The MetaTrader 4/5 terminal’s Forex Sentiment Indicator is made to display market sentiment data right on the chart, giving traders useful insights into the present state of the market’s players.

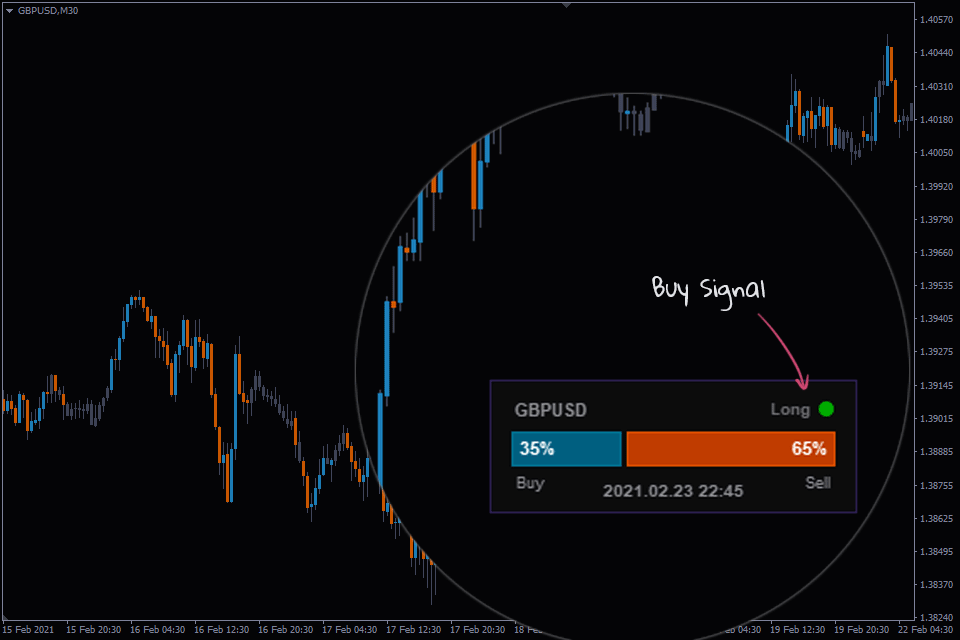

Once the indicator is installed, a histogram showing the percentage-based association between bullish and bearish market participants will be visible on the chart. The Speculative Sentiment Index (SSI), which is a valuable indicator of market sentiment, is a common name for this particular ratio.

The Sentiment Indicator MT4 is a more condensed form of the Current Ratio indicator, which is important to note. The amount of data sources that these two indicators use is the main distinction between them. The Current Ratio indicator, which is a more complete tool, makes use of a wider range of data sources to offer a more thorough study of market sentiment.

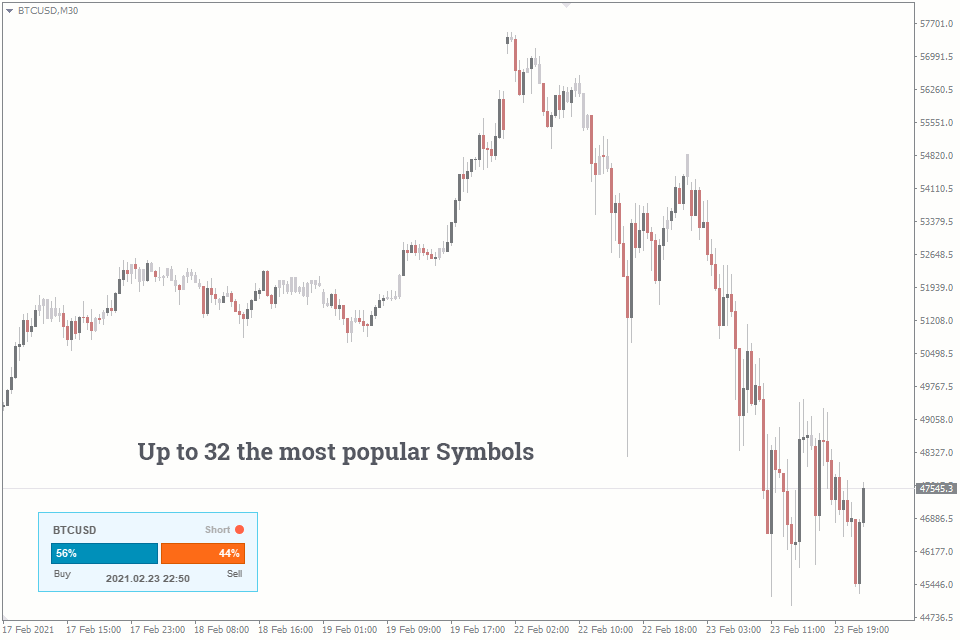

Any Forex currency pair as well as other assets, including commodities, cryptocurrencies, binary options, stock markets, indices, etc., can be traded using this sentiment indicator for MT5. Additionally, you may apply it to any time window that works best for you, from 1-minute charts to monthly charts.

There are no limitations placed on this indicator by the fxssi.com website. On this website, there are many beneficial free and paid indicators. So have a look at their other indicators and give the FXSSI Indicators some love.

