One free Forex dashboard indicator to download is the Trade Booster Digital Indicator. In order to help you make the most of version 4.0 of the Indicator, this article will go into detail about how it functions.

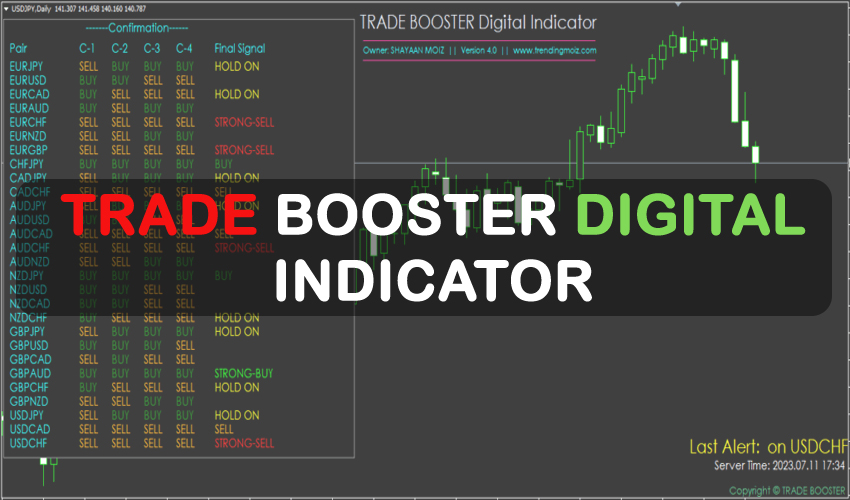

You will notice the Trade Booster Digital Indicator’s simplicity and user-friendly design right away. It is configured in eight distinct modes:

- RESISTANCE (Close Buy Trade)

- STRONG-BUY

- BUY

- SUPPORT (Close Sell Trade)

- STRONG-SELL

- SELL

- HOLD ON

- NO SIGNAL

These modes enable you to approach your trading activity in an efficient and methodical manner by giving you clear guidance on when to begin and close trades.

This Forex Dashboard Indicator has the option to notify you when a signal is received. This is useful since it allows you to monitor numerous charts at once and eliminates the need for you to spend the entire day staring at the charts while you wait for signals to appear.

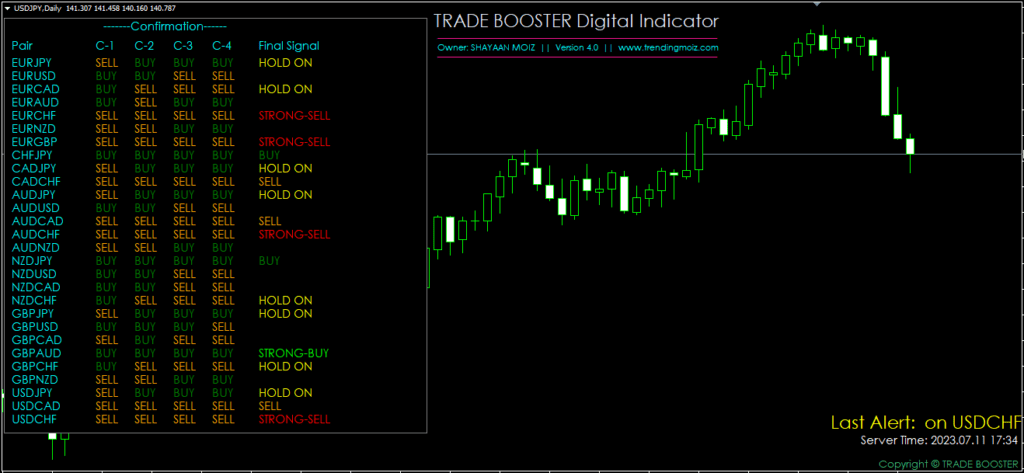

Version 4.0 of the Trade Booster Digital Indicator can be applied to any pair of Forex currencies as well as other assets like stocks, commodities, indices, cryptocurrencies, and binary options. Additionally, you may use it on whatever time interval—from the 1-minute charts to the month charts—that works best for you.

