The Pulse Fibonacci Pivot MT4 Indicator is a potent combination of pivot points and Fibonacci levels designed to give traders a thorough analysis of potential support and resistance zones. This article will go into the intricacies, functionality, and application of the Pulse Fibonacci Pivot indicator in Forex trading strategies. In the dynamic world of Forex trading, where precision and insight are crucial, having the right tools can make all the difference.

Introduction to the Pulse Fibonacci Pivot Indicator

For traders that apply Fibonacci levels to their trading tactics, there is the Pulse Fibonacci Pivot indicator. This indicator computes and shows support and resistance levels directly on the currency pair chart by utilizing the power of the Fibonacci sequence. It provides traders with insightful information about possible entry and exit opportunities and is intended for intraday trading.

Unveiling Pivot Levels and Their Significance

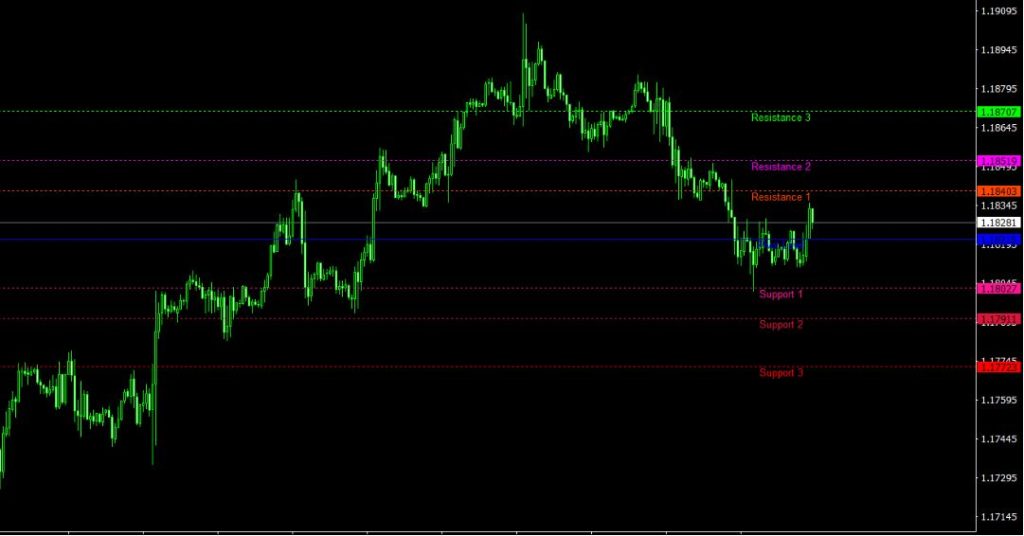

The pivot levels are the fundamental components of the Pulse Fibonacci Pivot indicator, and they are essential for identifying market patterns. The average price for the current trading day is represented by the center pivot level, which is clearly indicated by a blue line. The indicator displays three neighboring support and resistance levels around this center pivot, which are important indicators for traders. These levels help traders make decisions by indicating probable trend reversal or continuation locations.

Harnessing the Power of Fibonacci Levels

Fibonacci levels, which are based on the well-known Fibonacci sequence, are important in trading since they frequently indicate important support and resistance levels. The Pulse Fibonacci Pivot indicator gives traders specific regions where market movement may alter dramatically by fusing certain Fibonacci levels with pivot points. By improving the accuracy and consistency of possible trade settings, this integration gives traders the confidence to move confidently across the market.

Applications in Intraday Trading Strategies

When looking to profit from short-term price movements, intraday traders might find great value in the Pulse Fibonacci Pivot MT4 indicator. Traders can use this indicator in the following ways to enhance their intraday trading strategies:

Finding Entry Points: You can look for possible entry points by using the support and resistance levels that the Pulse Fibonacci Pivot indicator has indicated. As you wait for market reversals, think about taking long positions close to support levels and short positions close to resistance levels.

Placing Stop Loss and Take Profit Orders: Use the determined support and resistance levels to help you strategically set stop loss and take profit orders. While profit orders can be put before these levels to take advantage of price reversals, stop losses can be set below support levels and above resistance levels to reduce risk.

Analyzing Market Sentiment: Determine the degree of market sentiment by measuring the gap between the pivot level and levels of support and resistance. Greater trends might be indicated by wider gaps, and a more range-bound market situation might be suggested by smaller gaps.