Free forex technical analysis indicator for MT4 that can be used to spot short-term trends is the Hikkake Pattern. It is based on the idea of “false breakouts,” a strategy that is frequently employed by forex reversal traders. An approach like this works well when the market is in a sideways trend.

Are forex reversal techniques your thing? If that is the case, let’s examine it and provide some real-world forex trading examples.

Introducing

Overview of MT4 Forex Indicators

At the bottom of this post is a link for the Hikkake Pattern MT4 forex indicator’s free download. Your trading chart should resemble the image below once you’re finished.

The basic tenet of that forex signal is that price will falsely break out of a rangebound zone before immediately reversing and moving in the opposite direction. This action produces a pattern on the chart known as a “hikkake pattern,” which is Japanese for “trap.”

It comprises of two moving average lines, one solid and the other dotted, as you can see. A selling opportunity arises when the price touches or crosses below the dotted line during an upswing. On the other hand, a price that crosses over the dotted line suggests a possible purchasing opportunity. The profit objective is often a few candles above or below the opposing blue line.

The distance between these two lines is something to consider. The spacing should be as wide as possible. Avoid trading when these two are in such close alignment.

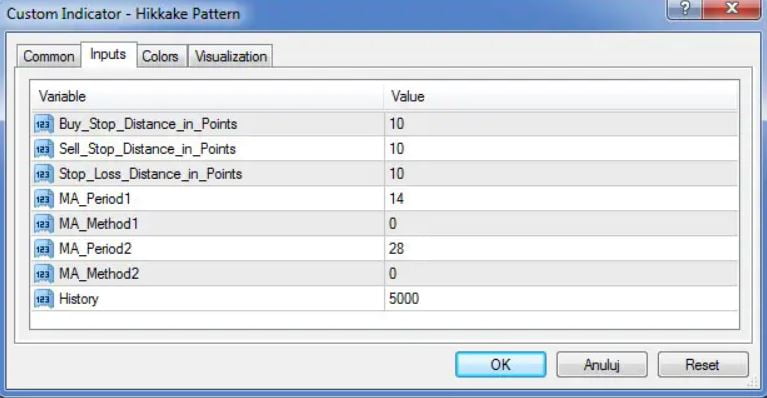

Settings

Buy Signal

- Below the solid line is the dotted line.

- Price comes close to or surpasses the dotted line.

- There is ample space between the two lines.

- When the aforementioned circumstances are met, open a long trade.

- Stop loss (SL) should be set a few pip’s below the most recent market low.

- After crossing the solid line, take the smallest profit possible, but frequently the price continues to rise for a few candles.

Sell Signal

- Below the solid line is the dotted line.

- Price comes close to or surpasses the dotted line.

- There is ample space between the two lines.

- Open a short position when the aforementioned criteria are met.

- Stop loss (SL) should be placed a few pip’s above the most recent market high.

- After passing the solid line, take the smallest profit possible, but frequently the price continues to decline for a few candles.

Installer’s Manual

The Hikkake Pattern.mq4 or HikkakePattern.ex4 indicator files should be copied and pasted into the MQL4 folder of the MT4 trading platform once you have downloaded the Hikkake Pattern.rar archive at the end of this page and unpacked it.

By selecting one of the following choices from the menu, you can open this folder:

(Paste here) File > Open Data Folder > MQL4 > Indicators.

Go now to your MT4 terminal’s left side. Locate the gauge name in the Navigator and choose Attach to Chart from the context menu that appears.

Conclusion

One of the most well-known reversal patterns is the Hikkake Pattern, which you should use in your trading. Any currency pair and time window can use it, although we advise utilizing it on intraday charts. Although we believe it’s best suited for traders with some experience, newbies may also be successful with a little training. Using it in conjunction with some technical analysis of forex indicators that identify sideways market circumstances, such as the MACD Flat Trend Detector, might be a smart idea.