What is Market Sentiment

Market sentiment, sometimes referred to as investor sentiment or market mood, is the general perspective or emotion that investors have toward a specific financial market, asset, or security. It reflects the general consensus or prevailing feelings, whether they are favorable (bullish) or unfavorable (bearish), that affect how market players act.

Market sentiment can be influenced by a number of variables, including economic indicators, business earnings reports, geopolitical events, news stories, and social media trends, among others. These elements may influence how investors behave, which may alter the demand for particular assets and, consequently, their prices.

There are many methods and tools for analyzing market sentiment, including:

- Market sentiment indicators are numerical measurements that keep tabs on the thoughts and feelings of market players. The Volatility Index (VIX), the Put/Call Ratio, and the American Association of Individual Investors (AAII) Sentiment Survey are a few examples.

- Technical analysis: This process involves examining past volume and price patterns to spot trends and forecast market moves. To assess market mood, technical analysts frequently search for chart patterns, trendlines, and support and resistance levels.

- News and social media analysis: Investors can learn about current market sentiment and foresee prospective changes in investor behavior by keeping an eye on the tone and substance of news articles, social media posts, and other online sources.

Understanding market mood can give investors insights into prospective market trends and reversals, which can help them make more informed decisions about when to buy or sell assets. It is important to remember, though, that market sentiment is not always a trustworthy indication, and that when making investment decisions, investors should take a variety of aspects into account.

How it used

Market sentiment in forex trading refers to the general opinion of investors and traders toward a specific currency or currency pair. As mood can influence price changes and patterns, it is essential in the foreign currency market. Market participants can utilize sentiment research to determine a currency’s strength or weakness and so make better trading decisions. In forex trading, market sentiment can be applied in the following ways:

- Market sentiment can be used by traders to gauge whether the majority of market players are bullish (optimistic) or bearish (pessimistic) about a certain currency. A trend that is mostly bullish denotes an upward movement, whereas a trend that is generally bearish suggests a downward movement.

- Trading in opposition to the current market sentiment is a strategy used by certain forex traders. They think that extremely optimistic or extremely negative positions may become unsustainable and trigger a correction, and that excessive sentiment levels can indicate probable market reversals.

- MT5 sentiment indicators are used by traders to assess the state of the market. The Commitment of Traders (COT) report, which displays the positions of large speculators, commercial hedgers, and small speculators, and the Daily Sentiment Index (DSI), which calculates the percentage of bullish traders for various currency pairs, are two popular sentiment indicators in the forex market.

- Investors’ appetite for risk is gauged by their attitude toward risk. Positive risk sentiment may lead traders to purchase higher-yielding, riskier currencies and sell safe-haven currencies more frequently. In contrast, traders may favor safe-haven currencies over risky assets during times of low risk sentiment.

- Forex traders pay close attention to news and economic data releases in order to gauge their possible impact on market mood. When it comes to a particular currency, positive news or robust economic data can increase sentiment while unfavorable news or weak data might reduce it.

- Technical analysis: To spot sentiment-driven price patterns and probable entry and exit points for trades, forex traders also employ technical analysis tools including trendlines, moving averages, and support and resistance levels.

Along with other elements like technical and fundamental research, forex traders also need to take market sentiment into account. Traders can make better decisions and predict future market moves by adding market sentiment into their trading techniques.

Supported Currency Pairs

Upon the launch of the Market Sentiment Indicator, it displayed data for the following currency pairs:

EURUSD, GBPUSD, XAUUSD (Gold), USDCAD, USDJPY, USDCHF, AUDUSD, NZDUSD, GBPJPY, EURGBP, EURJPY, GBPCHF, GBPCAD, EURCHF, EURAUD, CADJPY, AUDJPY, CADCHF, GBPNZD, EURNZD, AUDCAD, GBPAUD, AUDCHF, NZDJPY, AUDNZD, EURCAD, NZDCAD, CHFJPY, CHFSGD, NZDCHF.

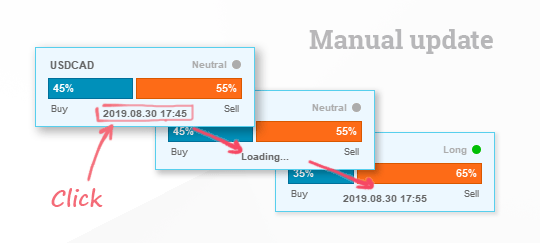

The Market Sentiment Indicator’s Update Period

The Sentiment MT4 Indicator updates once per hour by default. You can, however, shorten this time to 5 minutes if necessary.

Additionally, by selecting “time” on the indicator panel, you can manually update the data.

How to Use

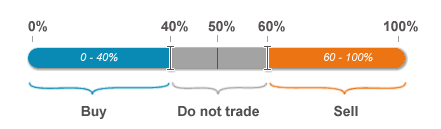

It is essential to evaluate the current market attitude before to making a deal. For instance, figure out the percentage of traders that favor long (buy) positions over short (sell) positions right now.

With this information in hand, you may either decide to start a new trade or refrain from initiating one that is likely to end in a loss.

If more than 60% of traders are holding short positions, think about purchasing; if the majority are holding long ones, think about selling. The technique to market sentiment analysis that is typically used is based on this core notion.

You can then adjust this percentage barrier in light of your individual trading preferences and experience.

See our research on the profitability of market sentiment data for more information on this subject.