A Forex hedge fund strategy that provides non-repaint buy/sell signals is USA Bank Academy FX Hedge Fond. Three distinct indications form the basis of this system. They are TOP_Ultimate_Breakout, DST_WeeklyTrend, and DST_WeeklyTrendBars.

For buy trades and sell transactions, there are many formats. Additionally, colored candle sticks in the hues of the weekly trend can be used if you want your candlesticks to be easier to see. Contrary to typical candle sticks, you receive this sign of colored candles in the content, so you can use them as much as your eyes please. templates for “WEEKLY BARS” to load.

Here are several indications that may be used to discover the best market entry opportunities and their minimum Stop Losses depending on the overall trend picture.

The employed indicators are “NO REPAINT”, which implies that Old Signals won’t ever change color or do anything similar once the candle is finished, closed, and a new candle is opened.

All manual work goes into this FOREX Hedge Strategy. The indicators generate the signals, but the trader ultimately decides whether to enter the market and whether to establish protection stops or profitable exit stops. As a result, the trader needs to be familiar with risk and reward principles.

You can use the trading signals provided by the FX Hedge Fond Strategy as-is or, as is advised, add extra chart analysis to further filter the signals. Although this strategy can be used by traders of all experience levels, it may be helpful to practice trading on an MT4 demo account first until you are reliable and self-assured enough to trade in real time.

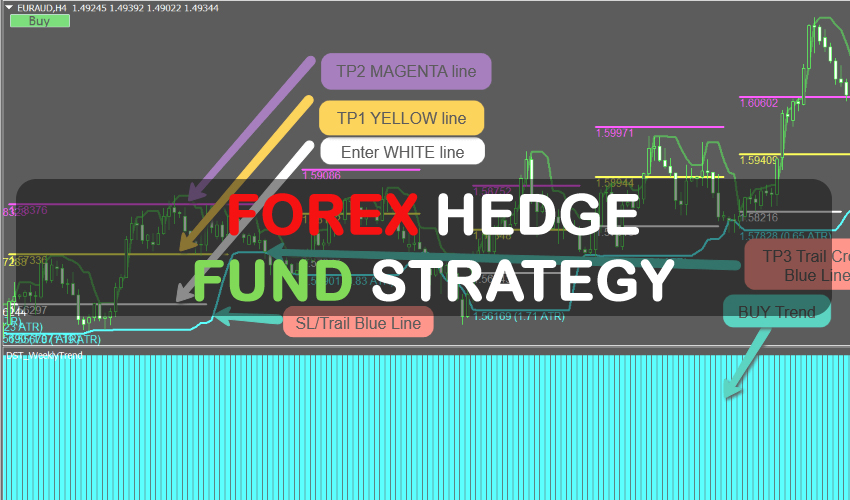

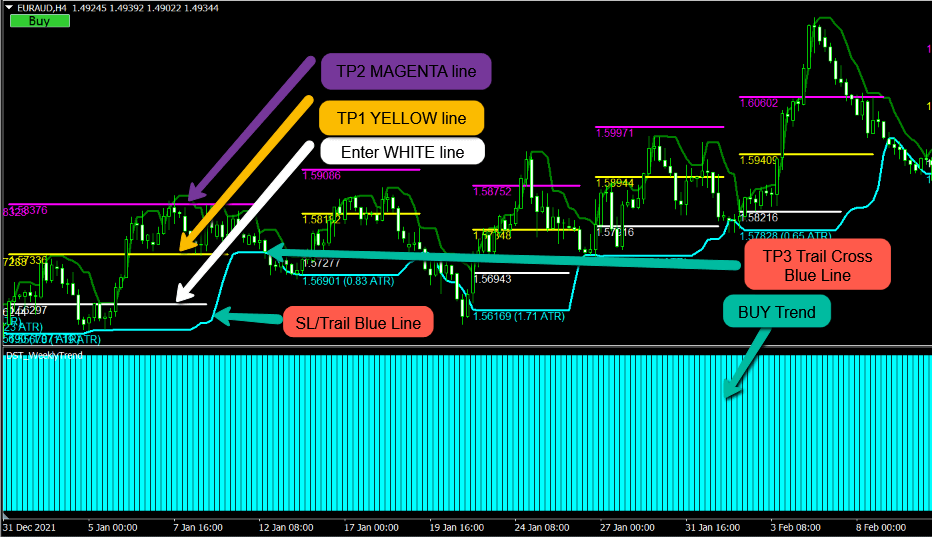

Main Chart

- “BLUE” or “MAGENTA” Trend indicator. It shows you a weekly Global Trend.

