The pivot Points Indicator for MT4 and MT5 terminals is an indicator that is intended to automatically draw significant Pivot Levels. The forex market is a fast-moving, dynamic environment where a variety of factors are constantly at work. Trading professionals use a variety of tools and tactics to help them make sense of this complicated trading environment. The Pivot Point Mt4, a crucial component of technical analysis that pinpoints probable support and resistance levels, is one such instrument.

Numerous pivot point calculation techniques, including the Classical, Camarilla, Woodie, Fibonacci, and CPR, are supported by this auto pivot points indicator. Due to this versatility, traders can select the calculating approach that works best for their particular trading strategy.

Any Forex currency pair as well as other assets, including commodities, cryptocurrencies, binary options, stock markets, indices, etc., can be employed with this pivot points MT5 tool. Additionally, you may apply it to any time window that works best for you, from 1-minute charts to monthly charts.

There are no limitations placed on this indicator by the fxssi.com website. On this website, there are many beneficial free and paid indicators. So have a look at their other indicators and give the FXSSI Indicators some love.

What are Pivot Points

Traders utilize pivot points, a tool for technical analysis, to identify probable support and resistance levels. These are price levels, usually based on the trading range from the previous day, where the price of an item, such as a stock, may undergo a large fluctuation.

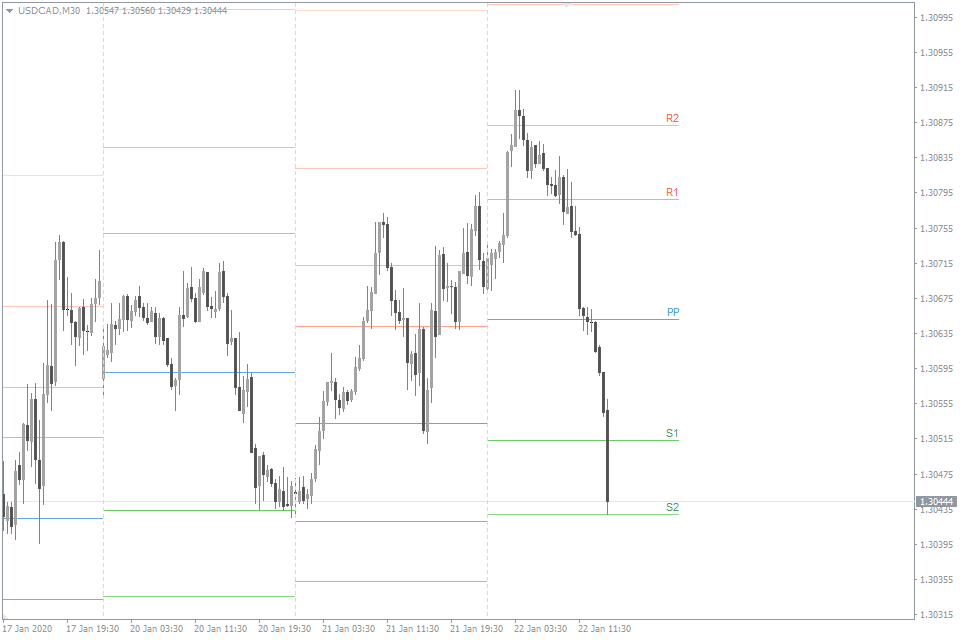

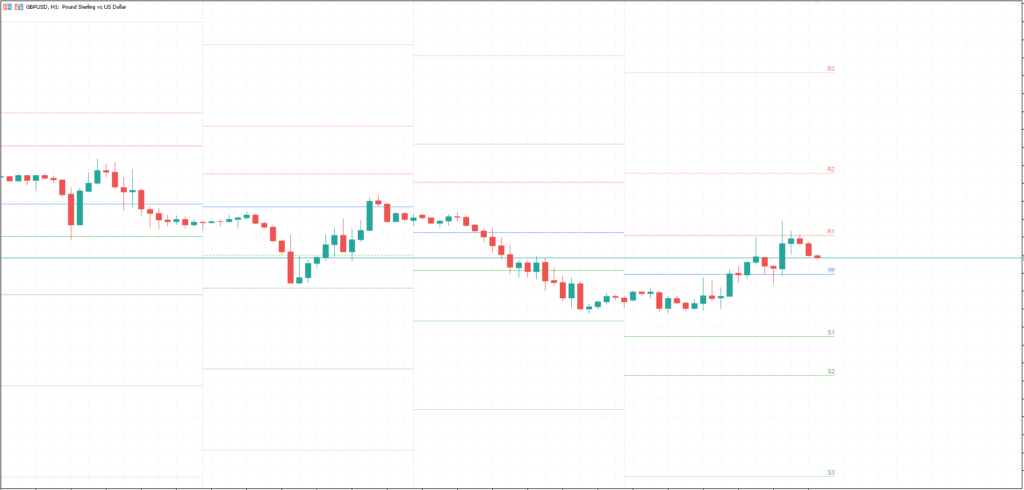

The five-point approach, which consists of the pivot point (P), two resistance levels (R1 and R2), and two support levels (S1 and S2), is the most used method for calculating pivot points.

