An MT4 strategy called Triangle Retracement System provides simple buy/sell signals. It uses a few more indications but primarily relies on the Zig Zag 2vf. It is a flexible forex scalping trading strategy that works with all different timeframe charts and can be used to trade all different forex currency pairings.

The Triangle Retracement Strategy For MT4 does not rely on triangle chart patterns, which the majority of traders view as a sign of a trend continuation. Instead, it is based on the ZigZag indication, which comes with the MT4 platform as standard.

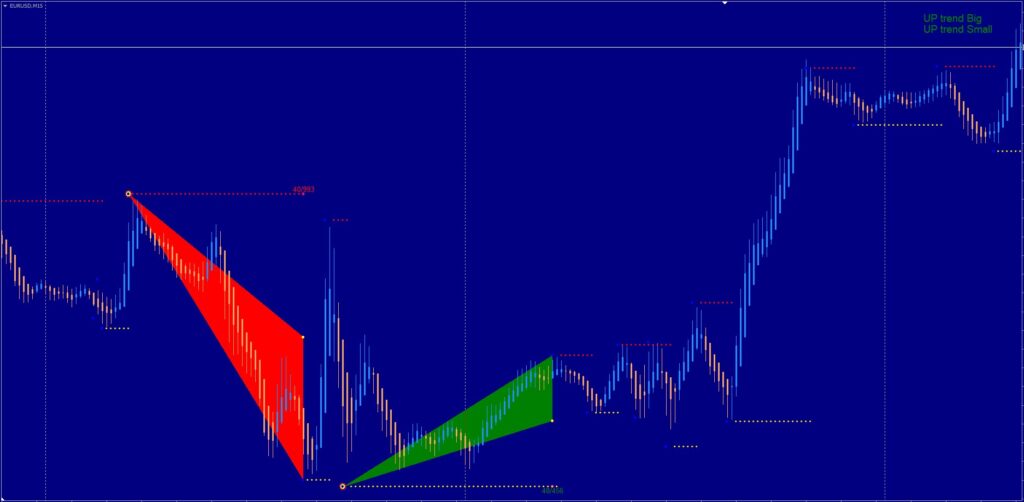

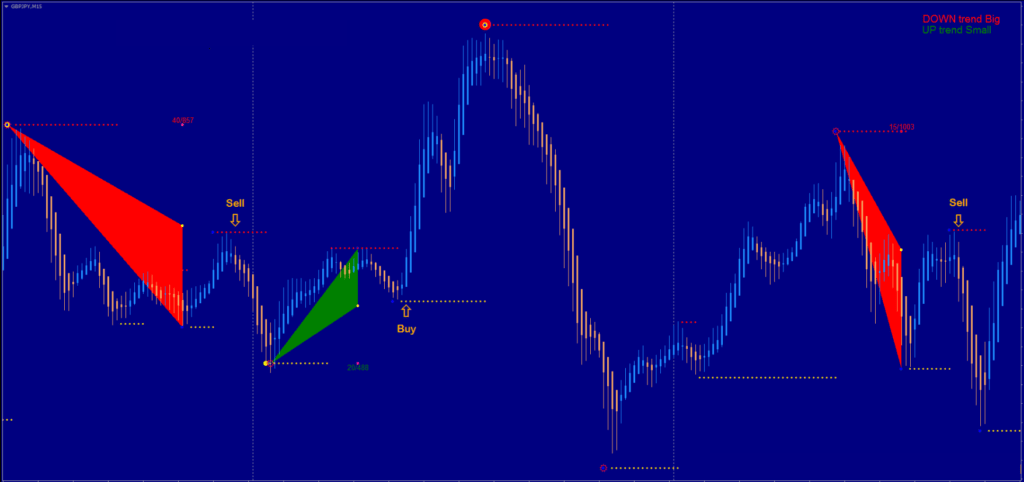

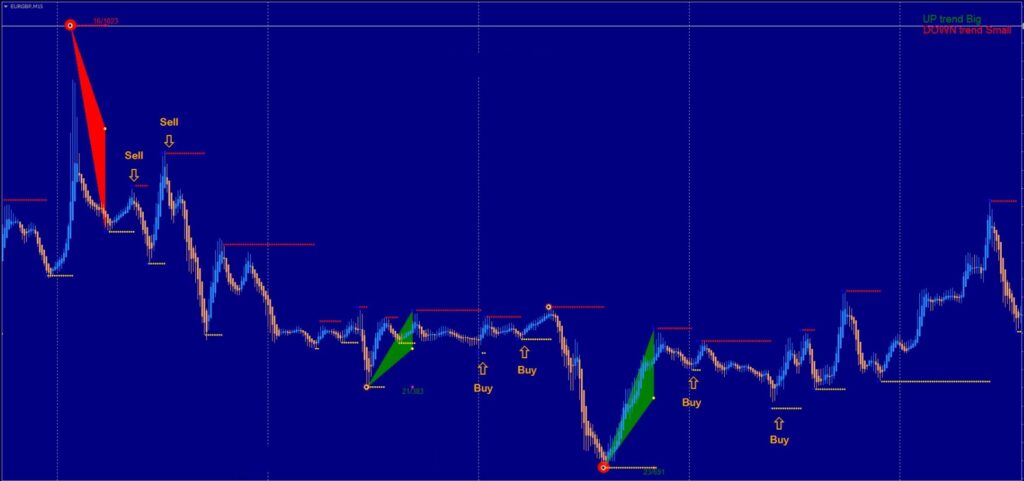

The “Zig zag 2vf” indicator, a modified version of the MT4 ZigZag indicator, will be used by this approach. This standard indicator variation provides additional visualization. Instead of drawing a line to represent price movement, it joins three points to form a triangle that is either blue or red in hue.

Additionally, based on the bar count parameter, it also indicates whether the larger trend is up or down.

The idea that price will return to the triangle’s middle point (depicted by the yellow point) provides the foundation for employing the indicator, which is called a “triangle retracement.” This strategy creates a trade entry due to the price’s propensity to return at that time.

There are three additional instruments in this system that are required to trade Chaos Semafor, the Buy and Sell, and the Heiken Ashi MA T3 indicator, as opposed to basing the completion of the triangle merely on the discovery of an entry.

The pivot points of the chart are displayed by the Chaos Semafor indicator. It shows circles in either green or red that represent bullish or bearish price movement, respectively.

