The Total Trend System is a trend trading system that distinguishes itself by integrating trend following, momentum, and volatility analysis to produce a comprehensive market picture. A tried-and-true approach that has been used in the forex market for a very long time is the Total Trend Trading System. It has received a split reaction, with some praising its efficiency and others being less enthused.

The Total Trend System’s primary objective is to locate possible buy and sell signals in the financial markets through the use of technical analysis. This is accomplished by using a mix of volatility measurements, momentum indicators, and moving averages, each of which offers a distinctive viewpoint on market activity. This diverse strategy enables traders to get a full view of market patterns and prospective changes in the market’s course.

Understanding this Trend Trading System

Moving averages, mathematical tools that create an average price that is continuously updated, are a crucial part of the Total Trend Trading System. This tool is essential for determining the market’s general trend.

Multiple moving averages are utilized simultaneously in the Total Trend System to assess short-, intermediate-, and long-term trends. For instance, a 10-day moving average of a short-term moving average might be used to identify short-term trends. To discover intermediate-term patterns, however, a longer-term moving average, like a 50-day moving average, can be employed. This multi-timeframe research offers a more nuanced understanding of market trends and aids in avoiding the problems of placing an excessive amount of trust on a single time frame.

Momentum indicators are used

The Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and moving averages are examples of momentum indicators used by the Total Trend Trading System. These instruments provide information about the strength of the current market trend and can support moving average signals.

The RSI, for instance, attempts to detect whether an asset is overbought or oversold by comparing the size of recent gains to recent losses. On the other hand, the MACD monitors the relationship between two moving averages of the price of an asset. When the MACD crosses above or below its signal line, buying or selling indications are generated.

Embracing Volatility Measures

Last but not least, the Total Trend Trading System recognizes the influence of volatility on market trends. The system improves its capacity to recognize periods of uncertainty and probable trend reversals by integrating volatility measurements. Furthermore, a trader’s risk tolerance can be taken into account when determining the proper position sizing and risk management strategies.

Estimator of Quantitative Qualitative Data

The Quantitative Qualitative Estimator is known as the QQE. Many bad transactions can be filtered out or eliminated with this potent indicator.

Although quite easy to use, this indicator does need some explanation. The QQE is essentially a signal line-equipped smoothed RSI indicator. A smoothing average known as Wilder’s Period serves as the signal line. The two lines function as a 2-line MACD or a stochastic oscillator when combined. A trade signal is only legitimate if the lines are in. The middle of the indicator window has a line drawn through it that is known as the 50 lines.

The entire Trend Trading MT4 process is manual. The indicators generate the signals, but it is up to the trader to decide when to enter the market, create protective stops, and when to quit it profitably. As a result, the trader must be conversant with the concepts of risk and reward and set entries and exits using initial support and resistance levels.

The Trend trade System can provide you with trade signals that you can use as-is or further filter with your own chart research, which is advised. All levels of traders can utilize this strategy, but until you are reliable and self-assured enough to trade on a live account, it can be helpful to practice trading on an MT4 demo account.

Total Trend Indicator can be configured to send you signal warnings. This is advantageous since it allows you to keep an eye on numerous charts at once rather than having to spend the entire day waiting for signals to come on the charts.

Any Forex currency pair as well as other assets including stocks, commodities, cryptocurrencies, precious metals, oil, gas, etc. can be traded using the Trend Trading System System. Additionally, you may apply it to any time frame that works best for you, including charts for one minute to one month.

Trading rules

When employing this Total Trend System, keep in mind to tighten your stop losses around High Impact News Releases or to refrain from trading at least 15 minutes before and after these events.

As usual, use wise money management to get the best outcomes. You need to master discipline, emotions, and psychology to be a successful trader. Knowing when to trade and when not to is essential. Trading should be avoided at times and under unfavorable market conditions, such as low volume or volatility, outside of the main sessions, with exotic currency pairs, wider spreads, etc.