While the Trade Booster Digital Indicator can not provide solo indications, it can be a very helpful tool for further chart research, determining the trade exit position (TP/SL), and other trading-related tasks. Although this technique is accessible to traders of all skill levels, it can be helpful to practice on an MT4 demo account until you have the consistency and self-assurance necessary to move on to actual trading. With most Forex firms, you can open a genuine or demo trading account.

How This Forex Dashboard Indicator Works

Confirmations

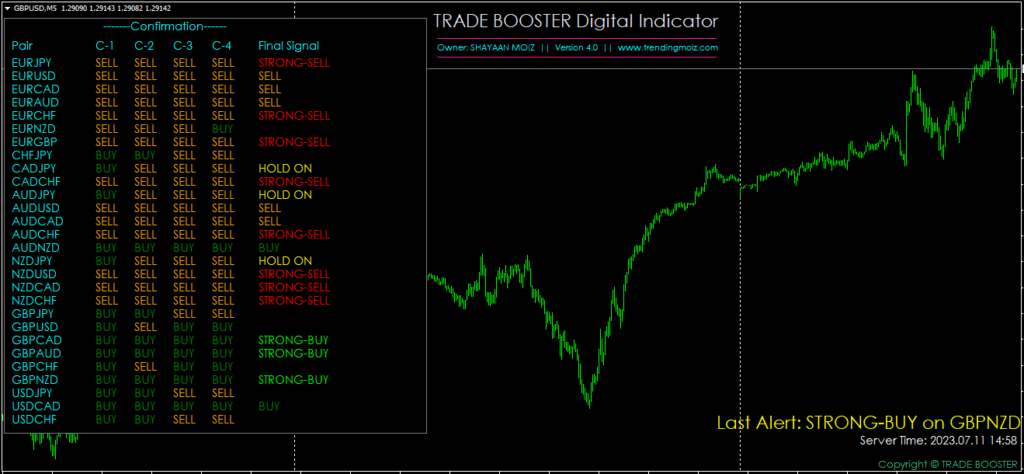

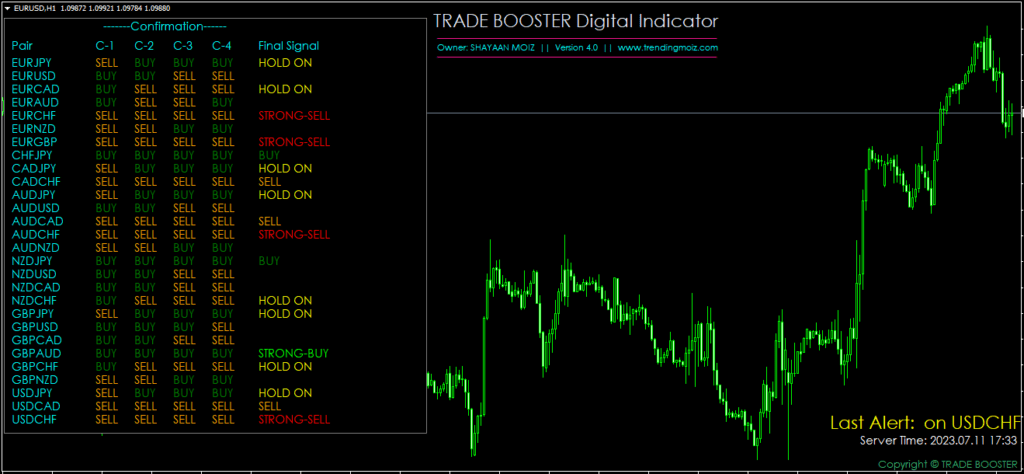

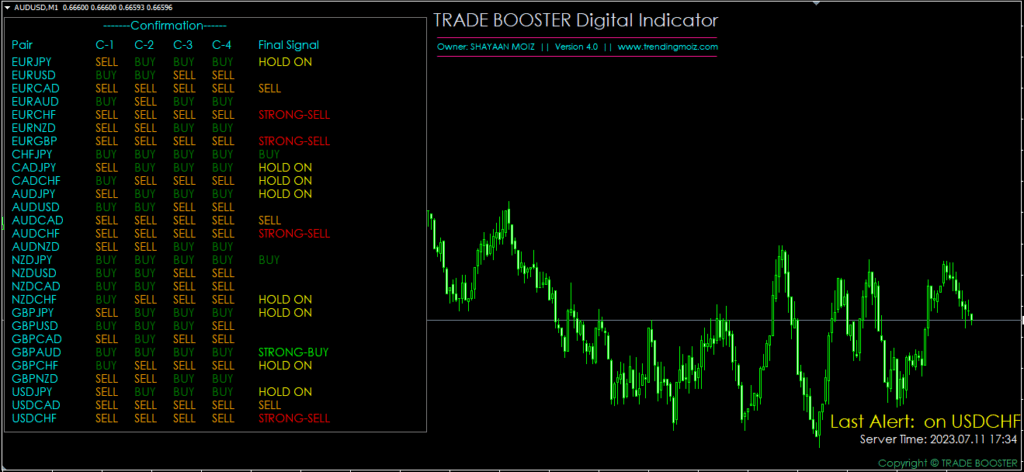

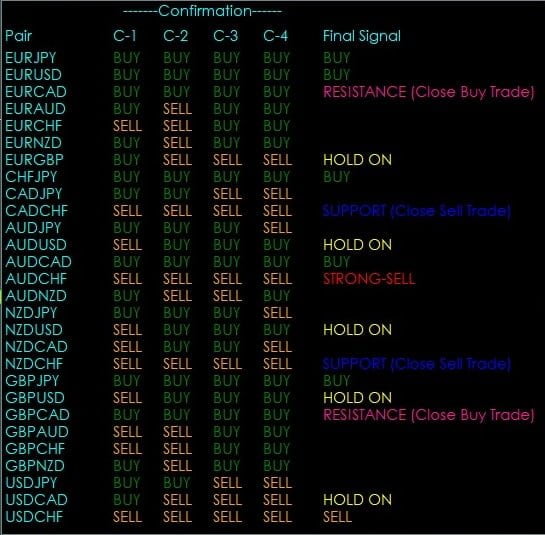

This Forex Dashboard Indicator offers four levels of confirmation: C-1, C-2, C-3, C-4. All these confirmations must align in the same direction for a final STRONG-SELL or STRONG-BUY signal to be triggered.

If, for example, you receive a STRONG-BUY signal and the C-1 conformation changes to SELL, the final signal will shift to HOLD ON. At this point, you can hold or close your trade. If subsequent confirmations also switch to SELL, the final signal will become NO SIGNAL; at this point, it is recommended to close any open trades.

Trend Reflection

A certain order is followed by trend alterations, which are initially shown in C-1 and then in C-2, C-3, and C-4. The ability to respond and adjust dynamically to the changing market is made possible by this sequential trend reflection.

How to Trade using Trade Booster Digital Indicator

Trade Placement