The Buy and Sell indicator then displays important support and resistance levels for the current timeframe. This can occasionally match the Chaos Semafor’s pivot points, which is useful for confirmation. And the Heiken Ashi indicator is really another method of noise filtering, much as the ZigZag indicator.

This MT4 Strategy can provide trade signals that you can use as-is or further filter with further chart research, which is advised. Although this strategy can be used by traders of all experience levels, it may be helpful to practice trading on an MT4 demo account first until you are reliable and self-assured enough to trade in real time.

The Triangle Retracement Indicator System allows you to choose whether to receive signal alerts by email, platform pop-ups, or mobile notifications. This is advantageous since it allows you to keep an eye on numerous charts at once rather than having to spend the entire day waiting for signals to come on the charts.

Any Forex currency pair as well as other assets like equities, commodities, cryptocurrencies, precious metals, oil, gas, etc. can be employed with the Triangle Retracement Strategy. Additionally, you may use it on any time frame that works best for you, from 1-minute to 1-hour charts. M15 periods are the most effective.

Trading rules

Buy

- On the graph, a green triangle is depicted.

- Blue Heiken Aschi MA T3 bar. (optional)

- Retracement of the price near or just beyond the middle line of the triangle (yellow point)

If the price bounces off the aforementioned yellow point area and is supported by a yellow dotted line from the buy and sell indicator, a proper buy setup is in effect.

Sell

- On the graph, a red triangle is depicted.

- Orange bar from Heiken Aschi MA. (Optional)

- Retracement of the price near or just beyond the middle line of the triangle (yellow point)

If the price rebounds off the aforementioned yellow point area and is met with resistance from a red dotted line from the buy and sell indicator, a proper sell setup is in effect.