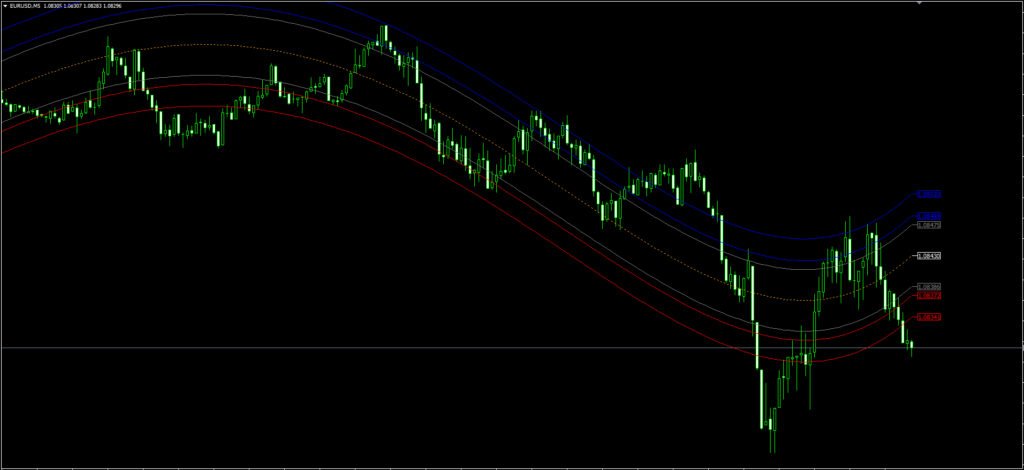

The Mean Reversion Indicator is an MT4/MT5 indicator that evaluates a currency pair’s price divergence from a historical mean or average in order to identify possible price reversals. Based on the theory that prices eventually return to a central average, this tool gives traders a clear picture of when a market is overbought or oversold.

The Mean Reversion Indicator, which combines historical data and mathematical algorithms, indicates possible entry and exit points, enables traders to take advantage of short-term price volatility while taking the asset’s longer-term equilibrium into account.

The fundamental tenet of mean reversion is that prices oscillate around a gravitational center, or average price, over a predetermined time frame. The “norm” for the stock or currency is this average. It is anticipated that the price will return to this average if it deviates too far from it—either by falling too far below or rising too high. Golden opportunities to purchase cheap and sell high are presented to traders by such moves.

What is Mean Reversion

A notion in finance and economics known as “mean reversion” postulates that over time, the prices or returns of an asset will generally tend to revert to their historical mean or average level. According to this hypothesis, an asset’s price will eventually tend to return to its historical average if it deviates considerably from it.

Let me elaborate a little bit:

- Rationale: Many financial assets, like stocks or commodities, experience periods where they are overvalued or undervalued. However, these asset prices often return to their historical mean over a longer timeframe. For example, suppose a particular stock has been trading above its historical average price for an extended period. In that case, it might be considered overvalued, and the mean reversion theory would suggest that it’s likely to decrease in price in the future.

- Applications: Traders and investors can use the concept of Mean Reversion MT4 to guide their investment decisions. For instance, if they believe that a particular asset is trading far away from its historical average, they might decide to short it (if it’s overvalued) or buy it (if it’s undervalued), expecting the price to revert back to its average over time.

- Limitations: While the concept of mean reversion can be a helpful guide, it’s not always accurate. Asset prices can deviate from their historical means for extended periods due to various factors like changes in fundamental economic conditions, shifts in investor sentiment, or technological innovations. Therefore, relying solely on mean reversion can be risky, and it’s essential to consider other factors and do a thorough analysis before making investment decisions.

- In the Broader Sense: Beyond finance, mean reversion can be observed in various phenomena. For example, temperatures might deviate from historical averages for a while, but they tend to revert to some long-term mean over time.

It’s critical to realize that the Mean Reversion Indicator cannot forecast when a return to the mean will occur or even assure that it will. Nevertheless, a lot of traders and investors take this notion into account when assessing possible chances.

There is more to this Mean Reversion MT5 than just a trading indicator system. Even so, it might be useful for you in trading as extra chart analysis, for determining the trade exit position (TP/SL), and for other purposes. Although this technique is accessible to traders of all skill levels, it can be helpful to practice on an MT4 demo account until you have the consistency and self-assurance necessary to move on to actual trading. With most Forex firms, you can open a genuine or demo trading account.

Any Forex currency pair as well as other assets including commodities, cryptocurrencies, binary options, stock markets, indices, etc. can be traded using this Mean Reversion MT4 tool. Additionally, you may use it on any time period—from the one-minute charts to the monthly ones—that works best for you.

Although the mean reversion principle can be used on a variety of time frames, a trader’s particular approach will frequently determine how effective it is. Shorter time frames, such as the 5-minute, 15-minute, or 30-minute charts, are preferred by many Forex traders. Why? There are often more frequent and sharper price departures from the mean in these time spans, which leads to more trading opportunities.

Mean Reversion Indicator: How Does It Work in Forex Trading?

The mean reversion indicator is a widely used strategy in the forex (foreign exchange) trading industry that traders employ to profit from price changes. Owing to the forex market’s great liquidity and large number of participants, short-term volatility in currencies frequently occur near longer-term equilibrium levels. The Mean Reversion MT5 is used in forex trading as follows:

- Identifying Overbought and Oversold Conditions: Forex traders often use technical indicators like the Relative Strength Index (RSI) or Stochastic Oscillator to identify overbought or oversold conditions in currency pairs. When these indicators reach extreme levels, it can suggest that the currency pair is stretched too far from its “average” or “mean” value and may be due for a correction or pullback.

- Bollinger Bands: Bollinger Bands are another technical tool forex traders use to detect mean reversion opportunities. When the price touches or moves outside the bands, especially the outer bands, it may indicate that the price deviates significantly from its average, suggesting a potential reversion back towards the middle band, representing a moving average.

- Pair Trading: In forex, mean reversion Indicator can also be applied using pair trading strategies. Traders might identify two currencies that historically move together. When there’s a significant deviation between them, traders can go long on the underperforming currency and short the outperforming one, expecting both to revert to their mean relationship.

- Historical Support and Resistance Levels: Traders often look at past price levels where a currency pair found support (a price level it tends not to fall below) or resistance (a price level it tends not to rise above). When the price deviates significantly from these levels and starts showing signs of reversing, traders might interpret this as a mean reversion opportunity.

- Fundamental Analysis: Beyond technical tools, some traders look at fundamental factors like interest rates, economic growth, and geopolitical events. Traders might expect a mean reversion if a currency moves significantly due to short-term news, but the underlying fundamentals remain unchanged.

- Risk Management: Importantly, while mean reversion strategies can be profitable, they aren’t foolproof. Traders must have robust risk management practices, including setting stop losses. Just because a currency is “overextended” doesn’t mean it can’t continue in that direction.

- Timeframes: Mean Reversion MT5 can be applied to various timeframes. Some traders might look for opportunities on shorter timeframes (like hourly or daily charts), while others might apply it on longer timeframes (like weekly or monthly charts).

Even though mean reversion is a well-liked technique, it’s important to keep in mind that the forex market can be influenced by a number of variables, such as macroeconomic data releases, central bank policies, and geopolitical events. For a more thorough strategy, traders should thus integrate their mean reversion tactics with other tools and analysis.