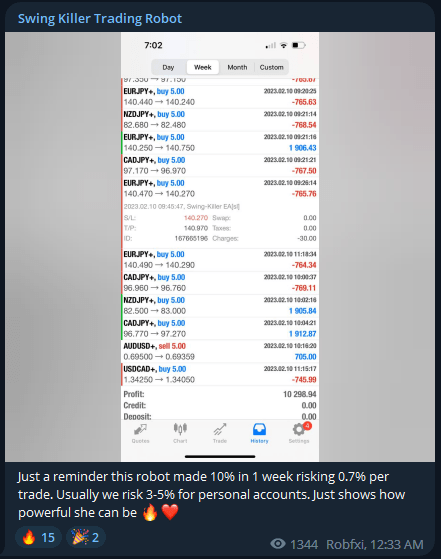

A completely automated Trading Expert Advisor called Swing Killer EA was created to make trading in the financial markets simpler and more successful. The EA automatically determines the best trading chances and places trades using sophisticated algorithms and technical analysis. This implies that traders do not need to constantly monitor the markets in order to profit from market swings.

The institutional levels on overbought and oversold markets are the ones that this intelligent trading robot has been created expressly to target. These levels are frequently the consequence of financial institutions such as banks manipulating the market, and they frequently portend a probable market reversal. The EA can execute lucrative trades with a high degree of accuracy by focusing on these levels.

Instead of depending on reactive trading, the EA uses a novel method that involves setting pending orders on certain levels. This enables the EA to take advantage of any prospective market moves by entering the market at the most advantageous time. As the EA is only activated if the market hits a specific level, the pending order method also lowers the possibility of losses.

Risk Management Techniques in this Smart Trading Robot

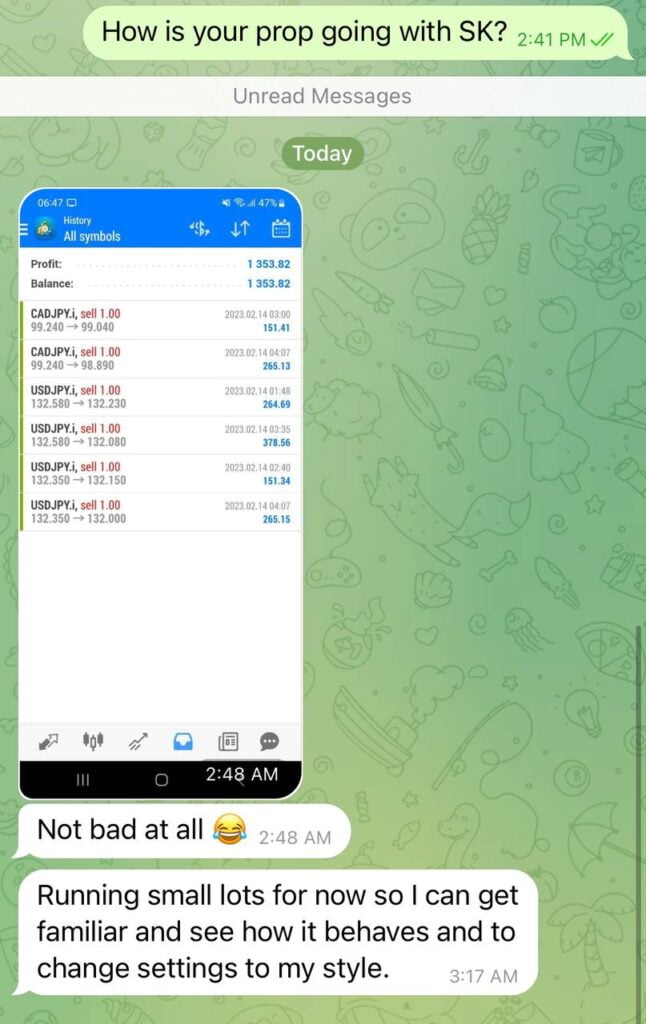

The application of risk management is another crucial component of this robot. A risk percentage strategy is used by the robot to determine how much risk it is willing to accept for each deal. By doing this, the robot is protected from potentially disastrous losses and is guaranteed to function within a predetermined risk tolerance threshold. Additionally, it can go days without making a trade because it doesn’t employ dangerous tactics like martingale, grid, HFT, etc.

