An automatic Fibonacci indicator called the Fibonacci Trading System is available for download for free. It is clear that this indicator is based on the Fibonacci numbers. It sets the take-profit and stop-loss targets as well as the market entry point automatically. The indicator has a signal arrow attached. Very simple to use, with encouraging trading results.

with a variety of patterns, traders may quickly and simply find prospective trades with the Automatic Fibonacci retracement indicator. It operates by examining a security’s price movement and seeing patterns that are frequently connected to particular kinds of trades. For traders, who frequently need to manually search for these patterns to make wise trading decisions, this can be a big time-saver.

It is especially helpful for traders who want to profit from passing trends. Traders can enter and exit positions more effectively and perhaps increase their earnings by immediately spotting possible transactions. Additionally, by warning them about potential deals that might not be as beneficial as they first seem, it can help traders avoid costly mistakes.

This Fibonacci indicator mainly relies on physical labor. It does create independent indications, but I don’t advise relying only on them. The trader will decide whether to enter the market, place protection stops, and profitable exit stops. As a result, the trader must be conversant with the concepts of risk and reward and set entries and exits using initial support and resistance levels.

Although the Fibonacci retracement indicator is a stand-alone trading tool, in my opinion it is most helpful for trading as an additional chart analysis tool, for determining trade exit positions (TP/SL), and for other purposes. Although this strategy can be used by traders of all experience levels, it may be helpful to practice trading on an MT4 demo account first until you are reliable and self-assured enough to trade in real time. Most MT4 Forex brokers allow you to create a trading account, either genuine or practice.

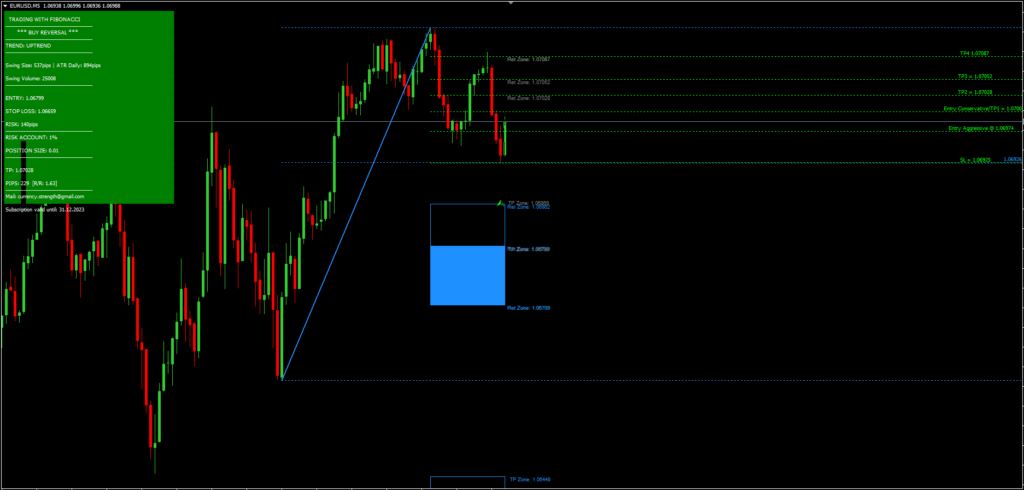

Main Chart

It contains two indicators,

- fibo analysis

- fibo entries

The goal of the fibo analysis indicator is to spot possible market reversal zones. The prospective area of the reversal zone is where the current swing might terminate and a new swing might start.

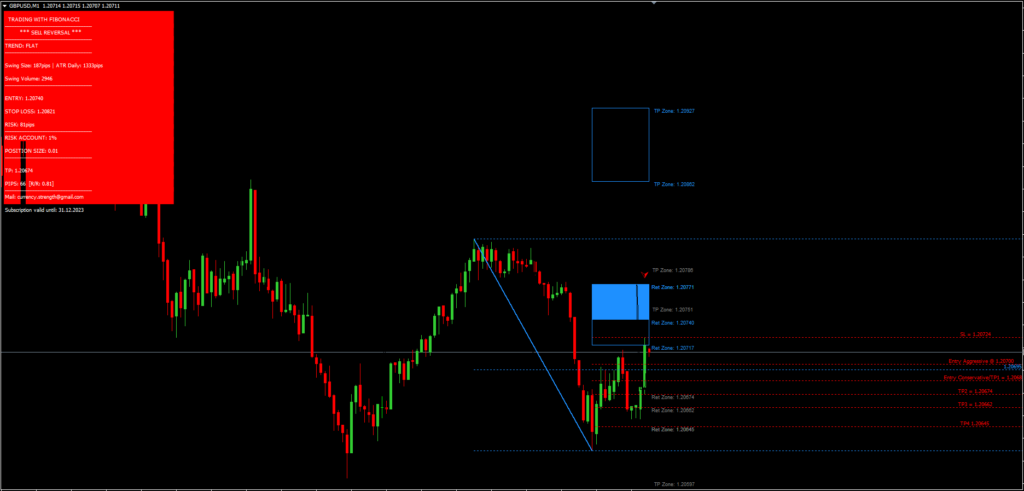

Three strategies are used in the analysis method for determining swing: manual, cautious, and aggressive. The proactive approach entails spotting transient fluctuations and accounting for more rumors and conjecture. The conservative approach is less speculative and emphasizes locating long-term swings. The trader can choose the swing’s depth setting manually using the manual approach.

For FOREX, CFD, FUTURES, and CRYPTO, it is perfect. Additionally, you can use it on whatever time frame that works best for you, from 1-minute to 4-hour charts. works best on higher TFs but can also be applied to lesser ones.

The Fibonacci Trading System can spot a number of patterns, including:

- Divergences between the price and a trend indicator, such as a moving average, can be bullish or bearish. Divergences that are bullish or bearish indicate that the price is most likely to increase or decrease.

- Breakouts: A breakout happens when the price traverses a level of support or resistance. Depending on the direction of the trend, breakouts can either be bullish or bearish.

- Trend lines: Trend lines are used to determine a price’s general direction. A trend change may be indicated when a price crosses through a trend line.

The Automatic Fibonacci Indicator allows traders to spot trends and base their trading decisions on them. A trader might think about buying, for instance, if there is a bullish divergence. The trader could think about security, though, if the Fibonacci Trading System detects a breakout of a negative trend line.

Stick to your money management plan and avoid trading during a period of breaking news. Half an hour after the big currency news, stop your trades.

As usual, use wise money management to get the best outcomes. You need to master discipline, emotions, and psychology to be a successful trader. Knowing when to trade and when not to is essential. Trading should be avoided at times and under unfavorable market conditions, such as low volume or volatility, outside of the main sessions, with exotic currency pairs, wider spreads, etc.