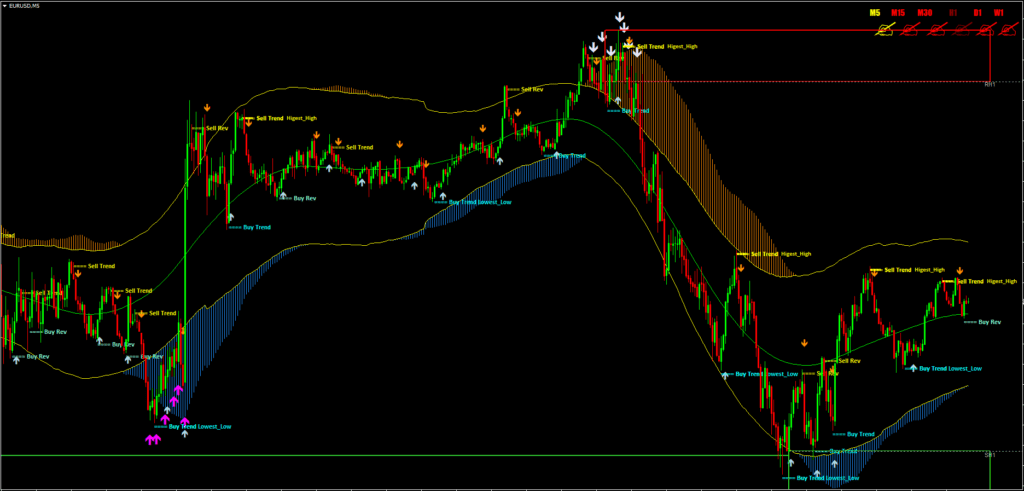

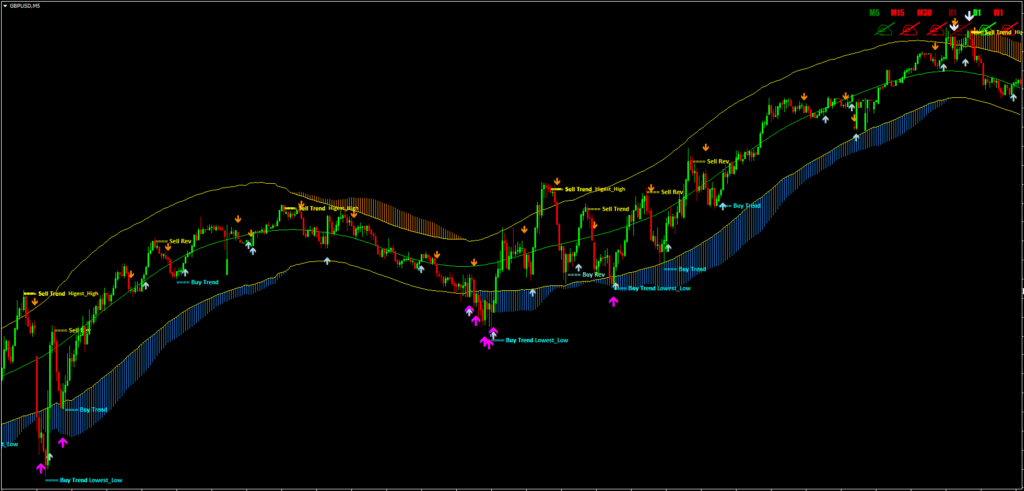

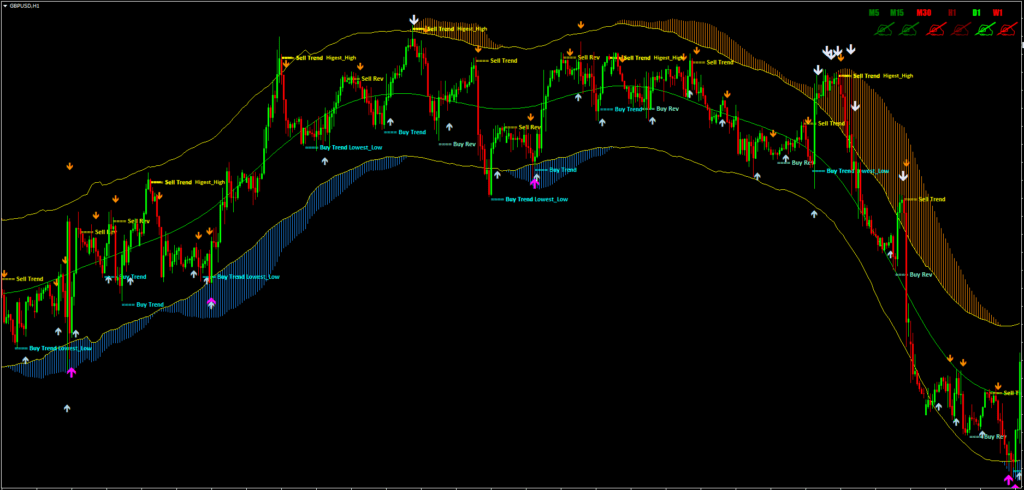

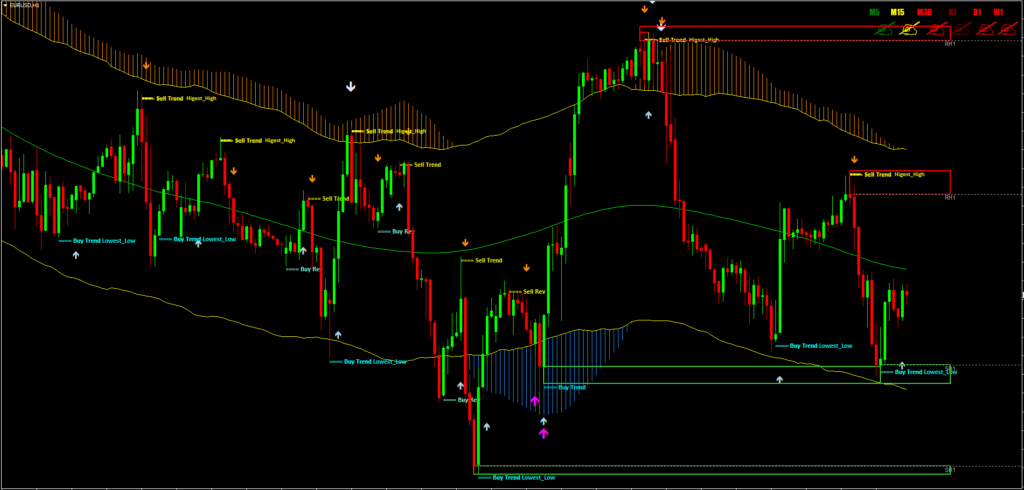

Verified Profit System (VPS), which offers a reliable and understandable method to market evaluations, has emerged as a prominent participant in financial trading. This price action trend method is based on the TMA (Triangular Moving Average) principle because of its tendency to follow trends and wide range of sophisticated tools, including levels of continuation/reversal, support, and resistance zones.

Indicators Used in this Trend Strategy

Let’s dive deeper into the specific indicators utilized in this system

Confluence 2 and Confluence 5

This in-house indicator is a crucial component of the VPS, assisting traders in locating high-probability trading opportunities when a number of variables favor a specific price movement. Traders can view market circumstances more broadly thanks to the numerous levels of analysis provided by the Confluence 2 and 5 indicators.

Zone Indicator

For correctly locating market support and resistance zones, the Zone Indicator on the VPS is essential. These are the price levels when there are noticeable shifts in buying or selling pressure, which could result in price reversals or continuations. By being aware of these zones, traders may forecast probable price changes and prepare their trades accordingly.

Trend Signal

The VPS really shines in the Trend Signal indicator. These tools aid traders in determining the general trend direction of the market and possible entry locations.

Trend Meter

The Trend Meter, which offers a visual picture of market patterns, is a crucial part of the VPS. It’s a useful tool for traders since it allows them to quickly assess the strength of a trend and make more educated decisions.

Levels Reversal

The Levels Reversal function in VPS is mainly used to identify probable market turning points. It identifies the regions where there is a good chance that the price will change course. Having an understanding of these levels might assist traders in taking advantage of market chances.

This Trend Strategy only uses manual labor. The indicators generate the signals, but it is up to the trader to decide when to enter the market, create protective stops, and when to quit it profitably. As a result, the trader must be conversant with the concepts of risk and reward and set entries and exits using initial support and resistance levels.