Additionally, this Trading Expert Advisor uses a single entry strategy with stop loss and take profit protection for trades. In other words, the robot makes a single market entry and then exits when it reaches its stop loss or take profit objectives.

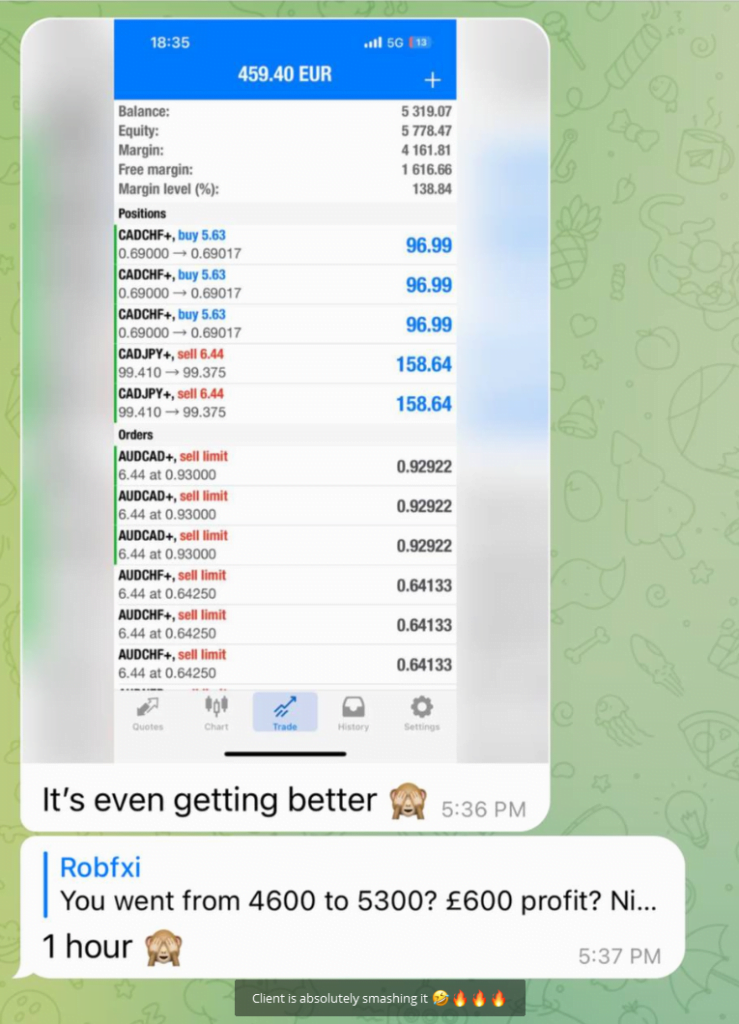

The robot diversifies its portfolio and lowers the chance of losing all of its investments in a single trade by dividing its risk into three entries with three separate take-profit levels (same SL). The robot places a pending order on each of these entries, each of which has a unique fraction of the entire risk.

The robot also employs the ATR stop-loss approach, a popular way for traders to reduce losses. The ATR stop-loss approach ensures that the robot is not stopped out too early or too late by adjusting the stop loss according on market volatility.

In addition, depending on the state of the market, the robot uses either pip-based or percentage-based take-profit targets. The robot can increase revenues thanks to its adaptability to the constantly shifting market conditions.

Last but not least, the robot employs a filtering method based on the Moving Average (MA) to identify the major market patterns. This lowers the chance of losses and guarantees that the robot won’t place transactions that are contrary to the current trend.

Recommendations

- $100 is the minimum balance required.

- best on all significant pairs. (Attain any pair.)

- The M5 TimeFrame works best. (Attend to all deadlines)

- This free forex EA should be run 24/5 on a VPS (Reliable and Trusted FOREX VPS – FXVM).

- low spread ECN account is also advised (Find the Perfect Broker For You Here).