You may get the JackPot Elite Strategy, a free MT4 scaling strategy, here. In order to give traders a comprehensive understanding of market circumstances, several trading techniques combine several indicators. The JackPot Elite Strategy is one such tactic. Using a combination of indicators, this innovative method produces a non-repaint buy-sell arrow indication that guarantees a trader is making decisions based on sound technical principles.

The non-repaint buy-sell arrow indicator is what sets the JackPot Strategy apart. This guarantees that a trading signal is fixed and does not alter after it is sent, allowing traders to feel confident in their choices.

Indicators Used in JackPot Elite

Bollinger Bands

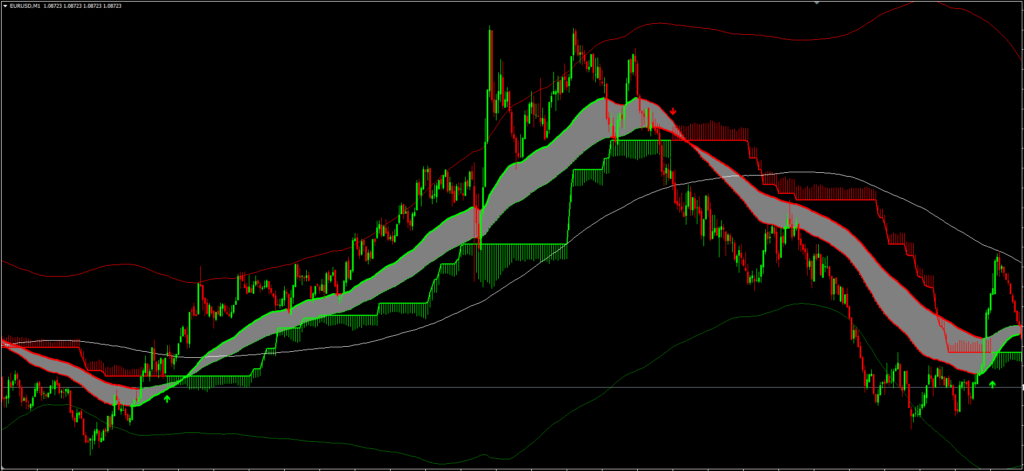

Bollinger Bands reveal details about price fluctuations. The bands can provide information about future price reversals and longer-term price fluctuations when used with a longer period setting, like 200. Prices that cross over the upper band may be overbought, while those that cross over the lower band may be oversold.

Ichimoku Kinko Hyo

Often called the Ichimoku Cloud, this indicator gives you a quick overview of momentum, market direction, and support and resistance levels. The Ichimoku’s several components can be used by traders to identify possible breakout or breakdown scenarios.

Color Changing EMA 50 and 100

One widely used technique for figuring out the overall trend direction over a given number of periods is the Exponential Moving Average (EMA). The 50 and 100 EMAs are used by the JPS Elite. With the intuitive layer added by the color change function, traders can rapidly distinguish between bullish and bearish scenarios.

Indicator of Market Open Price

This supplementary instrument furnishes data regarding the market open price throughout four time intervals: daily, weekly, monthly, and annual. Traders can assess momentum and establish trade benchmarks by having a thorough understanding of these opening prices.

This JackPot Elite Strategy can provide you with trade signals that you can use exactly as they are or, as is advised, refine the signals further by adding your own chart analysis. Although this technique is accessible to traders of all skill levels, it can be helpful to practice on an MT4 demo account until you have the consistency and self-assurance necessary to move on to actual trading.

The entire JackPot Strategy is done by hand. The trader will decide whether to enter the market, put protective stops, or take profitable profits when the indicators generate the signals. As a result, the trader needs to understand the concepts of risk and return and know when to enter and quit based on initial support and resistance zones.

The JackPot Elite Indicator can be configured to warn you by platform pop-ups or mobile notifications. This is useful since it allows you to monitor numerous charts at once and eliminates the need for you to spend the entire day staring at the charts while you wait for signals to appear.

Any Forex currency pair as well as other assets including equities, commodities, cryptocurrencies, precious metals, oil, gas, etc. can be traded using the MT4 strategy. Although it functions best at a lower TimeFrame, you can use it on any time frame that works best for you.

Trading Rules

Even if the Jackpot Elite Strategy is mostly technical, it makes sense to keep up with important news developments. The market can be greatly impacted by high impact news.

As usual, effective money management is essential to getting the best results. You need to understand psychology, emotions, and discipline in order to trade profitably. Understanding when to trade and when not to is essential. Steer clear of trading amid negative market conditions, such as low volume or volatility, after significant sessions, exotic currency pairs, wider spread, etc.

Buy (Long) Trades

- The arrow should be green, indicating a buy signal.

- Price should touch or be near the bottom Bollinger band, hinting at potential upward movement.

- The color-changing EMA 50 and EMA 100 should turn green, indicating bullish momentum. (Crossing of two EMAs is also plus.)

Sell (Short) Rules

- The arrow should be red, indicating a sell signal.

- Price should touch or be near the top Bollinger band, hinting at potential downward movement.

- The color-changing EMA 50 and EMA 100 should turn red, indicating bearish momentum. (Crossing of two EMAs is also plus.)

Take Profit (TP) and Stop Loss (SL)

- Take Profit: Depending on the trader’s risk-to-reward ratio, the TP can be set at a significant resistance (for buy trades) or support (for sell trades) level, or at a specific number of pips for JPS Elite.

- Stop Loss: Set the SL at the most recent swing low (for buy trades) or swing high (for sell trades). Another strategy is to use the Bollinger Bands as a reference point.

Exit Rules

- An opposite arrow appears, signaling a potential change in trend or pullback.

- Other technical indicators show signs of the opposite market sentiment (bearish/bullish)