The Market Profile Trendlines MT4 indicator highlights the key price levels, value areas, and control values for a particular trading session by displaying price density across time.

The indicator is made up of data from the volume, time, and number of ticks at particular levels during the course of a specified period.

In-depth explanations of the MP Trendlines MT5 indicator and how to use them to your trading strategy are provided in this article.

What is a Market Profile Trendlines MT4 indicator?

Market profile indicator was created by a trader at the Chicago Board of Trade (CBOT). Its original goal was to clearly display the price and time data gathered throughout a trading session.

The trend lines and other elements of the traditional indication are different in the MP Trendlines indicator. Additionally, this indicator examines the areas of a currency pair or other market where there is the most price activity at any given moment.

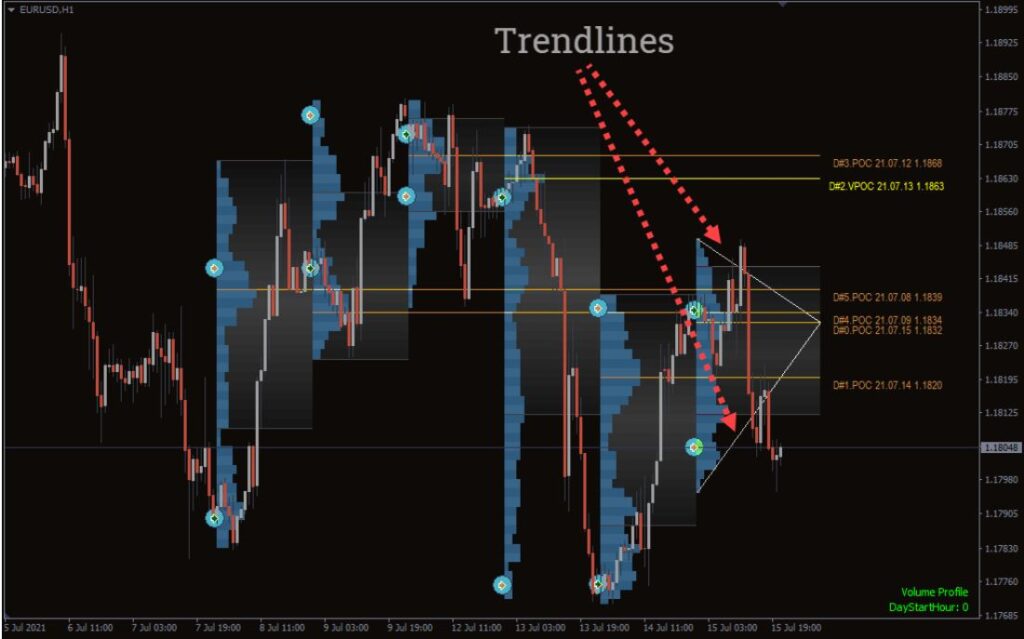

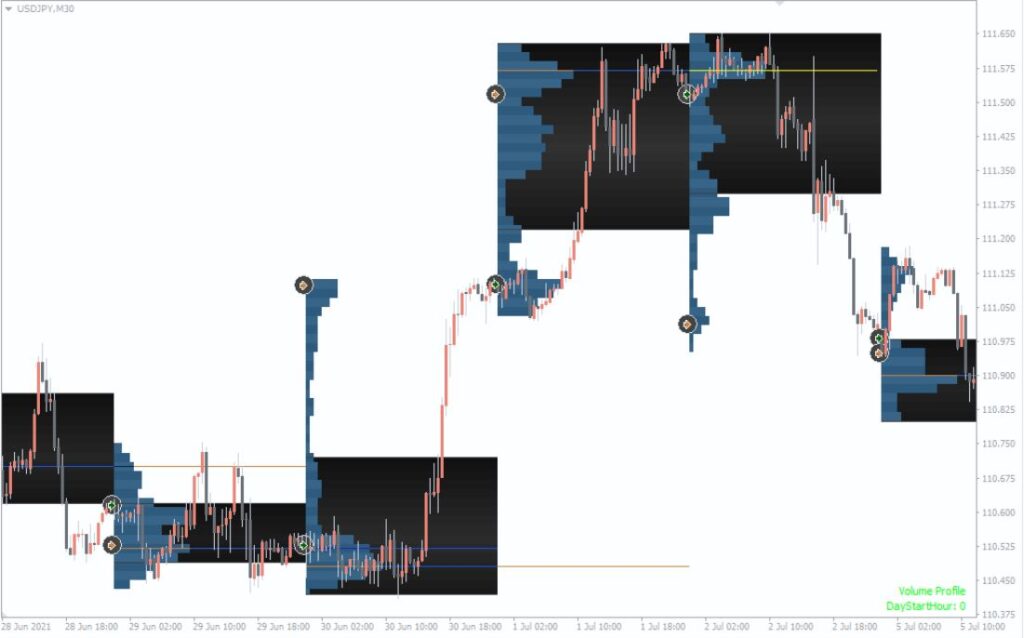

Every single market tick or change is used to calculate using the most precise tick data. Based on this, the Market Profile Trendlines indicator creates the histogram.