Here is how to calculate it:

- Pivot point (P) = (High + Low + Close) / 3

- First level of resistance (R1) = (2 x P) – Low

- First level of support (S1) = (2 x P) – High

- Second level of resistance (R2) = P + (High – Low)

- Second level of support (S2) = P – (High – Low)

“High,” “Low,” and “Close” are the highest price, lowest price, and closing price of the previous trading period, respectively.

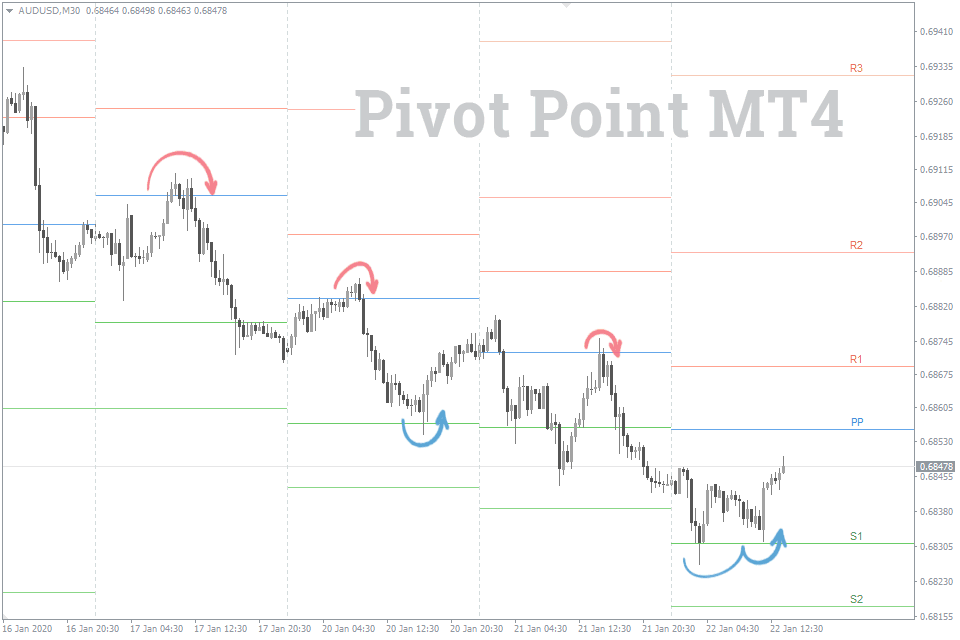

These pivot points are used by traders to forecast possible price movement and decide when to enter and exit transactions. Price above the pivot point denotes bullish sentiment, while price below the pivot point denotes bearish feeling. The support and resistance levels are also taken into account by traders as potential areas for price reversals or breakthroughs.

How is it used in Forex Trading

Similar to how they are employed in other types of trading, such those in stocks or commodities, pivot points are frequently used in forex (foreign exchange) trading. The primary goal of employing pivot points in forex trading is to identify probable market turning points, or points at which the mood of the market may switch from bullish to bearish or vice versa.

An overview of using pivot points in forex trading is provided below:

- Identify the Pivot Point: First, calculate the pivot point using the formula mentioned in the previous response. The high, low, and close prices used in the calculation are typically taken from the last day’s trading in the forex market.

- Determine Support and Resistance Levels: After calculating the pivot point, you can calculate the support and resistance levels. These levels can serve as potential entry or exit points. They can also act as alerts for trend continuation or reversal.

- Use the Pivot Point to Assess Market Sentiment: If the current price is higher than the pivot point, it could indicate that the market is in a bullish (upward) trend. Conversely, if the current price is lower than the pivot point, the market could be considered bearish (downward).

- Plan Your Trades: You can use these levels to plan your trades. For example, some traders choose to go long (buy) when the price approaches a support level or go short (sell) when the price approaches a resistance level.