- If it is in “BLUE”, that means the Trend is “BUY” and you can look for “BUY” setups only

- If it “MAGENTA” that means the Trend is “SELL” and you can look for “SELL” setups only

- Light Blue Line is the line where you can place your STOP LOSS. Also as a price moves, this line is dynamic, and you can use it as a “TRAILING STOPLOSS”.

- “WHITE LINE” is the line where you can place your order (BUY or SELL).

- “YELLOW LINE” is the line of your first TP1.

- “MAGENTA LINE” is the line of your second TP2.

- KEEP ON MIND: When the price Hit your TP1, move your SL on Break Even, and after that, use “LIGHT BLUE LINE” as your Trail SL

The USA Bank Academy Indicator System has a signal warning setting that you can use. This is advantageous since it allows you to keep an eye on numerous charts at once rather than having to spend the entire day waiting for signals to come on the charts.

Any Forex currency pair as well as other assets including equities, commodities, cryptocurrencies, precious metals, oil, gas, etc. can be traded using the FX Hedge Fond Strategy. Additionally, you may apply it to any time frame that works best for you, including charts for one minute to one month.

Trading rules for this Forex Hedge Strategy

As usual, use wise money management to get the best outcomes. You need to master discipline, emotions, and psychology to be a successful trader. Knowing when to trade and when not to is essential. Avoid trading at times and under unfavorable market conditions, such as low volume or volatility, outside of the main sessions, with exotic currency pairs, wider spreads, etc.

You may also use H1 or M30, M15, and the FX Hedge Fond Strategy is highly accurate on H4 because we altered the fixed weekly trend indicator. However, because all indicators have been optimized for the H4 time frame, we advise using “Exclusively on H4 TimeFrame.”

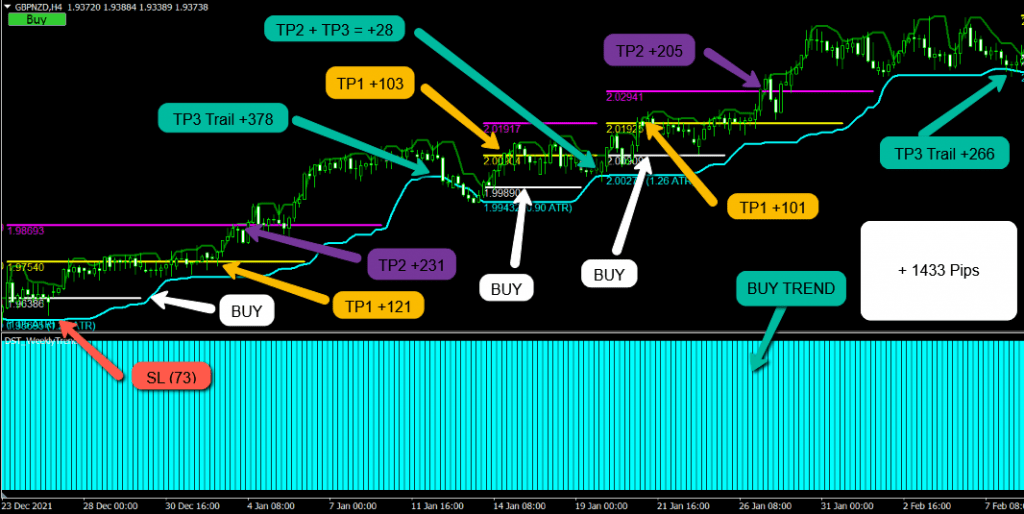

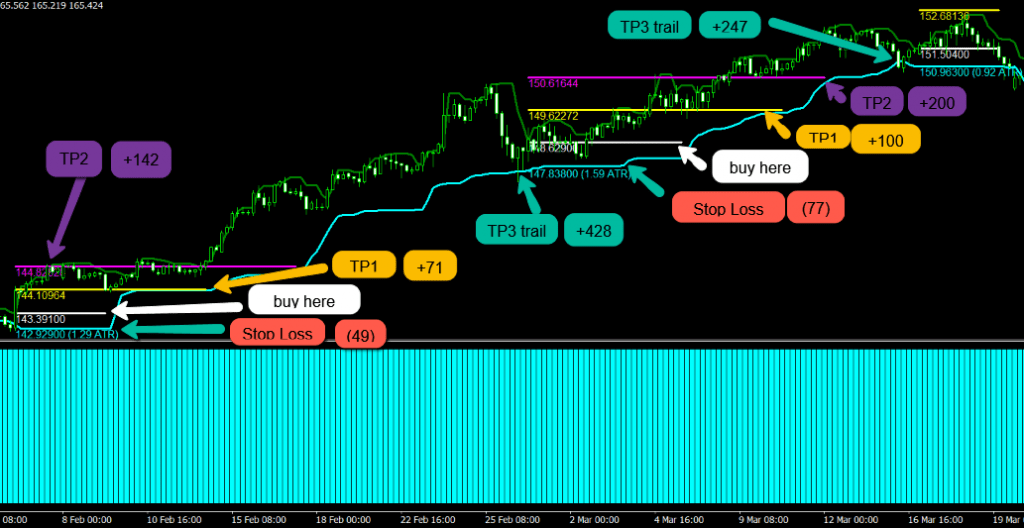

Buy Entry

- The trend must be for BUY (BLUE BARS).

