks, no jagged lines, and short candle wicks).

- These simple charts respect the Support and Resistance levels better, therefore the indications they provide are more trustworthy.

- Wait until the price is getting close to a zone.

- Watch for any indications of a potential breakout or reversal in the area covered by the Support and Resistance Indicator.

- There are two sorts of common break-out formations:

- A large, distinct candle with rapid motion

- As the zone approaches, the candles get smaller and smaller before finally breaking through (slower).

- There are numerous reversal indicators, such as enveloping, pinball, etc.

- If there is a combination with any other level system (such as Fibo, pivot, etc.), that is another confirming factor.

- Of course, the trend lines also serve as sloped Support and Resistance levels.

- More significant Support and Resistance zones are provided by higher time frames.

- The price breaking through the zone and then making a retest (support turning into resistance and vice versa) is (perhaps) the most dependable scenario.