The histogram shows the price zones and price levels where there is a lot of trading activity. The Market Profile Trendlines indicator depicts a histogram from right to left. It can be advantageous to concentrate on the present trading session without complicating its chart, in contrast to the traditional left-to-right style.

You will always be aware of the most important price zones and levels for upcoming market price fluctuations with the help of this indicator.

The Market Profile Trendlines indicator shows the trading session profiles for timeframes ranging from M1 to D1. This indicator does not use any common MetaTrader indicators and is completely dependent on price action.

Indicator Settings

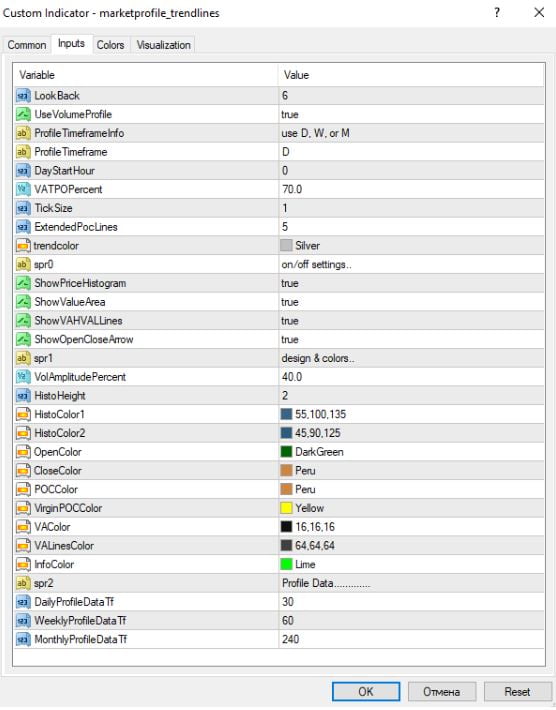

- LookBack displays several chosen profiles.

- UseVolumeProfile, if true, shows the current volume.

- ProfileTimeframeInfo draws profiles from a chosen timeframe.

- ProfileTimeframe shows the current timeframe.

- DayStartHour mentions the profiles starting an hour.

- VATPO percent displays profiles chosen timeframe percentage gain.

- TickSize presents the number of ticks.

How to use

The Market Profile Trendlines indicator is primarily used in the value area.

As the market develops over a session, the price will vary upward and downward with buy and sell orders. This indicator creates a value area by integrating time, volume, and tick data.

The middle point between the current supply and demand levels is represented by this price range. You will also have two tails, or the top and bottom market profiles, in addition to the value area.

Market Profile Trendlines mt4 indicator trading strategy

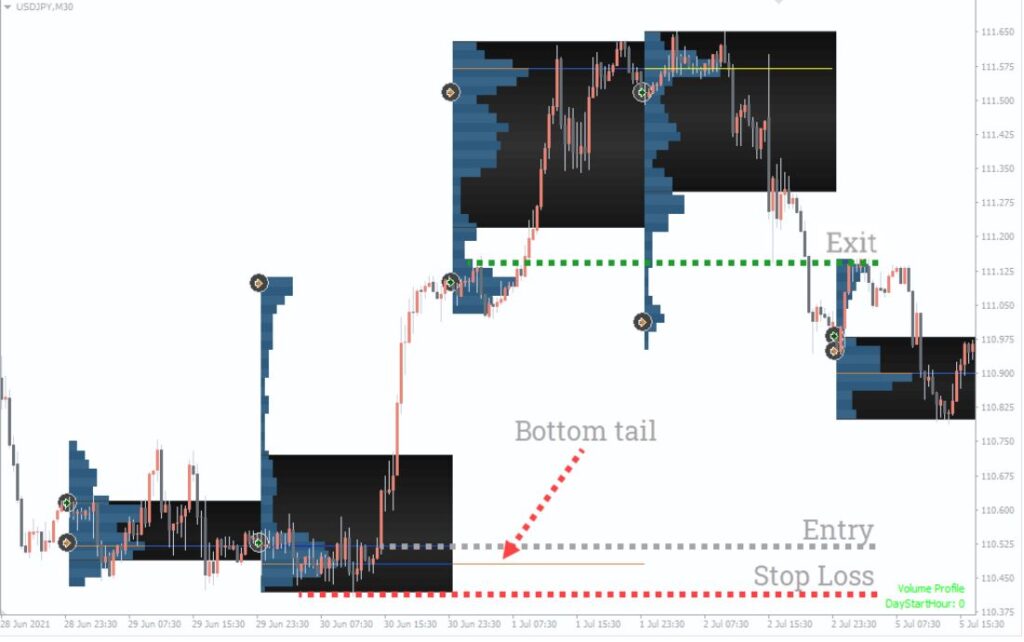

The huge tails below and above the value region represent the price ranges that the market rejected. At such price ranges, buyers outperform sellers, according to the bottom tail. However, the top tail indicates that sellers are surpassing buyers at the relevant price points.

Buy setup

- Find the bottom tail on the chart

- Wait for the price action to turn bullish

- Place a stop-loss near the recent low

- Exit when the trend changes its course

Sell setup

- Locate the top tail on the chart

- Wait for the price action to turn bearish

- Place a stop-loss near the recent high

- Exit when the trend changes its course