- When you first detect a global trend (bottom trend indicator), load the appropriate TEMPLATE for that direction. In this case, Load “BUY TEMPLATE.”

- After you notice that the candle has touched or passed through “LIGHT BLUE LINE” after your Closed previous trades or Stop Loss hit, place a pending order (BUY STOP) on “GREEN LINE” which is located above “LIGHT BLUE LINE”.

- When BUY STOP is activated, you will be shown the network with the displayed (ENTER line “WHITE”, TP1 line YELLOW, TP2 line MAGENTA). Place your TP1/TP2 there, and SL few pips below “LIGHT BLUE LINE”, for TP3, use Trail Stop and close TP3 when Price hits “LIGHT BLUE LINE”.

- NOTE: The Advice is when you enter in BUY (manually or with pending order) (Do this with 3 orders), because you have 3 TP (TP1/TP2/TP3).

- KEEP ON MIND: When the price Hit your TP1, move your SL on Break Even, and after that, use “LIGHT BLUE LINE” as your Trail SL.

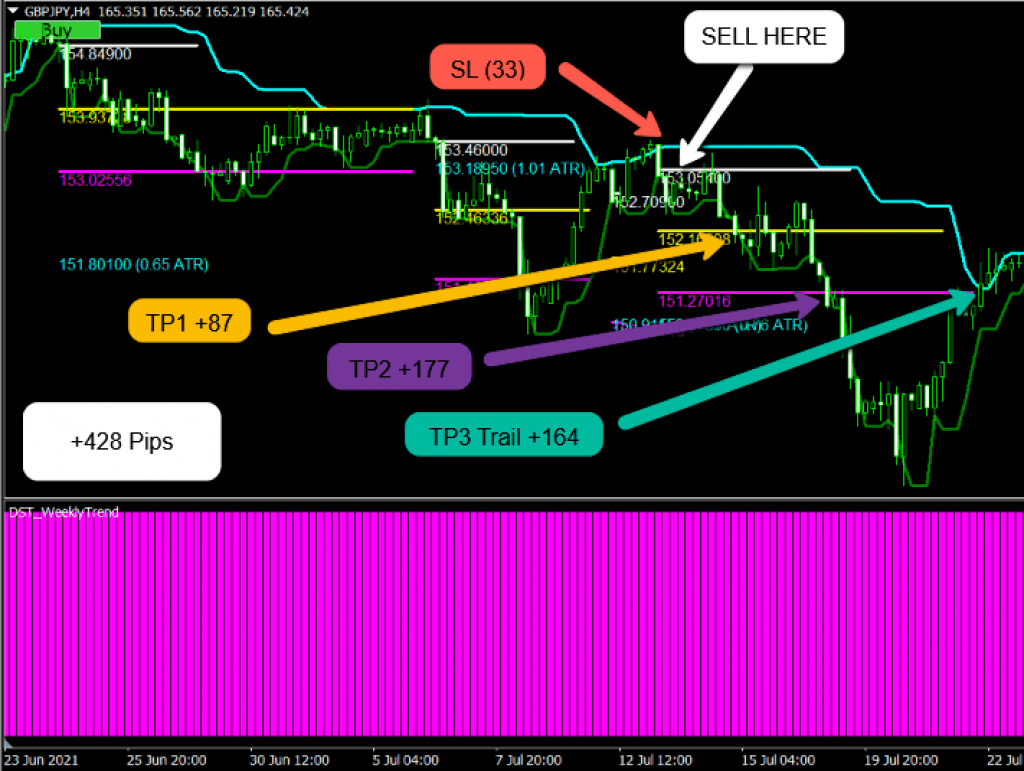

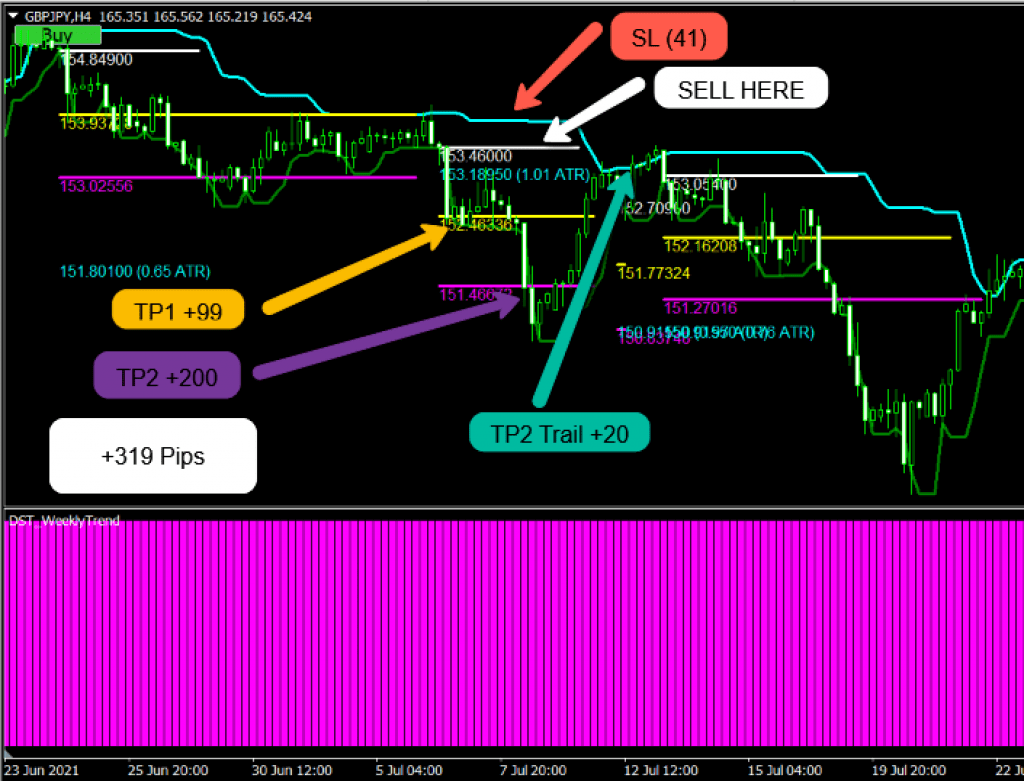