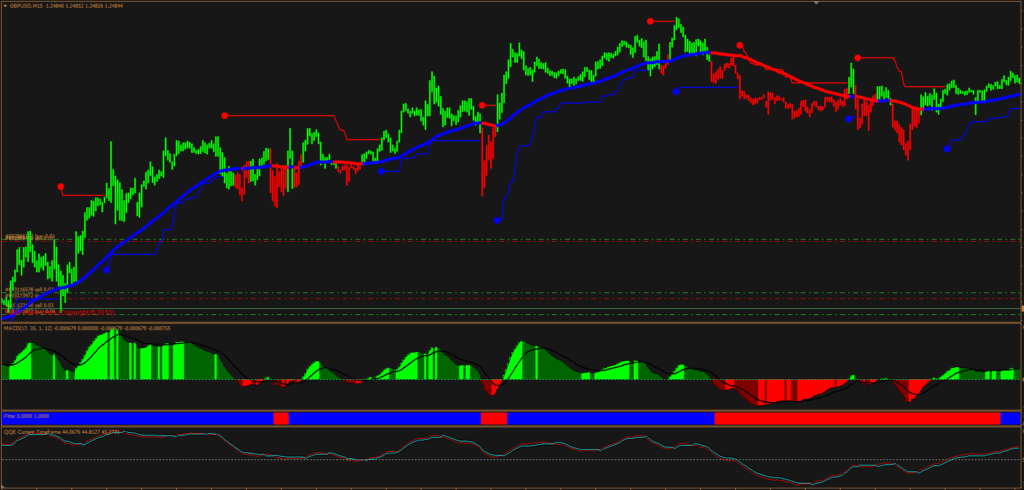

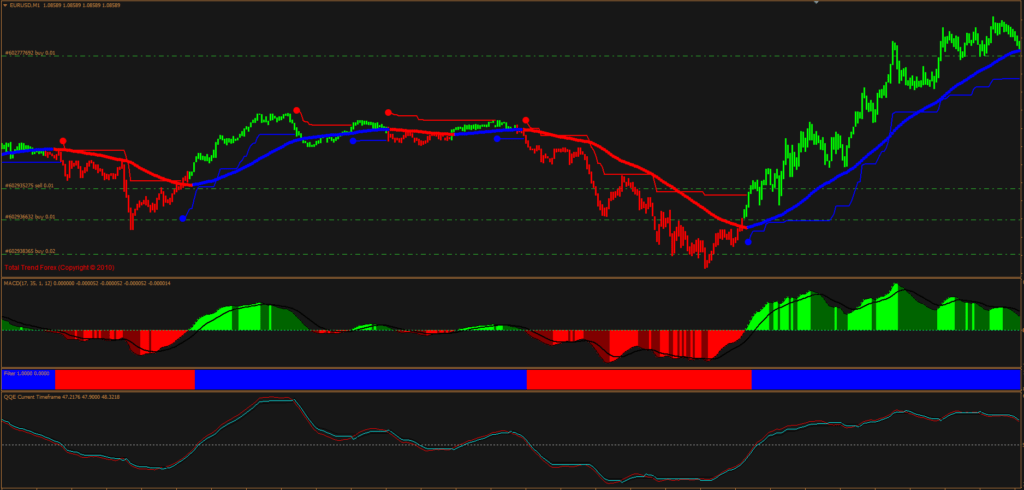

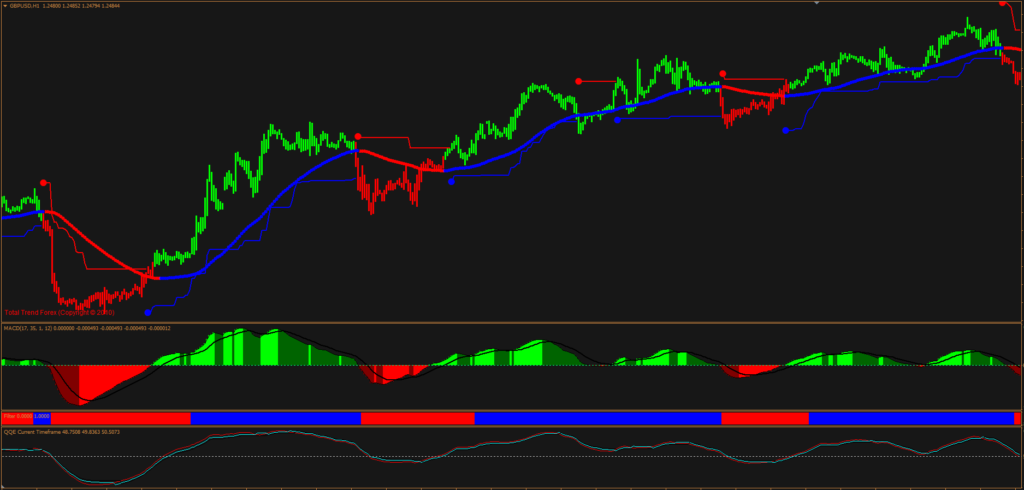

Buy Entry

- The primary Volty Channel indicator gives BLUE Dot Signal.

- Red and Blue Moving average Indicator showing uptrend with BLUE.

- The MACD has crossed GREEN upward.

- The Red and Blue second window indicator is BLUE.

- QQE above the 50 lines.

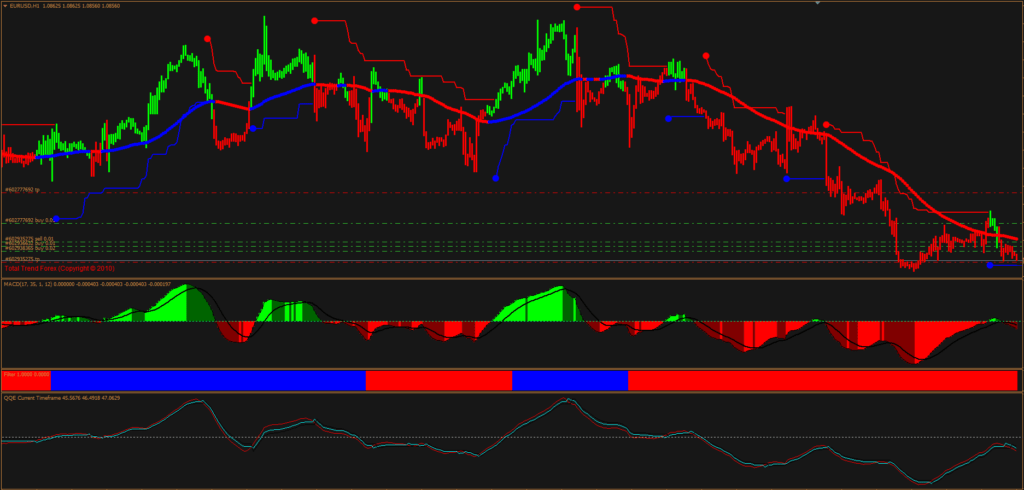

Sell Entry

- The primary Volty Channel indicator gives RED Dot Signal.

- Red and Blue Moving average Indicator showing downtrend with RED.

- The MACD has crossed RED downward.

- The Red and Blue second window indicator is RED.

- QQE below the 50 lines.

Trade Exist

With this trend trading system, any positions can be closed out using a predetermined profit objective. As an alternative, the profit objective should be established utilizing a previous level of support, resistance, or high-low as a guide. In the event that the system conditions change, you can also manually close the transaction.

It is advised to employ a stop loss. Set the stop loss below the entry price using prior support and resistance as a guide or on the prior high and low swing. It is not advised to use fixed stop loss values without any reference points.