Only on STRONG-BUY and STRONG-SELL indications should trade be done. When the Trade Booster Digital Indicator suggests a SELL, please wait for it to upgrade to a STRONG-SELL before placing a trade. In a same vein, please hold off on buying until the signal escalates to STRONG-BUY. Your chances of success rise when you trade with greater conviction thanks to your patience.

Refrain from trading currency pairings that have been trapped in the STRONG-BUY or STRONG-SELL positions for a long time. Trades should ideally be executed when the indicator shifts from BUY to STRONG-BUY or from SELL to STRONG-SELL. Alerts are a useful indicator to start these kinds of trades.

Closing Trades

The modes of SUPPORT and RESISTANCE are essential for handling active trades. It’s time to exit out of open deals when you see a signal for resistance (close buy trade) or support (close sell trade). A minimum of 30 to 45 minutes should pass after closing before making any more trades on the same currency because of Support and Resistance (SnR) level concerns.

Confirmation Strength

Make sure there are three or more strong signals from the same currency (such as the AUD) before you execute a trade. For example, a transaction should only be made if concurrent STRONG-BUY signals show on AUDUSD, AUDJPY, and AUDCAD. Both single and multiple signals are insufficient for confirmation. This strategy is intended to make sure you trade with a strong sense of the market, which could improve the success of your trades.

Lastly, keep in mind that the Forex Dashboard Indicator runs on a 15-minute time interval. Therefore, on all currency pairs, your Take Profit and Stop Loss levels shouldn’t be higher than 15 to 20 pip.