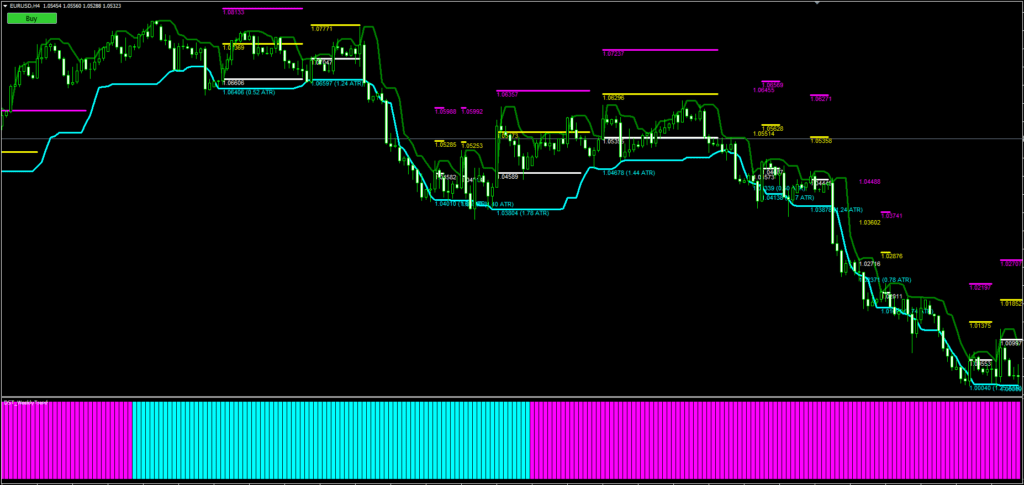

Sell Entry

- The trend must be for SELL (MAGENTA BARS)

- When you first detect a global trend (bottom trend indicator), load the appropriate TEMPLATE for that direction. In this case, Load “SELL TEMPLATE”

- After you notice that the candle has touched or passed through “LIGHT BLUE LINE” after your Closed previous trades or Stop Loss hit, place a pending order (SELL STOP) on “GREEN LINE” which is located below “LIGHT BLUE LINE”

- When SELL STOP is activated, you will be shown the network with the displayed (ENTER line “WHITE”, TP1 line YELLOW, TP2 line MAGENTA). Place your TP1/TP2 there, and SL few pips above “LIGHT BLUE LINE”, for TP3 use Trail Stop and close TP3 when Price hits “LIGHT BLUE LINE”

- NOTE: The Advice is when you enter in SELL (manually or with pending order) (Do this with 3 orders), because you have 3 TP (TP1/TP2/TP3)

- KEEP ON MIND: When the price Hit your TP1, move your SL on Break Even, and after that, use “LIGHT BLUE LINE” as your Trail SL