You can use the trade signals provided by this Verified Profit System as-is or, as is advised, combine them with extra chart research to further filter them. All levels of traders can utilize this strategy, but until you are reliable and self-assured enough to trade on a live account, it can be helpful to practice trading on an MT4 demo account.

This indicator allows you to choose whether to receive signal alerts via email, SMS, mobile notifications, or platform pop-ups. This is advantageous since it allows you to keep an eye on numerous charts at once rather than having to spend the entire day waiting for signals to come on the charts.

Any Forex currency pair as well as other assets including stocks, commodities, cryptocurrencies, precious metals, oil, gas, and so on can be traded using the Verified Profit System. Additionally, you may apply it to any time window that works best for you, from 1-minute to 1-month charts.

Trading Rules

Remember to tighten your Stop Losses around High Impact News Releases or avoid trading at least 15 minutes before and after these events when using this Trend Strategy. As always, remember about proper money management to achieve good results. To be a profitable trader, you must master discipline, emotions, and psychology. Avoid trading during unfavorable times and market conditions like low volume/volatility, beyond market open, and before market close.

Buy Entry

- Trend Signal Light Blue Buy Arrow.

- Blue bars are below the price.

- Support Zone. (GREEN Box)

- Level reversal Buy. (BLUE “Buy” text)

Sell Entry

- Trend Signal Orange Sell Arrow.

- Orange bars are above the price.

- Resistance Zone. (RED Box)

- Level reversal Sell. (Yellow “Sell” text)

Trade Exist

This Verified Profit System allows for the liquidation of any holdings utilizing a set profit target. As an alternative, the profit objective should be established utilizing a previous level of support, resistance, or high-low as a guide. In the event that the system conditions change, you can also manually close the transaction.

Set your initial stop loss beneath or above the previous swing’s high/low.

Gain before the zone indicator’s subsequent level or the ratio stop loss 1: 2.5

It is advised to employ a stop loss. Using prior support/resistance as a guide, set SL below the entry price. or on the high/low swing that came before. It is not advised to use fixed stop loss values without any reference points.