- Use in Conjunction with Other Indicators: Pivot points are often used in conjunction with other indicators in a comprehensive trading strategy. For example, a trader might combine pivot points with moving averages, stochastic oscillators, or MACD (Moving Average Convergence Divergence) to confirm potential trading signals.

Although pivot points might be a useful tool, keep in mind that no technical indication is faultless and that each one has drawbacks. As a result, it’s critical to employ risk management techniques and avoid relying solely on one kind of indicator while making trading selections.

Calculation Modes

1. Classical Pivot Points

The high, low, and closing prices from the previous trading period are used to compute Classical Pivot Points, which are the most often utilized method. These ideas are the main points of reference for traders and give the most comprehensive picture of probable price movement.

2. Camarilla Pivot Points

A cutting-edge technology called Camarilla Pivot Points employs a special formula to offer more support and resistance than conventional approaches. This technique is popular among short-term traders due to its high degree of precision.

3. Woodie Pivot Points

The closing price from the prior period is given more significance by this strategy. According to traders who use the Woodie approach, the closing price provides greater insight into market emotion than the beginning price, providing more trustworthy indications.

4. Fibonacci Pivot Points

The principles of pivot points and Fibonacci levels, a popular tool for locating probable retracement levels, are combined in Fibonacci Pivot Points. This technique frequently helps traders spot potential market reversal points.

5. Central Pivot Range (CPR)

By determining a range around the central pivot, the Central Pivot Range approach builds on the idea of the Classical Pivot Point. This range, which offers a more thorough market view, consists of the primary pivot point and two additional pivot levels above and below it.

By examining over the course of days whether the pivots are higher or lower or if the range breadth is widening or decreasing, CPR aids a trader in predicting future market conditions.

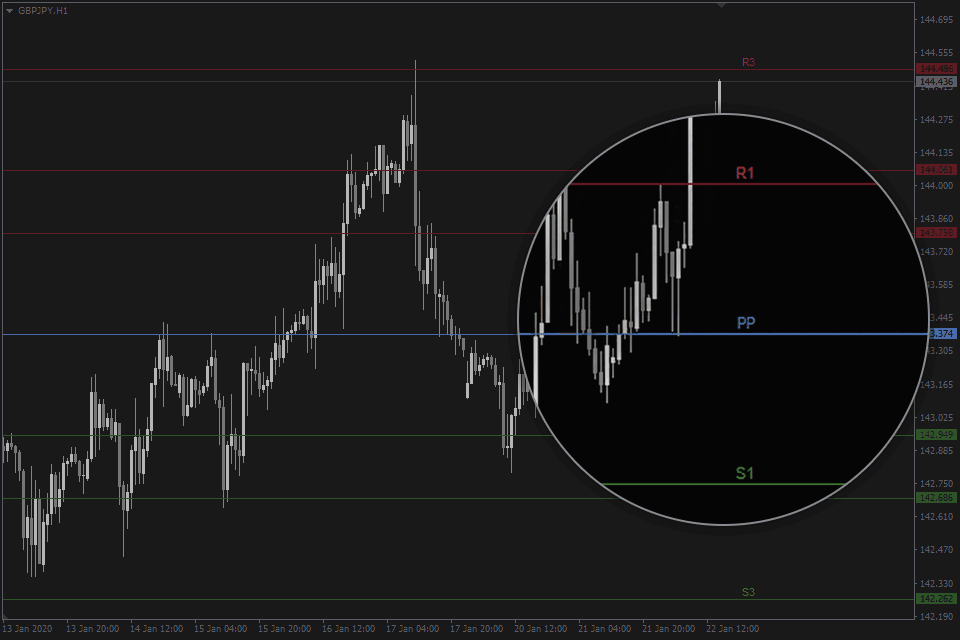

How to Use Pivot Points MT5

The fundamental idea that prices are more likely to return to the previous day’s closing level rather than exceed the range of the previous day’s trading is at the core of trading with auto pivot points. The daily time frame is the most frequently used computation period for pivot points because of this premise. Each pivot level performs the crucial role of acting as support or resistance in this scenario.

One can observe numerous interactions between the price and these levels while looking at a chart that has Pivot Points MT4 installed, demonstrating their importance in market analysis.

The frequent use of Pivot Points MT5 among traders is a significant benefit. The more traders using the same instrument, the more likely it is that price fluctuations will interact with it, improving the predictability of the tool. The usefulness and importance of Pivot Points as a trustworthy instrument for analyzing market patterns are increased by this phenomena.